-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

Updated Aug 26, 2025, 3:53 p.m. Published Aug 26, 2025, 3:52 p.m.

- CME Group’s crypto futures suite has surpassed $30 billion in notional open interest, with SOL and XRP futures each crossing $1 billion.

- XRP became the fastest contract to reach $1 billion in notional open interest, achieving this milestone in just over three months.

- Despite regulatory pressures in the U.S., corporate adoption and pilot remittance programs keep XRP in focus, with institutional flows supporting its price action.

- CME Group said its crypto futures suite has surpassed $30 billion in notional open interest for the first time, with SOL and XRP futures each crossing $1 billion. XRP became the fastest contract to hit the milestone, doing so in just over three months.

- The development is viewed as a signal of market maturity and new institutional capital entering derivatives.

- Broader crypto markets remained firm into late August, though regulatory overhang in the U.S. has continued to pressure XRP relative to peers.

- Corporate adoption trends and pilot remittance programs keep XRP in focus for treasury desks, even as volatility spikes test investor conviction.

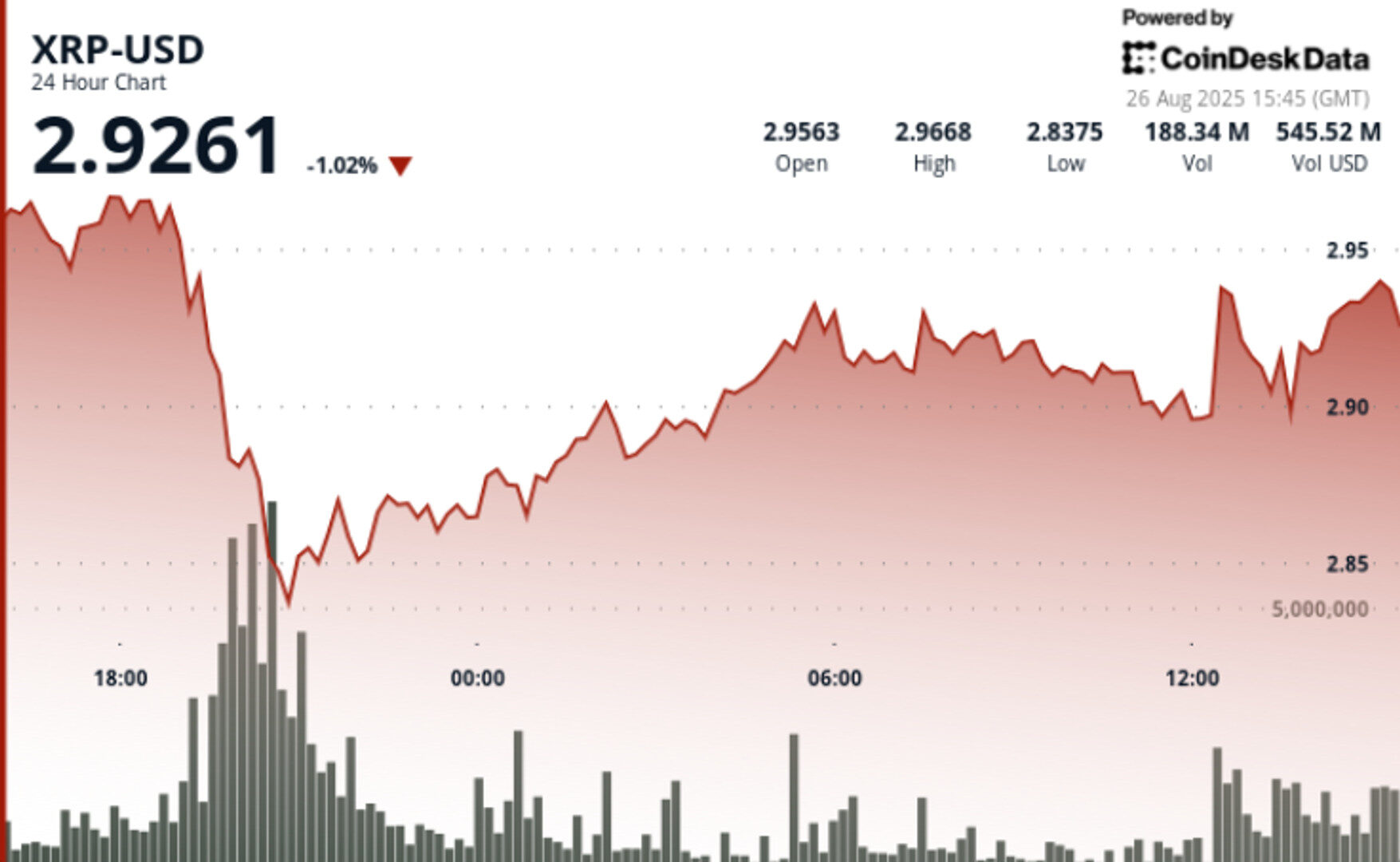

- XRP traded through a 5% range between $2.98 and $2.84 in the 24-hour session ending August 26 at 14:00.

- The steepest move occurred on August 25 during evening hours, when XRP dropped from $2.96 to $2.84 on 217.58 million tokens — triple its 72.45 million daily average.

- The token rebounded to $2.92, with the $2.84 level emerging as critical support as institutional flows stepped in.

- In the final hour of trading, XRP rose 0.7% from $2.90 to $2.92 on more than 5.7 million volume, signaling fresh corporate and fund participation.

- Support confirmed at $2.84 with high-volume absorption of sell pressure.

- Resistance remains at $2.94–$2.95, with repeated profit-taking capping upside attempts.

- RSI climbed from oversold 42 back into mid-50s, suggesting stabilizing momentum.

- MACD histogram tightening, indicative of potential bullish crossover in coming sessions.

- Weekly momentum divergence patterns point to compressed volatility, setting up for a directional breakout.

- Order books show concentrated institutional bids above $3.60, signaling strategic positioning ahead of regulatory catalysts.

- Bulls see $3.70 as the next upside target if $2.90–$2.92 base holds.

- Bears flag $2.80 as the downside trigger, with a break below support likely to accelerate losses.

- Derivatives flows now dominate the backdrop: CME’s $1B open interest in XRP futures will be a key barometer of institutional conviction.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

More For You

By Shaurya Malwa, CD Analytics

30 minutes ago

Technical indicators suggest potential for a bullish reversal, though market sentiment remains divided between risks of a breakdown and optimism for a rebound.

What to know:

- Dogecoin experienced significant volatility between August 24–26, with prices swinging within a $0.013 range before stabilizing near $0.21.

- A massive transfer of 900 million DOGE to Binance contributed to market uncertainty, despite ongoing accumulation by large holders.

- Technical indicators suggest potential for a bullish reversal, though market sentiment remains divided between risks of a breakdown and optimism for a rebound.