-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By CD Analytics, Oliver Knight

Updated Aug 21, 2025, 3:24 p.m. Published Aug 21, 2025, 3:24 p.m.

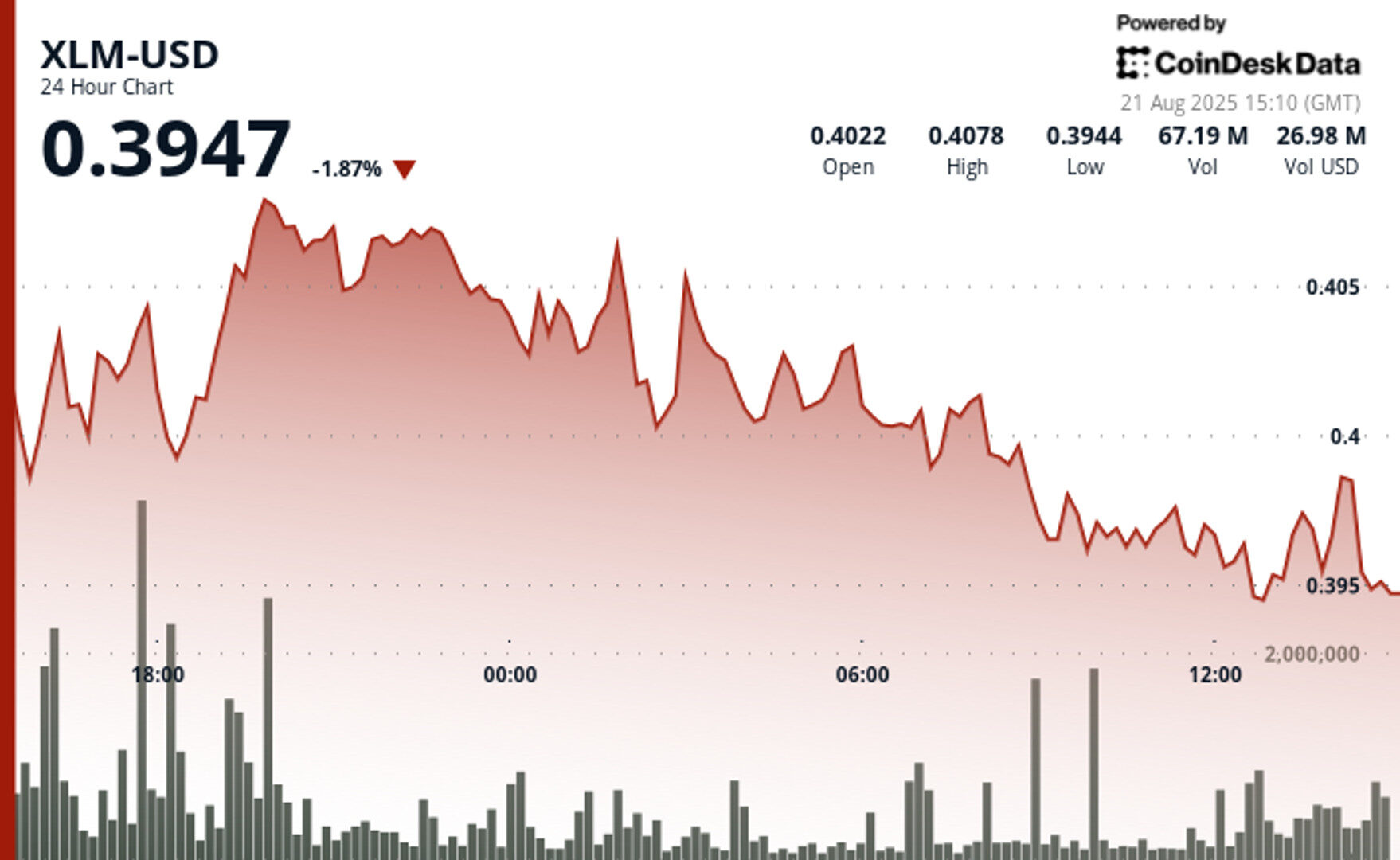

- Tight Range Trade: XLM held between $0.39 and $0.41 for 24 hours before breaking higher.

- Breakout Signal: Price pierced $0.398 resistance in the final hour on strong volume above 1.5 million tokens.

- Macro Tailwinds: Shifting trade policies, stablecoin rules, and inflation concerns are boosting demand for payment-focused tokens.

XLM traded in a narrow band between $0.39 and $0.41 over a 24-hour stretch ending Aug. 21, reflecting a consolidation phase ahead of a potential move. Sellers repeatedly capped upside at $0.41, while buyers defended support at $0.40, keeping volatility subdued. A gradual dip in volume suggested traders were positioning for a breakout attempt.

That breakout came in the final hour of trading, when XLM rallied from $0.396 to $0.399. Strong buying momentum pushed through the $0.398 resistance level, accompanied by a sharp spike in volume exceeding 1.5 million tokens traded. The push set fresh intraday highs, reinforcing a short-term bullish setup.

STORY CONTINUES BELOW

Broader market currents also support rising demand for payment-focused tokens. Shifting trade dynamics, evolving stablecoin frameworks, and heightened inflation risks tied to supply chain pressures are reshaping the global payments landscape. Against this backdrop, XLM’s recent strength reflects growing interest in blockchain-based settlement alternatives.

- Price action broke through key $0.398 resistance level with strong volume confirmation.

- Trading range of $0.01 or 3% indicates contained volatility before breakout.

- Volume spike exceeding 1.55 million during final hour suggests institutional interest.

- Support established around $0.40 level with multiple successful bounces.

- Declining volume trend reversed during breakout, indicating renewed conviction.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

Oliver Knight is the co-leader of CoinDesk data tokens and data team. Before joining CoinDesk in 2022 Oliver spent three years as the chief reporter at Coin Rivet. He first started investing in bitcoin in 2013 and spent a period of his career working at a market making firm in the UK. He does not currently have any crypto holdings.

More For You

38 minutes ago

The data currently on hand does not support the case for lowering interest rates, said the president of the Cleveland Fed.

What to know:

- Cleveland Fed President Hammack says the data do not support the case for a rate cut.

- Her remarks suggest Chairman Powell continues to have support at the central bank for his hawkish stance.

- Bitcon fell to a session low following the comments.