-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By Krisztian Sandor, CD Analytics|Edited by Aoyon Ashraf

Aug 26, 2025, 1:14 p.m.

- Bitwise filed an S-1 statement to launch the first U.S. spot-based ETF focused on Chainlink’s native token.

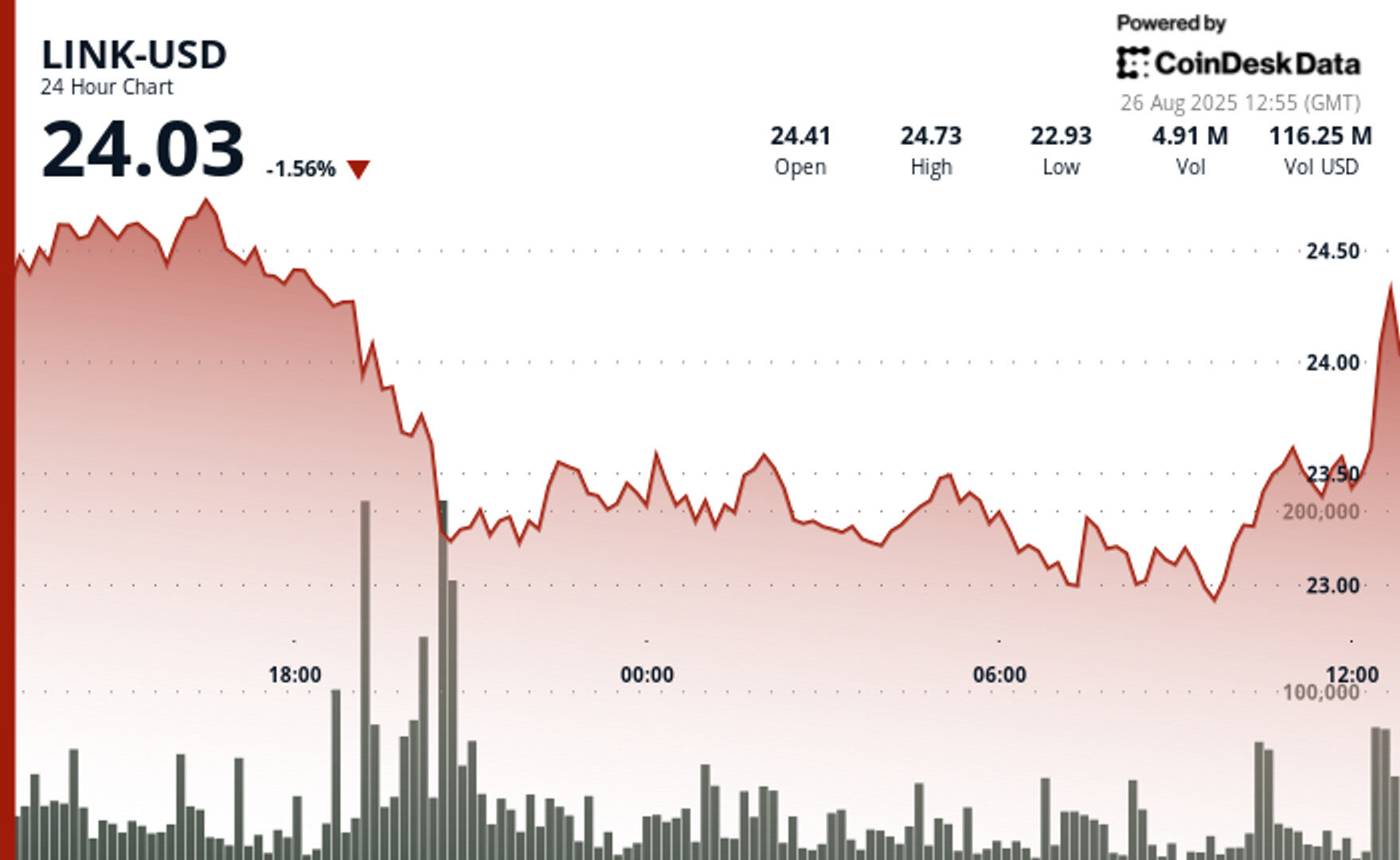

- LINK’s price rebounded 5% from the overnight lows on the news but remains under bearish pressure according to Coindesk Research’s technical analysis model.

Digital asset manager Bitwise is preparing to launch a spot-based exchange traded fund (ETF) focused on holding the native token of Chainlink LINK$23.92, a first in the U.S.

According to the S-1 registration statement filed with the U.S. Securities and Exchange Commission on Tuesday, the Bitwise Chainlink ETF aims to provide investors with direct exposure to LINK and named Coinbase Custody as the proposed custodian for the tokens.

STORY CONTINUES BELOW

The filing fits into a broader trend of asset managers seeking to launch altcoin-focused spot ETFs in the U.S. as regulatory headwinds receded under the Trump administration, following the success of bitcoin BTC$109,978.59 and ether (ETH) vehicles.

LINK bounced 5% from the overnight lows on the news, but was still down 1.6% over the past 24 hours, per CoinDesk data.

Despite the rebound, CoinDesk Research’s technical analysis model suggested sustained bearish pressure for LINK as the crypto market is going through a consolidation period.

LINK encountered substantial downward pressure over the past 24 hours, falling from a session peak of $24.81 to a low of $22.90.

A notable recovery effort surfaced during 10:00-11:00 UTC, coinciding with the ETF filing, as the price rallied from $23.02 to $23.54 on heightened volume of 3.35 million units, indicating possible consolidation above the crucial $23.00 psychological threshold.

The model suggested that reclaiming the $24.00 level is key to halting the bearish momentum, while the recent rebound implies oversold conditions may be attracting value-seeking investors.

- Price declined 4.67% from $24.61 to $23.46 during the last 24-hours from Aug. 25 12:00 to Aug. 26 11:00 UTC.

- Trading range of $1.84 between a maximum of $24.81 and a minimum of $22.90.

- Volume surged to 6.58 million units, significantly above 24-hour average of 2.29 million.

- Strong resistance established around $24.30 with support near $23.00.

- Failure to reclaim $24.00 indicates continued bearish sentiment.

- Break below $23.40 support level suggests further downside risk toward $23.00.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Krisztian Sandor is a U.S. markets reporter focusing on stablecoins, tokenization, real-world assets. He graduated from New York University’s business and economic reporting program before joining CoinDesk. He holds BTC, SOL and ETH.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

More For You

By Shaurya Malwa|Edited by Parikshit Mishra

24 minutes ago

Institutional inflows are driving ETH’s price highs, while retail DeFi activity remains subdued compared to previous cycles.

What to know:

- Ether (ETH) reached a new all-time high of $4,946, but its total value locked (TVL) in DeFi is below previous records.

- The shift in TVL is due to more efficient protocols and increased competition from other chains, affecting Ethereum’s dominance.

- Institutional inflows are driving ETH’s price highs, while retail DeFi activity remains subdued compared to previous cycles.