-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By Helene Braun, CD Analytics|Edited by Cheyenne Ligon

Aug 8, 2025, 7:19 p.m.

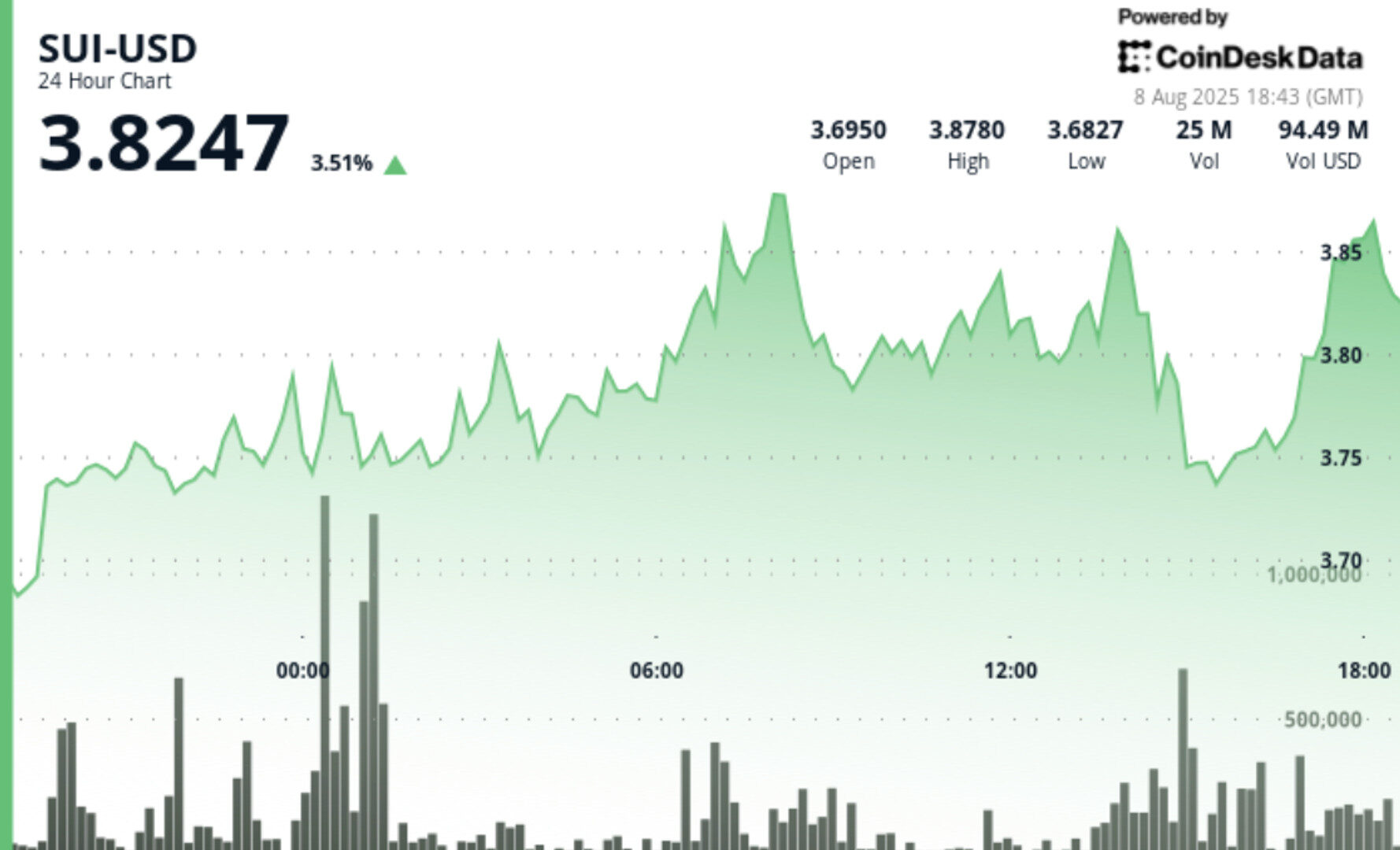

- SUI is trading at $3.82 after Sygnum Bank launched custody, trading and lending services for institutional clients.

- Amina Bank has become the first regulated bank in the world to support the layer-1 blockchain’s native token.

- Trading volume has doubled as buyers stepped in to defend a key support zone around $3.73.

Sui’s (SUI) price rose 4% in the past 24 hours to $3.82 as Swiss digital asset bank Sygnum expanded its offerings to include custody, trading and lending products tied to the blockchain for its institutional clients.

STORY CONTINUES BELOW

The move means regulated investors in Switzerland can now hold, trade and borrow against SUI through Sygnum’s platform, broadening access to the layer-1 blockchain’s ecosystem. The bank’s services are aimed at professional and institutional investors seeking exposure under Swiss financial regulations.

Earlier this week, another Swiss institution, Amina Bank, said it had started offering both trading and custodial services for SUI. Amina described the step as making it the first regulated bank globally to support the blockchain’s native asset.

The announcements appear to have spurred market activity. CoinDesk Analytics data shows trading volume spiked to 36.45 million tokens over midnight, more than double the 14.31 million daily average, as buyers stepped in to defend a support zone between $3.72 and $3.74. That level has held since mid-July, suggesting short-term traders see it as a key price floor.

SUI’s daily gains track closely with the broader crypto market, as measured by the CoinDesk 20 Index , which climbed 4.5% in the past day. The token’s monthly performance is also positive, up 7% over the past 30 days, but significantly lower than the broader market, with the CD20 up 24%.

For institutional clients, the expansion of regulated access to newer blockchain projects like Sui represents more than just another trading option. It signals growing comfort among banks with integrating blockchain networks beyond the largest, most established assets. In practice, this could mean asset managers, corporate treasuries and high-net-worth clients have more ways to diversify holdings without leaving regulated frameworks.

Sui, developed by Mysten Labs, aims to offer high-speed, low-cost transactions using a novel data structure called “objects” to improve scalability. Wider access through banks like Sygnum and Amina could help it compete for developer attention and real-world applications.

If demand for bank-mediated blockchain exposure continues to grow, Sui may find itself in a stronger position to attract not only speculative traders but also enterprise adoption.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Helene is a New York-based markets reporter at CoinDesk, covering the latest news from Wall Street, the rise of the spot bitcoin exchange-traded funds and updates on crypto markets. She is a graduate of New York University’s business and economic reporting program and has appeared on CBS News, YahooFinance and Nasdaq TradeTalks. She holds BTC and ETH.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

More For You

By Omkar Godbole, AI Boost|Edited by Aoyon Ashraf

2 hours ago

The net gamma exposure of dealers in the Deribit-listed ether options market is negative between $4,000 and $4,400.

What to know:

- The net gamma exposure of dealers in the Deribit-listed ether options market is negative between $4,000 and $4,400.

- The dynamic could create a self-reinforcing positive cycle, leading to a quick ascent to $4,400, one observer said.