-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By James Van Straten|Edited by Stephen Alpher

Aug 11, 2025, 12:06 p.m.

- Today marks the five-year anniversary of Strategy’s (then called MicroStrategy) first bitcoin purchase.

- Including a fresh buy announced Monday morning, MSTR’s BTC holdings have surged to 628,946 BTC worth nearly $76 billion.

- Since adopting bitcoin, MSTR stock has gained over 3,000% compared to bitcoin’s nearly 1,000% return.

Disclaimer: The analyst who wrote this article owns shares in Strategy.

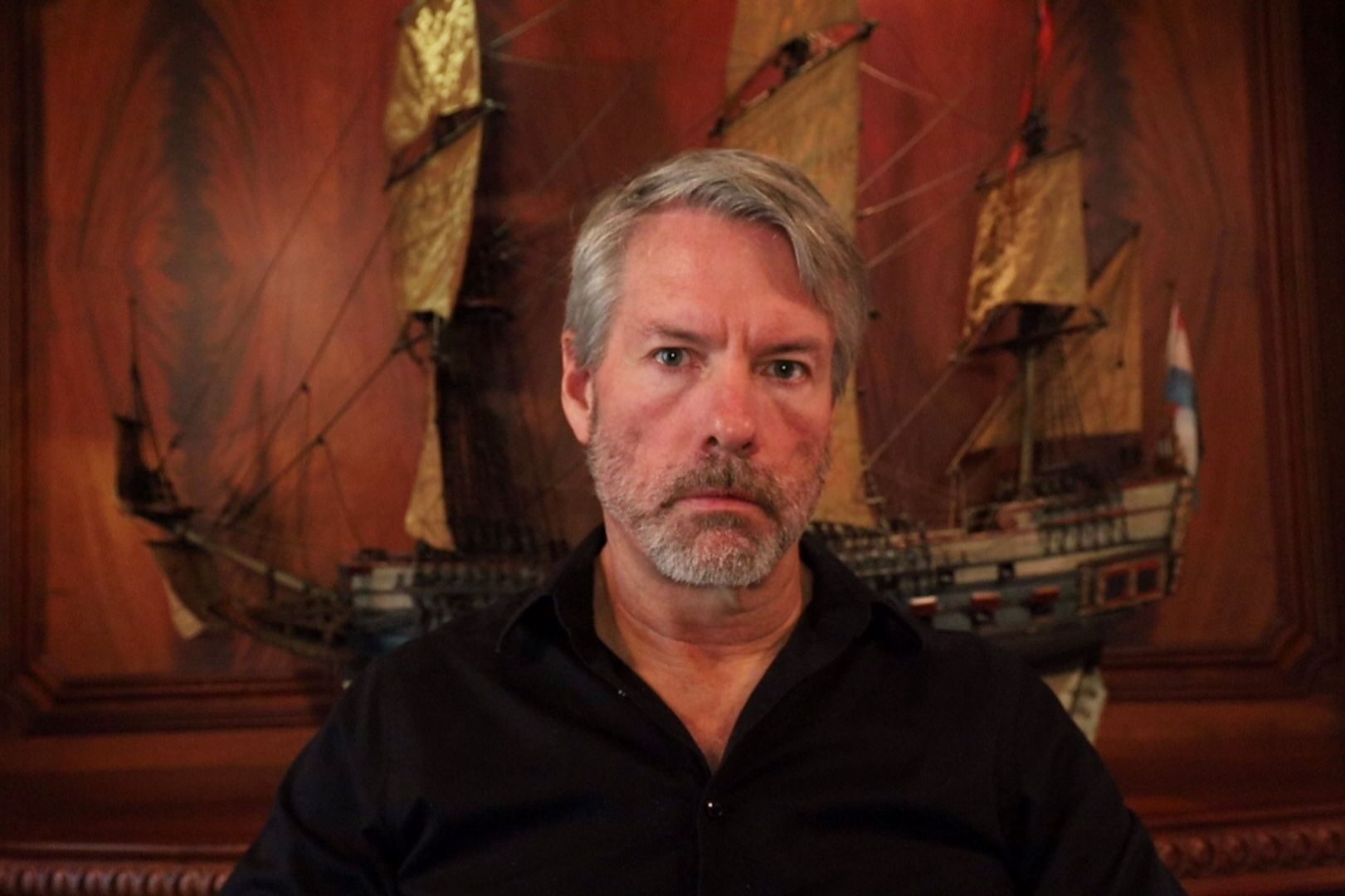

Strategy (MSTR) adopted a bitcoin standard five years ago today, on Aug. 11, 2020, with its first purchase of 21,454 BTC for $250 million. The acquisition marked a historic shift in corporate treasury strategy.

To that point, former AI and software development company had seen its share price stagnate for two decades after the early 2000 tech boom-and-bust, falling over 95% from its peak.

STORY CONTINUES BELOW

However, since August 2020, MSTR has delivered 100% average annual returns, compounding to over 3,000% cumulative gains, while bitcoin itself has returned nearly 1,000% over the same period.

To fund its BTC accumulation, the company has employed diverse strategies, raising $46 billion via equity and credit, which includes $8.2 billion in outstanding convertible debt and four perpetual preferred stock offerings, STRK, STRF, STRD, and STRC, designed to appeal to different segments of the yield curve.

The company Monday morning disclosed the purchase of another 155 BTC for $18 million — a rather small weekly buy, but nevertheless bringing its total stoack to 628,946 coins valued at about $76 billion. That representis 3% of bitcoin’s fixed 21 million supply. With an average cost of about $74,000 per BTC, the company sits on unrealized gains of roughly $30 billion, or 65%.

MSTR is today one of the most actively traded stocks, posting $4.4 billion in daily trading volume just behind Google (GOOG) at $4.9 billion. Open interest in MSTR options totals $90 billion, also second to Google at $99 billion. Despite a $112 billion market cap compared to Google’s $2.4 trillion, the trading activity reflects the intense focus on MSTR.

Its success has inspired a wave of bitcoin treasury strategies among other corporations. The top 100 public companies now collectively own 964,314 BTC, much of it financed through capital raises that follow the MSTR playbook.

James Van Straten is a Senior Analyst at CoinDesk, specializing in Bitcoin and its interplay with the macroeconomic environment. Previously, James worked as a Research Analyst at Saidler & Co., a Swiss hedge fund, where he developed expertise in on-chain analytics. His work focuses on monitoring flows to analyze Bitcoin’s role within the broader financial system.

In addition to his professional endeavors, James serves as an advisor to Coinsilium, a UK publicly traded company, where he provides guidance on their Bitcoin treasury strategy. He also holds investments in Bitcoin and Strategy (MSTR).

More For You

By CD Analytics, Will Canny|Edited by Cheyenne Ligon

19 minutes ago

Support has formed at $3.90 with resistance at the $4.15 level.

What to know:

- DOT declined 6% from its intraday high.

- Selling by institutional investors triggered the reversal.