BTC

$119,882.05

+

1.02%

ETH

$3,015.07

+

1.11%

XRP

$2.9399

+

4.59%

USDT

$1.0001

–

0.01%

BNB

$693.23

+

0.45%

SOL

$164.34

+

1.64%

USDC

$0.9997

+

0.01%

DOGE

$0.1995

+

0.23%

TRX

$0.3008

–

1.02%

ADA

$0.7334

–

0.61%

HYPE

$47.73

–

1.13%

XLM

$0.4560

–

1.15%

SUI

$3.8685

+

11.99%

LINK

$15.98

+

2.43%

HBAR

$0.2387

–

1.97%

BCH

$504.52

–

0.13%

WBT

$45.78

–

0.59%

AVAX

$21.53

+

1.54%

LEO

$9.0026

–

0.46%

SHIB

$0.0₄1336

+

1.05%

By Oliver Knight, CD Analytics

Jul 14, 2025, 3:38 p.m.

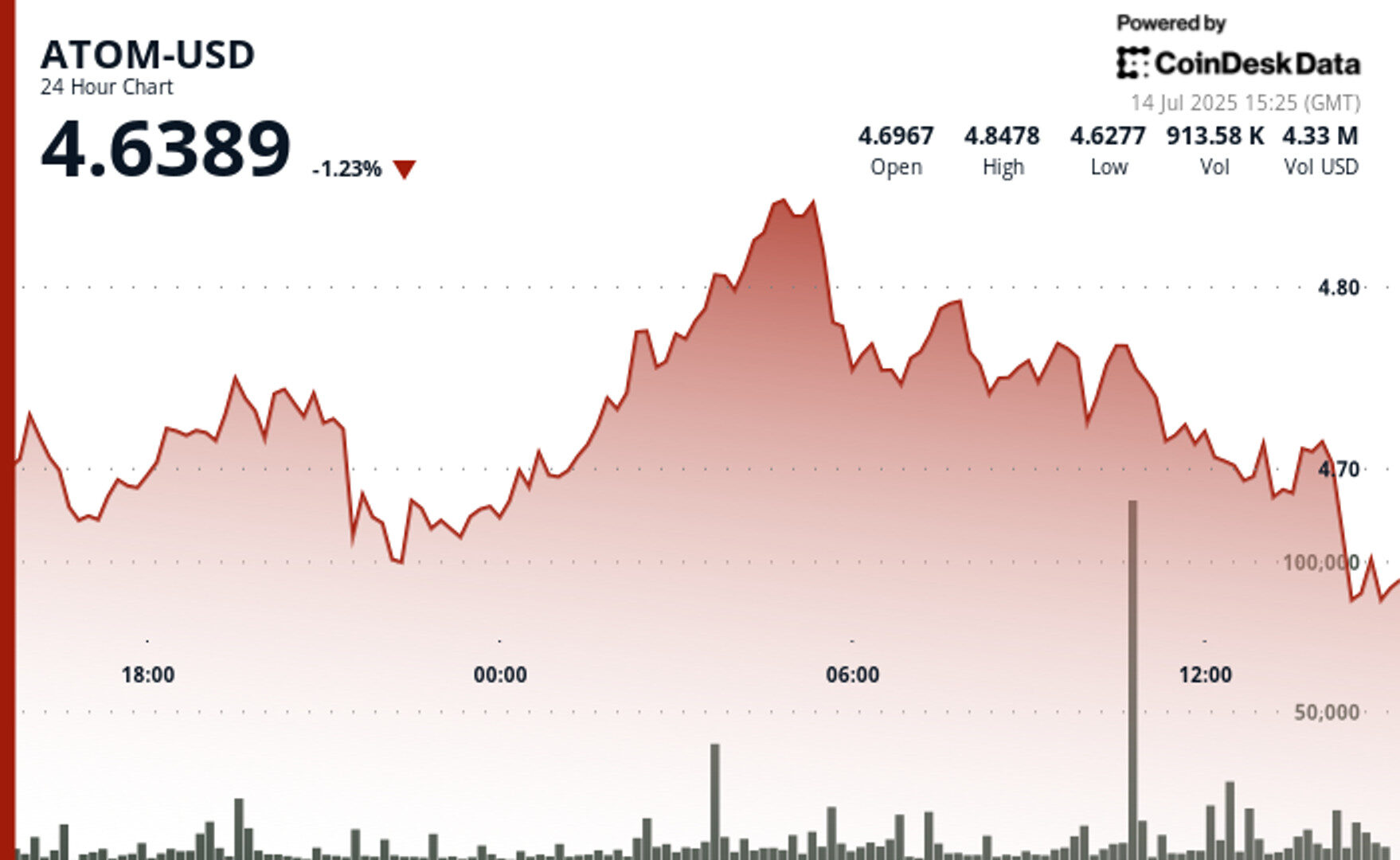

- ATOM trades between $4.64–$4.85, showing a V-shaped recovery amid broader crypto market bullishness as BTC hits $123K.

- Technical indicators turn positive, with MACD crossover and RSI at 62.4 signaling momentum, while volume spikes suggest institutional activity.

- Key levels to watch: support at $4.64–$4.67; resistance at $4.85–$4.86; breakout above $5.46 could target $6.20 and $7.75.

ATOM traded within volatile range between $4.64 and $4.85 on Monday.

The move comes among a backdrop of bullish sentiment after bitcoin

rose to fresh record highs of $123,000 on Monday.

STORY CONTINUES BELOW

ATOM price action shows classic V-shaped recovery, dropping to $4.64 before rallying hard to the $4.85 level of resistance.

It’s worth noting that ATOM remains far lower than the previous bull market when it topped $44.55 in a classic “altcoin season.”

In the short term, a break above $5.46 would indicate a bullish break out with upside targets expanding to $6.20 and $7.75.

Technical Indicators Summary

- MACD posts positive crossover signaling bullish momentum shift.

- RSI hits 62.40 showing moderate buying without overbought signals.

- Volume spikes past 40,000 units confirm institutional participation.

- Support zone locks in at $4.64-$4.67 with heavy volume backing.

- Resistance forms near $4.85-$4.86 where selling pressure builds.

- Higher lows pattern around $4.67-$4.68 confirms uptrend continuation.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Oliver Knight is the co-leader of CoinDesk data tokens and data team. Before joining CoinDesk in 2022 Oliver spent three years as the chief reporter at Coin Rivet. He first started investing in bitcoin in 2013 and spent a period of his career working at a market making firm in the UK. He does not currently have any crypto holdings.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.