-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By CD Analytics, Oliver Knight

Updated Aug 22, 2025, 12:30 p.m. Published Aug 22, 2025, 12:30 p.m.

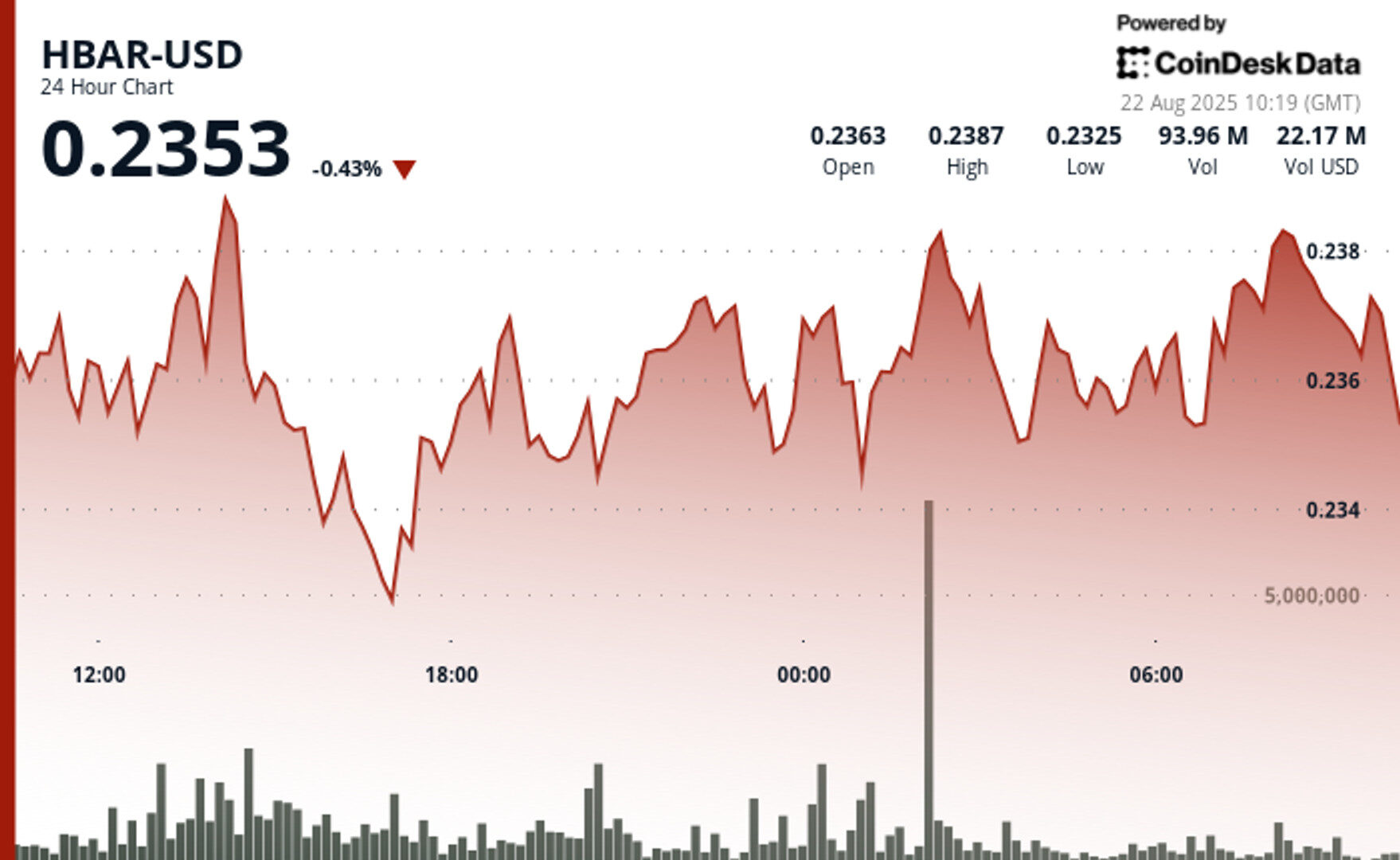

- HBAR tests key support at $0.23 after a 3% pullback Friday, with resistance forming near $0.24.

- Bullish catalysts emerge as SWIFT announces blockchain payment trials and Grayscale files HBAR-related trust documents, fueling ETF speculation.

- Institutional interest builds with volumes topping 80 million, highlighting growing confidence in Hedera’s role in global payments infrastructure.

Hedera’s native token HBAR is testing a key level of support at $0.23 after selling off by more than 3% on Friday.

Trading volume spiked beyond 80 million during crucial intraday windows on August 21.

STORY CONTINUES BELOW

Despite the sell-off, HBAR has a number of bullish catalysts; SWIFT revealed plans to launch live blockchain payment trials featuring HBAR across its $150 trillion annual payments network starting in November 2025.

At the same time, speculation over a potential exchange-traded fund gathered steam after Grayscale filed Delaware trust documents linked to HBAR. These developments spotlight hashgraph technology’s ability to process over 10,000 transactions per second, bolstering investor confidence in its role in transforming traditional finance infrastructure.

With global payments integration on the horizon, HBAR continues to attract institutional interest as both a technical and fundamental play.

- $0.01 trading range creates 2.40% volatility between $0.24 resistance and $0.23 support levels.

- Volume explosions past 80 million mark key reversal points at midday trading sessions.

- Support holds firm, for now, at $0.23 while resistance builds near $0.24 price targets.

- Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

Oliver Knight is the co-leader of CoinDesk data tokens and data team. Before joining CoinDesk in 2022 Oliver spent three years as the chief reporter at Coin Rivet. He first started investing in bitcoin in 2013 and spent a period of his career working at a market making firm in the UK. He does not currently have any crypto holdings.

More For You

By Omkar Godbole, Shaurya Malwa|Edited by Sheldon Reback

49 minutes ago

Bitcoin held a crucial support level amid cautious market positioning ahead of Powell’s Jackson Hole speech.

What to know:

- Bitcoin held a crucial support level at $112,500 amid cautious market positioning ahead of Federal Reserve Chair Jerome Powell’s Jackson Hole speech.

- Speculative activity has cooled, with traders waiting for Powell’s comments, while options data suggests potential price swings for bitcoin and ether.

- On-chain investigations revealed insider trading activities during the YZY and LIBRA token launches, raising concerns about market manipulation.