-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By Shaurya Malwa, CD Analytics|Edited by Aoyon Ashraf

Updated Aug 23, 2025, 4:02 p.m. Published Aug 23, 2025, 3:41 p.m.

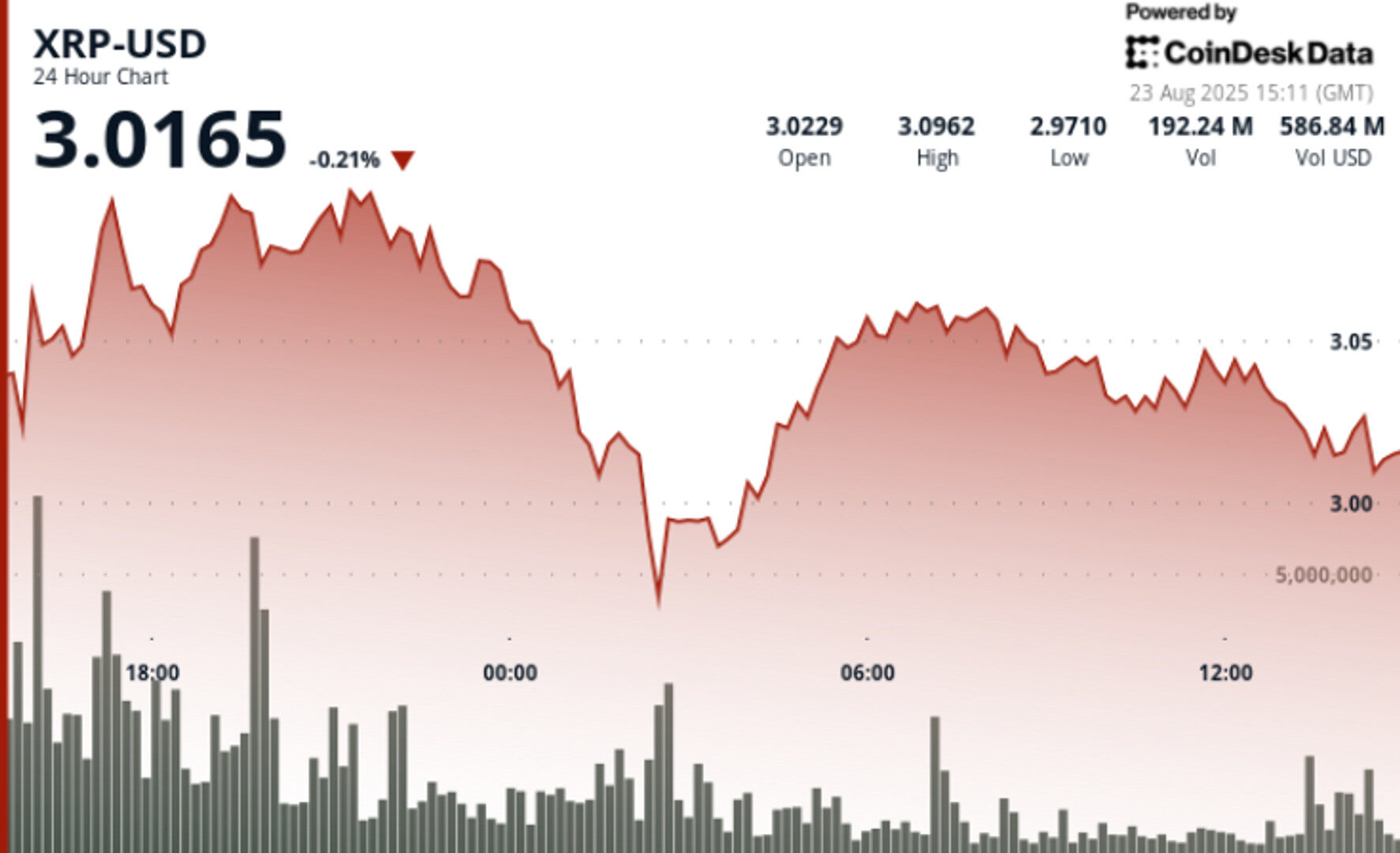

- XRP surged 8.56% during the August 22–23 session, testing resistance near $3.10 after dovish comments from the Federal Reserve Chair.

- On-chain settlement volumes on the XRP Ledger increased by 500%, indicating potential institutional adoption despite ongoing whale distribution.

- Traders are watching if the $3.00 support holds and whether a breakout above $3.10 could lead to further gains.

XRP advanced sharply during the Aug. 22–23 session, testing multi-month resistance near $3.10 after weeks of sideways trading.

The move coincided with dovish commentary from Federal Reserve Chair Jerome Powell at Jackson Hole, which reinforced expectations of a September rate cut and lifted risk sentiment across digital assets.

STORY CONTINUES BELOW

On-chain settlement volumes on the XRP Ledger surged 500% earlier this week, adding to optimism around institutional adoption despite ongoing whale distribution.

• XRP gained 8.56% across the 23-hour session from August 22 at 11:00 to August 23 at 10:00, climbing from $2.83 to $3.03, according to CoinDesk Research’s technical analysis data.

• The token swung between $2.79 and $3.10, creating an 11% intraday range.

• The breakout occurred at 14:00 UTC on August 22, with XRP surging from $2.84 to $3.03 on 667.4 million volume—five times session averages.

• Late-session volatility capped the move, with XRP retreating 0.47% in the final hour to settle near $3.01.

• Support has consolidated around $2.97–$3.00 while resistance remains firm at $3.08–$3.10.

• Breakout levels: $2.84–$2.97 accumulation zone triggered upside impulse on high volume.

• Resistance: Strong supply pressure emerged at $3.08–$3.10, rejecting further advance.

• Support: New floor forming at $2.97–$3.00 psychological level, repeatedly defended intraday.

• Volume: Breakout candle logged 667.4 million trades, 72% above weekly average.

• Structure: Pattern resembles continuation setup if $3.00 holds, though fading volume late in the session suggests consolidation before next leg.

• Whether $3.00 support holds during profit-taking, or if a deeper retrace tests $2.95.

• Breakout confirmation above $3.08–$3.10 zone, which could open the path toward $3.25.

• Fed policy signals ahead of the September meeting, and impact on risk asset flows.

• On-chain activity, which has surged to 844 million tokens settled in a single day, signaling enterprise adoption potential.

• Whale flows, as recent exchange deposits continue to weigh on intraday momentum.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

More For You

By Siamak Masnavi, CD Analytics|Edited by Aoyon Ashraf

3 hours ago

AAVE jumped 19% to $355.29, leading the top 40 cyrptocurrencies as investors weighed its Aptos expansion, Powell’s dovish tone and renewed focus on WLFI exposure.

What to know:

- AAVE, the governance token of Aave, gained 18.7% in 24 hours to $355.29, the top gainer among the 40 largest cryptocurrencies

- Its recent Aptos expansion and Powell’s dovish comments on rate cuts boosted demand.

- Analyst Simon of Delphi Digital says Aave’s WLFI exposure may be undervalued by the market.