-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By Jamie Crawley, CD Analytics|Edited by Stephen Alpher

Updated Aug 11, 2025, 4:10 p.m. Published Aug 11, 2025, 4:05 p.m.

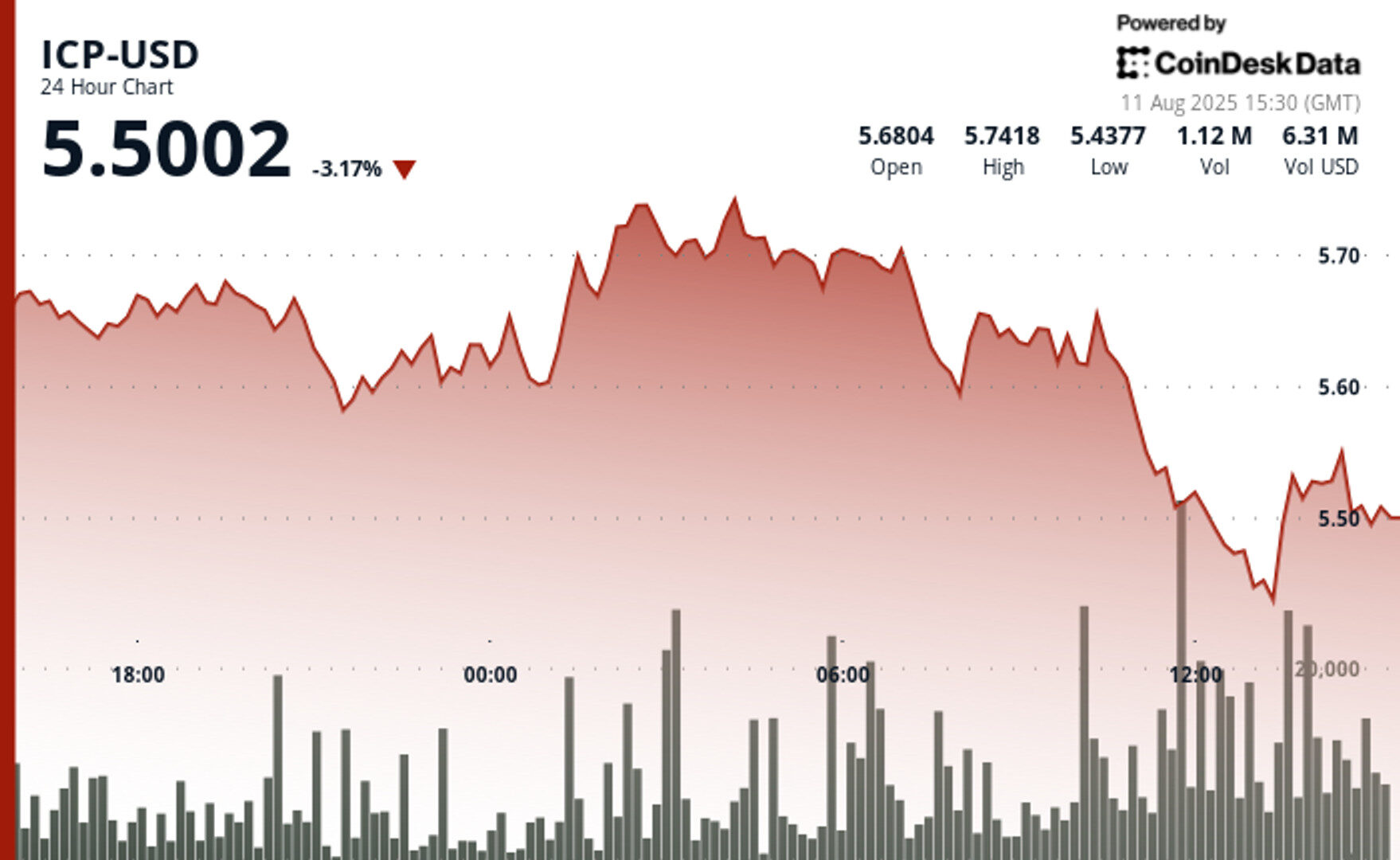

- ICP fell from $5.75 to $5.43 in a 5% swing before staging a partial recovery.

- Selling volume hit 965,595 units, nearly double the 24-hour average.

- Push from $5.46 to $5.54 signaled renewed buying interest.

Internet Computer

reversedafter testing the $5.75 level in the early hours of Aug. 11, succumbing to selling pressure that drove the token down to $5.43.

ICP appeared to be in a steady consolidation pattern between $5.65 and $5.67 before a rally propelled the token to its $5.75 peak. However, the momentum faded as sellers stepped in heavily after 11:00 UTC. Trading volume surged to 965,595 units — almost double the daily average of 487,064 — as distribution intensified around the $5.61 resistance zone, indicating profit-taking and institutional selling, according to CoinDesk Research’s technical analysis data model.

STORY CONTINUES BELOW

Buyers then defended the $5.44 support level, triggering a rebound from $5.46 to $5.54. The climb was fueled by a volume spike to over 75,000 units between 13:41 and 13:48, more than quadrupling the hourly average and pointing to potential institutional accumulation after the sell-off.

Despite the recovery, ICP remains in the red at the time of writing. Still, the strong defense of key support levels and the breakout through short-term resistance zones hint at resilience, leaving the door open for bullish follow-through if buying pressure persists.

- Price range spanned $0.31, marking a 5% spread between $5.75 high and $5.43 low.

- Sideways consolidation at $5.65–$5.67 preceded the breakout to $5.75.

- Post-peak reversal accelerated after 11:00 UTC, led by heavy selling.

- Volume spike to 965,595 units dwarfed 487,064 daily average.

- Resistance formed at $5.61 during peak selling activity.

- Support held firm at $5.44 before rebound began.

- Recovery pushed through $5.47 and $5.52 resistance zones.

- Volume reached 75,000 units, topping 18,500 hourly average.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Jamie has been part of CoinDesk’s news team since February 2021, focusing on breaking news, Bitcoin tech and protocols and crypto VC. He holds BTC, ETH and DOGE.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

More For You

By CD Analytics, Oliver Knight

36 minutes ago

The Cosmos ecosystem token saw steep intraday losses before staging a strong final-hour recovery, breaking key resistance levels and signaling renewed institutional interest.

What to know:

- ATOM swung 6.20% between $4.77 and $4.48 over a 23-hour period, with an early rally to $4.75 supported by 1.465 million units traded before heavy selling pushed it to session lows.

- The token rebounded 1.68% in the final hour, breaking key resistance at $4.50 and $4.53, with strong buying establishing $4.54 as new support.

- Coinbase’s listing of dYdX (COSMOSDYDX) on the Cosmos blockchain lifted market confidence, signaling growing institutional interest despite broader market uncertainty.