BTC

$116,296.68

–

2.91%

ETH

$3,000.19

–

0.37%

XRP

$2.8695

–

2.33%

USDT

$0.9998

–

0.02%

BNB

$680.97

–

1.65%

SOL

$158.85

–

3.02%

USDC

$0.9999

+

0.02%

DOGE

$0.1904

–

4.22%

TRX

$0.2966

–

1.26%

ADA

$0.7181

–

1.98%

HYPE

$47.35

–

0.60%

XLM

$0.4462

–

1.97%

SUI

$3.9275

+

1.40%

LINK

$15.35

–

3.77%

WBT

$45.09

–

1.55%

HBAR

$0.2304

–

3.36%

BCH

$485.79

–

3.55%

AVAX

$20.87

–

2.62%

LEO

$8.9898

–

0.09%

SHIB

$0.0₄1300

–

2.36%

By Oliver Knight, CD Analytics

Updated Jul 15, 2025, 2:57 p.m. Published Jul 15, 2025, 2:57 p.m.

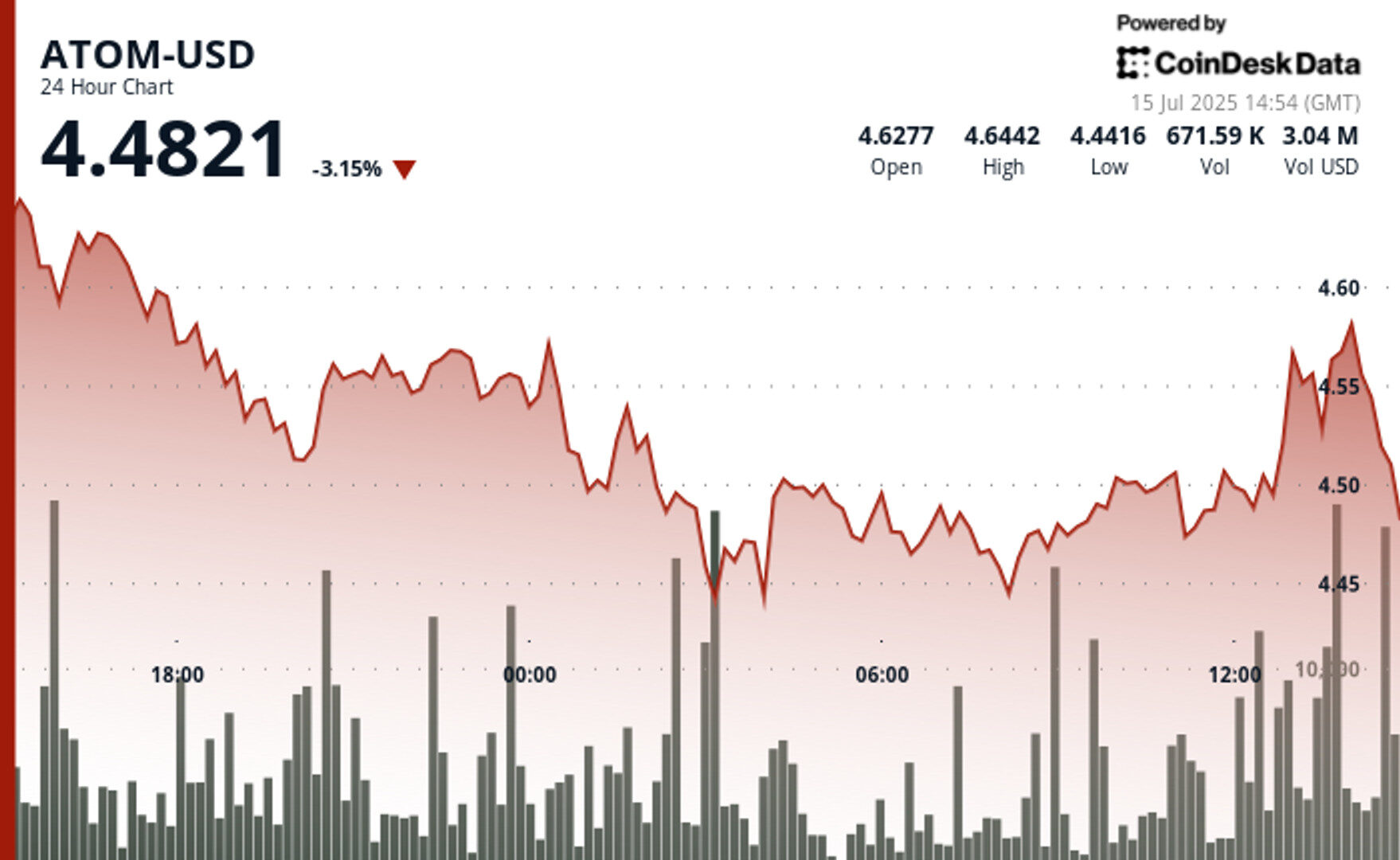

- ATOM price drops 2% amid market-wide sell-off, sliding from $4.65 to $4.56 with heightened volatility over a 24-hour period.

- Psychological support holds near $4.50, as a rebound from $4.52 to $4.58 and elevated trading volumes hint at potential stabilization.

- Institutional activity observed at key levels, with robust volume spikes during both sell-offs and recoveries signaling active participation.

Cosmos’ ATOM token fell victim to a market-wide sell-off on Tuesday, retreating from $4.65 to $4.56 amid a wave of volatility.

While several key areas of support have been tested, the recent rebound from $4.52 to $4.58 at 13:00 UTC, accompanied by heightened volume metrics, signals potential stabilization above the $4.50 psychological support threshold.

STORY CONTINUES BELOW

Technical Indicators Breakdown

- ATOM experienced considerable volatility during the preceding 24-hour period from 14th July 15:00 to 15th July 14:00, declining from $4.65 to $4.56, representing a 2 per cent drop with an aggregate range of $0.22 (5 per cent).

- The cryptocurrency confronted substantial selling pressure during nocturnal hours, reaching a critical low of $4.43 at 03:00 before establishing support around the $4.47-$4.50 zone.

- Robust volume activity exceeding the 24-hour average of 854,000 during the 03:00 decline and subsequent 12:00-13:00 recovery suggests institutional participation at these levels.

- The recent bounce from $4.52 to $4.58 during the 13:00 hour, accompanied by elevated volume, indicates potential stabilization above the $4.50 psychological support level.

- Throughout the preceding 60 minutes from 15th July 13:08 to 14:07, ATOM exhibited significant volatility with zero net change but experiencing substantial intraday movement with a peak at $4.58 and trough at $4.52, representing a 1 per cent intraday range.

- Volume patterns proved particularly noteworthy, with elevated activity during the 13:19 decline (46,270 units) and subsequent recovery phases, suggesting institutional participation at key support and resistance levels.

- The terminal minutes revealed concerning weakness as ATOM retreated from its hourly highs, closing the period with diminished momentum and zero volume in the last three minutes, indicating potential market uncertainty.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Oliver Knight is the co-leader of CoinDesk data tokens and data team. Before joining CoinDesk in 2022 Oliver spent three years as the chief reporter at Coin Rivet. He first started investing in bitcoin in 2013 and spent a period of his career working at a market making firm in the UK. He does not currently have any crypto holdings.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.