BTC

$116,695.60

–

2.92%

ETH

$3,040.68

+

0.68%

XRP

$2.8890

–

3.16%

USDT

$0.9997

–

0.02%

BNB

$682.82

–

1.50%

SOL

$160.46

–

2.52%

USDC

$0.9999

+

0.01%

DOGE

$0.1929

–

3.71%

TRX

$0.2986

–

0.95%

ADA

$0.7248

–

2.18%

HYPE

$47.56

–

0.73%

XLM

$0.4428

–

4.38%

SUI

$3.9596

+

1.56%

LINK

$15.61

–

2.52%

HBAR

$0.2327

–

3.60%

BCH

$487.73

–

3.63%

WBT

$44.53

–

2.57%

AVAX

$21.18

–

1.62%

LEO

$8.9887

–

0.05%

SHIB

$0.0₄1325

–

0.82%

By Oliver Knight, CD Analytics

Updated Jul 15, 2025, 3:48 p.m. Published Jul 15, 2025, 3:48 p.m.

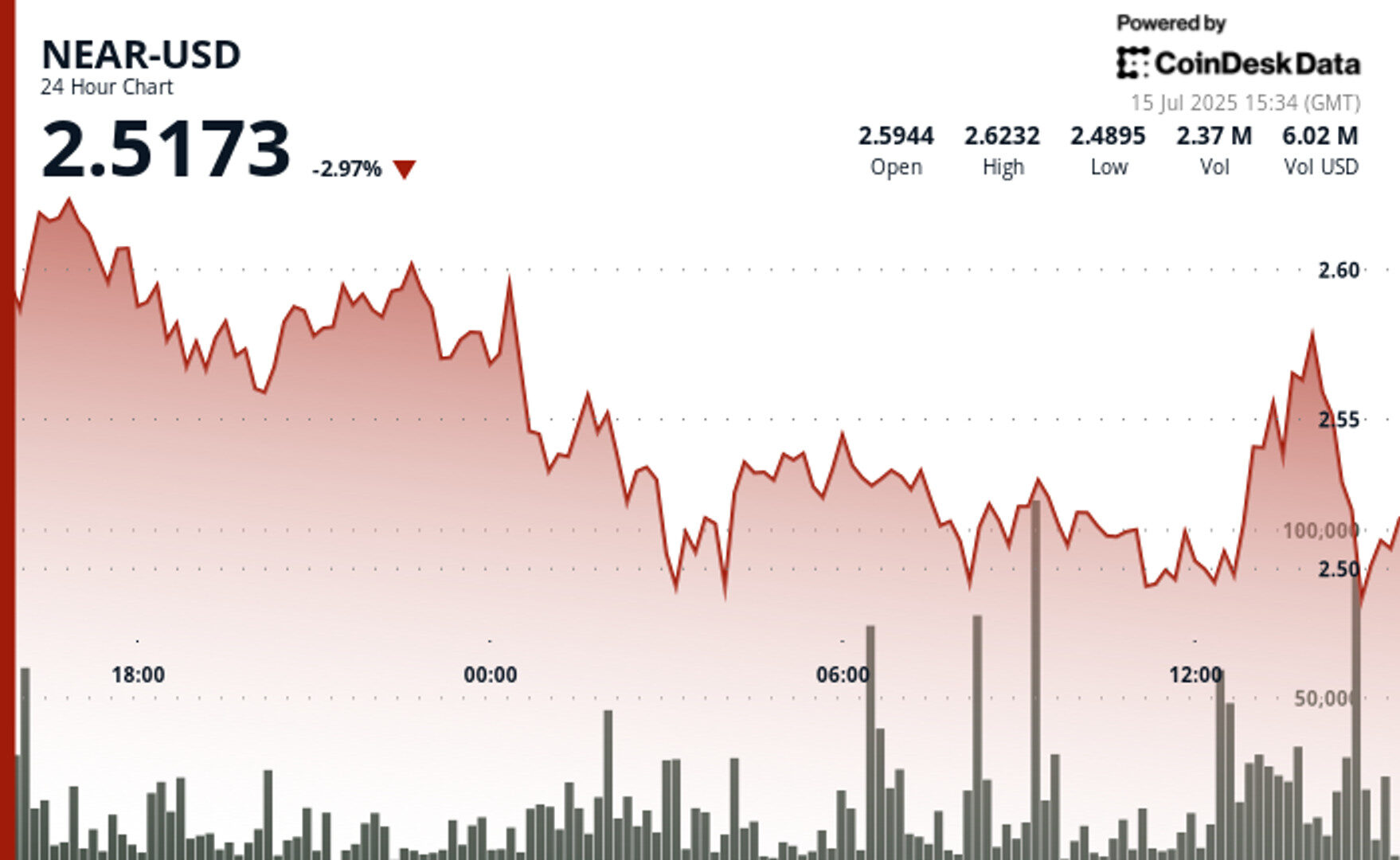

- NEAR is trading at $2.52, maintaining support above $2.50; a drop below $2.48 could trigger further downside toward $2.34.

- A bullish breakout above Monday’s high of $2.70 could target $2.91 and $3.12 levels.

- Strong support zones at $2.48-$2.52 and resistance at $2.57-$2.60 coincide with increased institutional activity and elevated trading volumes.

NEAR lost 3% of its value on Tuesday after demonstrating an impressive recovery at 13:00 UTC, rising from $2.54 to $2.56 in a move that nullified the previous drawdown.

The AI token is currently trading at $2.52 as it continues to hold above the $2.50 level of support. A drop below $2.48 would pave the way for downside extension all the way down to $2.34, which was the base of last Thursday’s rally.

STORY CONTINUES BELOW

A bullish breakout would occur if prices surpass Monday’s high of $2.70, which was incidentally also the high in June before a major correction. Upside targets above there would be $2.91 and $3.12.

Technical Indicators

- NEAR established formidable support mechanisms around $2.48-$2.52 with multiple technical rebounds occurring throughout volatile trading sessions.

- Resistance thresholds materialised near $2.57-$2.60 whereupon distributors maintained active positioning throughout the trading period.

- Volume acceleration to 3.68 million during the 03:00-04:00 session surpassed the twenty-four-hour average of 2.32 million, indicating heightened institutional participation.

- Final hour recuperation successfully breached resistance at $2.57 with exceptional turnover of 217,573 units at 13:55.

- Aggregate trading range of $0.15 represented 5.70% of the period’s zenith, demonstrating considerable intraday volatility characteristics.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Oliver Knight is the co-leader of CoinDesk data tokens and data team. Before joining CoinDesk in 2022 Oliver spent three years as the chief reporter at Coin Rivet. He first started investing in bitcoin in 2013 and spent a period of his career working at a market making firm in the UK. He does not currently have any crypto holdings.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.