-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By CD Analytics, Oliver Knight

Updated Aug 20, 2025, 3:00 p.m. Published Aug 20, 2025, 3:00 p.m.

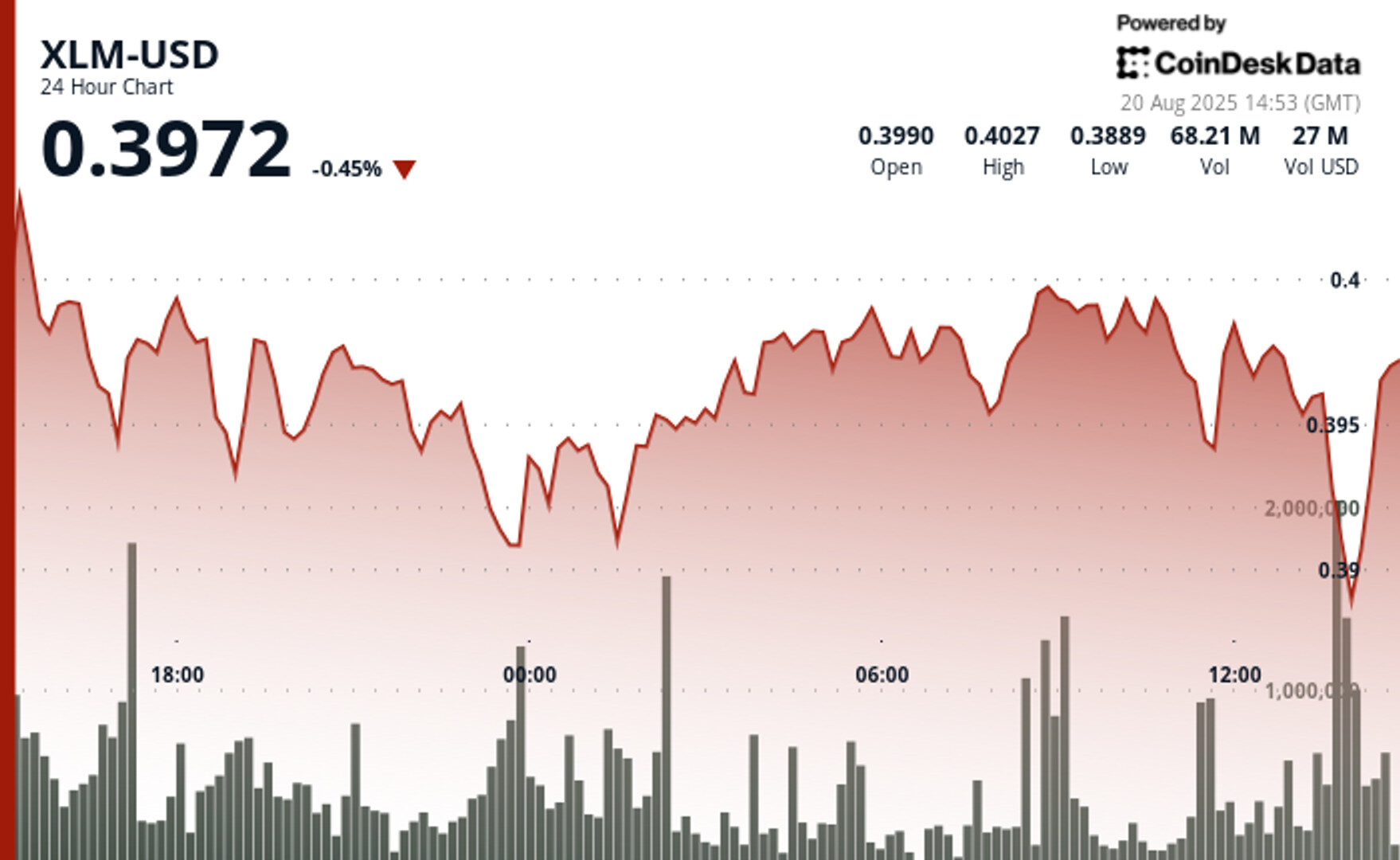

- XLM fell below key $0.39 support after a sharp sell-off in the final trading hour, extending its 24-hour bearish momentum.

- Trading volume spiked to 45M+ at peak selling, suggesting institutional participation in the downward move.

- Stellar Development Foundation’s investment in Archax highlights ecosystem growth, but broader altcoin weakness continues to pressure prices.

XLM slipped into a pronounced bearish trajectory over the past 24 hours, trading between $0.39 and $0.40 and breaking below key support levels. The token’s volatility intensified during the final trading hours of Aug. 20, when prices fell from $0.40 to $0.39, marking a decisive breach of support that had previously provided buying momentum. The move signals continued pressure on the asset despite its attempts to consolidate around the $0.40 threshold.

Trading data revealed heightened distribution activity, with turnover hitting 45.04 million during the 13:00 session—well above the 24-hour average. The spike in volume underscores notable institutional participation in the sell-off, amplifying downward momentum. XLM’s failure to hold above resistance levels and its breach of multiple intraday supports point to bearish conditions likely persisting in the near term.

STORY CONTINUES BELOW

The weakness in XLM comes despite constructive ecosystem news. The Stellar Development Foundation recently committed capital to U.K.-based tokenization firm Archax, underscoring its long-term growth strategy. Still, broader market conditions weighed heavily, with bitcoin holding near $113,500 while altcoins faced corrective pressure, leaving XLM exposed to continued downside risk.

- Price breached decisively beneath the established $0.39 support level that had previously provided accumulation interest.

- Volume surged dramatically during steepest decline phases, with 4.92 million recorded at 14:17—the highest single-minute reading.

- Failed to establish meaningful support above the $0.39 psychological level throughout the session.

- Persistent lower peaks pattern indicates accelerating downward momentum remains intact.

- Zero volume recorded at 14:20 suggests potential capitulation amongst market participants.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

Oliver Knight is the co-leader of CoinDesk data tokens and data team. Before joining CoinDesk in 2022 Oliver spent three years as the chief reporter at Coin Rivet. He first started investing in bitcoin in 2013 and spent a period of his career working at a market making firm in the UK. He does not currently have any crypto holdings.

More For You

By James Van Straten, AI Boost, Stephen Alpher|Edited by Stephen Alpher

26 minutes ago

MSTR fell to a five-month low Wednesday, testing key technical support.

What to know:

- MSTR is down 30% from its 2025 peak of $457 hit last month and now trades just below the 200-DMA at $340, a level that has historically acted as support.

- Bitcoin has dipped 3.5% over the past month, while Strategy has sizably underperformed, plunging 21%.

- Jim Chanos previously opened up a short MSTR/long BTC bet that’s looking like a winner at the moment.