-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

Share this article

Token climbs from $2.74 to $2.82 as whales add nearly $960M in exposure, even as analysts warn of potential correction.

By Shaurya Malwa, CD Analytics

Updated Sep 2, 2025, 3:25 a.m. Published Sep 2, 2025, 3:25 a.m.

- XRP rose 3% in 24 hours, with significant institutional trading activity.

- Whales accumulated 340M tokens, showing confidence despite market challenges.

- Analysts are divided on XRP’s future, with some predicting a drop to $1.00 and others targeting $7–$8.

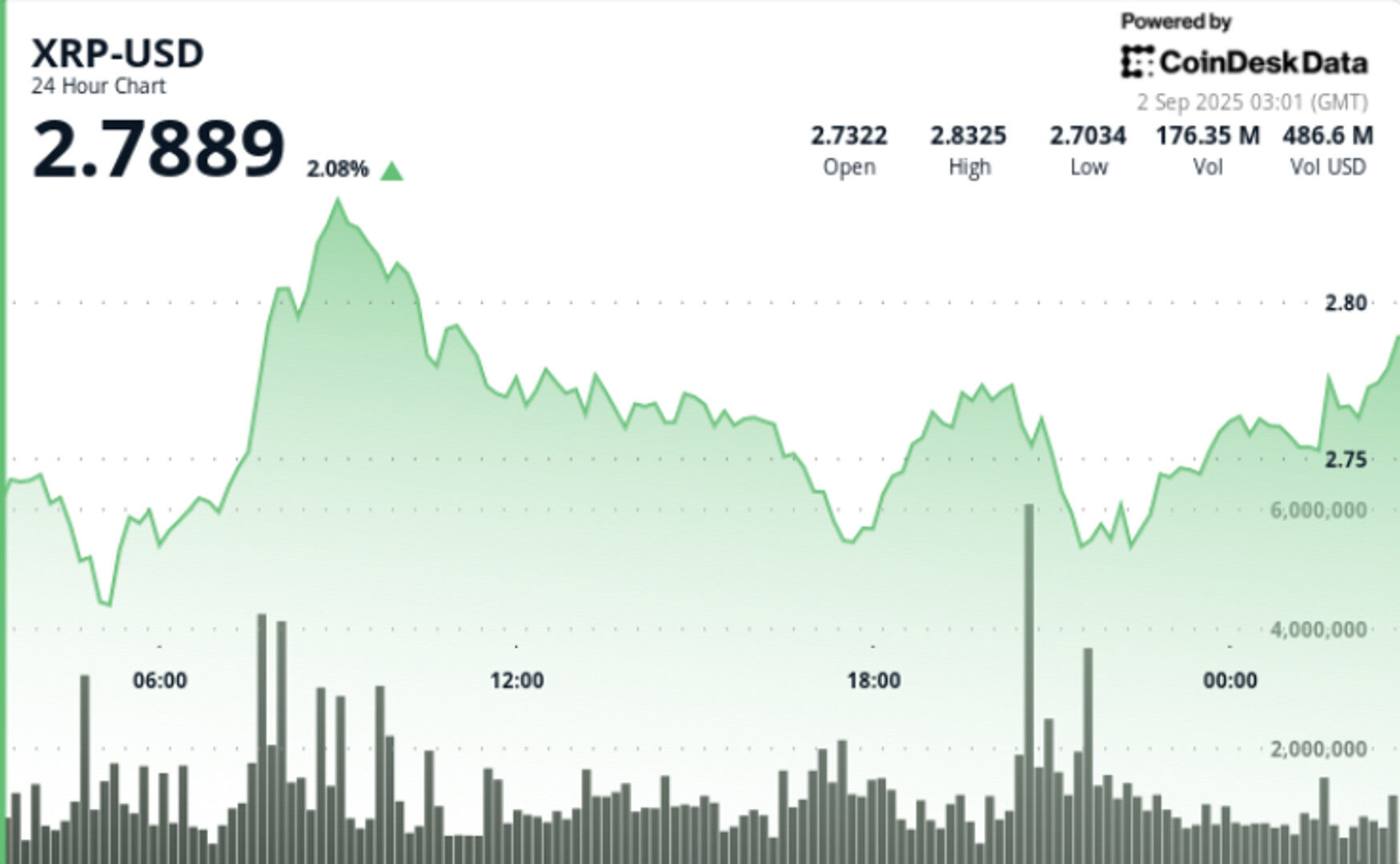

- XRP rose 3% in the 24-hour window from Sept. 1 at 03:00 to Sept. 2 at 02:00, moving between $2.70–$2.83 on 5% intraday volatility.

- Institutional activity dominated early hours, with 164.9M XRP traded at 07:00–08:00 GMT, almost double the 24-hour average of 86M.

- Whales accumulated 340M tokens (~$960M) over the past two weeks, signaling conviction despite broader market weakness.

- Seasonal September softness and regulatory uncertainty remain key headwinds. Spot XRP ETF applications from Grayscale, Bitwise, and others are pending with U.S. regulators.

- Analysts are split: some flag downside risks toward $1.00 after the July $3.65 peak, while others point to long-term breakout setups with $7–$8 targets.

- XRP opened near $2.74 and advanced to a morning high of $2.83 on heavy volume before fading to $2.77 by session close.

- Support repeatedly held at $2.70–$2.74, while $2.83 was rejected as short-term resistance.

- Late session (23:18–00:17 GMT) saw a 0.68% move from $2.74 to $2.77, with 2M+ tokens per minute traded during peak bursts, confirming institutional flows.

- Support: $2.70–$2.74 established as the near-term floor.

- Resistance: $2.83 is the immediate ceiling; $3.00–$3.30 remains the broader breakout band.

- Momentum: RSI stable in mid-50s, indicating neutral-to-bullish bias.

- MACD: Histogram converging toward bullish crossover as accumulation builds.

- Patterns: Symmetrical triangle with consolidation under $3.00; break above $3.30 could target $4.00+.

- Volume: Early-session spike to 164.9M signaled whale participation, later fading to 21.7M as retail dominated.

- Institutional accumulation vs. analyst calls for a cycle top — which side defines September’s trajectory.

- Pending ETF rulings as potential catalysts for inflows.

- Breakout scenario: reclaim $2.83, then test $3.00–$3.30.

- Breakdown scenario: lose $2.70 floor, exposing $2.50.

More For You

1 hour ago

Memecoin rallies to $0.22 on institutional flows before profit-taking and late-session selling push price back toward $0.21 support.

What to know:

- Dogecoin experienced significant volatility, trading within a 6% range amid broader market fluctuations influenced by trade policy and Federal Reserve signals.

- Institutional investors showed strong interest in Dogecoin, with trading volumes exceeding 800 million DOGE during key market movements.

- Analysts highlight the potential for Dogecoin to serve as a diversification tool for corporate treasuries amid ongoing macroeconomic uncertainties.