-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By Shaurya Malwa, CD Analytics

Updated Aug 28, 2025, 5:13 a.m. Published Aug 28, 2025, 5:13 a.m.

- A whale transferred 900 million DOGE to Binance, causing fears of a sell-off and a brief price drop.

- Despite the transfer, whales accumulated 680 million DOGE in August, indicating a balance between selling and buying.

- DOGE’s price remains in a tight range, with strong support at $0.219 and resistance at $0.225.

- Between August 24–25, a whale shifted 900 million DOGE (over $200 million) into Binance wallets, sparking fears of a broader sell-off. Prices briefly fell from $0.25 to test $0.23 support on elevated volumes.

- Despite this, on-chain data shows whales accumulated 680 million DOGE through August, creating a tug-of-war between distribution and accumulation.

- Futures positioning weakened, with open interest sliding 8% in the aftermath of the transfer, highlighting reduced speculative leverage.

- Broader meme-coin sentiment remains tied to macro signals, with Powell’s Jackson Hole remarks fueling a temporary sector-wide rally.

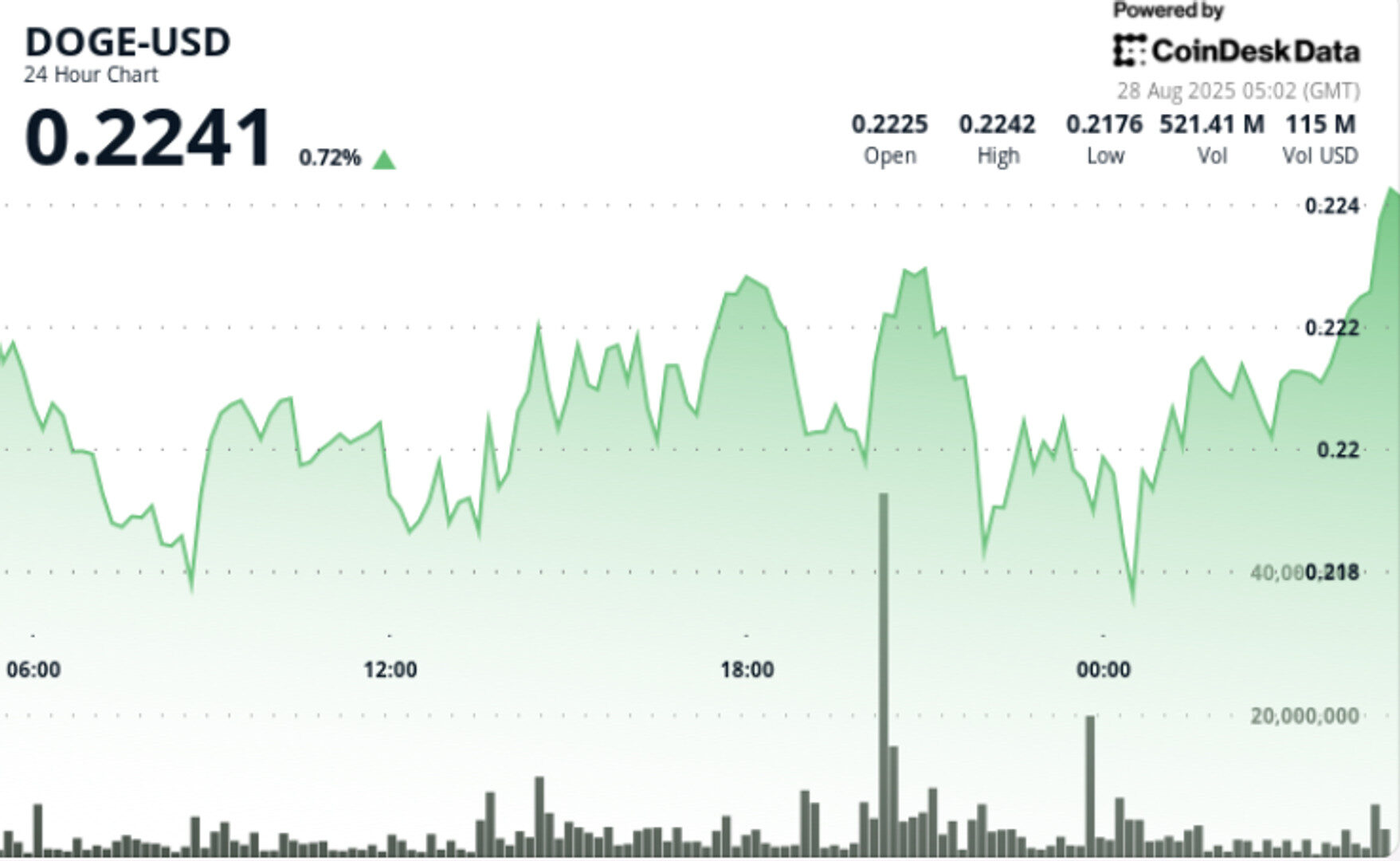

- From August 27 at 03:00 to August 28 at 02:00, DOGE traded in a tight $0.01 (3%) range, holding around $0.22.

- Peak institutional participation came at 20:00 GMT on August 27, when DOGE advanced from $0.219 to $0.224 on 1.26 billion volume — nearly 4x the hourly norm.

- Late in the session (01:20–02:19 GMT on Aug. 28), DOGE rallied from $0.219 lows to $0.224 intraday highs before profit-taking returned it to the $0.220–$0.221 band.

- Support: Strong bid interest around $0.219–$0.220 has emerged as the new floor.

- Resistance: $0.224–$0.225 continues to cap short-term rallies after repeated failures.

- Momentum: RSI steady in the mid-50s suggests equilibrium rather than trend acceleration.

- Volume: Institutional spike to 1.26 billion tokens at $0.22 marked accumulation interest, but overall declining activity hints at consolidation.

- Patterns: Tight trading range indicates compression phase; resolution could set the stage for directional breakout.

- Risk Gauges: Futures OI down 8% signals lighter positioning — reducing immediate volatility but also tempering breakout conviction.

- Whether $0.219 support holds under further whale distribution.

- Breakout above $0.225 as a trigger toward $0.23–$0.24.

- Sustained corporate accumulation around $0.22 as evidence of treasury desks positioning ahead of broader market catalysts.

- Signs of renewed leverage in futures markets that could amplify DOGE’s next directional move.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

More For You

By Omkar Godbole, AI Boost|Edited by Parikshit Mishra

37 minutes ago

Institutional interest in ether is growing, with large open interest holders hitting a record of 101 early this month.

What to know:

- The CME’s ether futures market has reached a record high in open interest, surpassing $10 billion.

- Institutional interest in ether is growing, with large open interest holders hitting a record of 101 early this month.

- Ether’s price has surged 23% this month, reaching new highs above $4,900.