-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

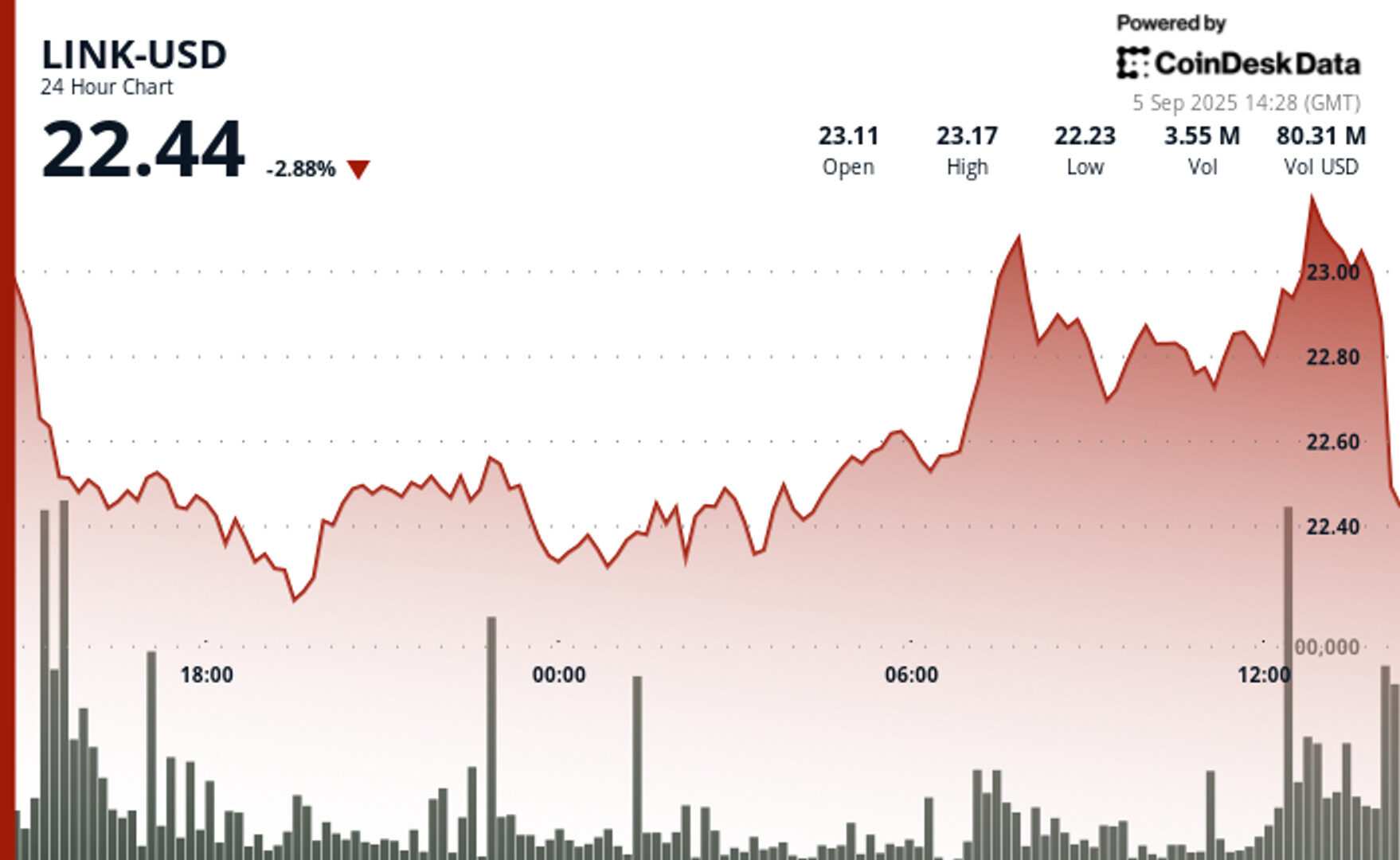

Chainlink’s native token encountered persistent bearish pressure as BTC, ETH and the broader crypto market consolidated, CoinDesk Research’s model shows.

By CD Analytics, Krisztian Sandor|Edited by Sheldon Reback

Sep 5, 2025, 3:22 p.m.

- Chainlink’s LINK token has tumbled from its August high despite positive developments such as a U.S. government partnership and a proposed ETF.

- The decline follows a 37% rally last month and comes amid a broader crypto market pullback.

- Technical analysis shows LINK facing resistance around $23.10-$23.16, with support at $22.28-$22.32.

LINK, the native token of oracle service Chainlink has been under pressure recently as a number of positive headlines failed to break the decline.

The token slid another 2.8% over the past 24 hours to $22.4 while the broader market, as measured by the CoinDesk 20 Index was little changed, CoinDesk data shows. It’s trading 15% lower since topping $27 on Aug. 22, despite being tapped by the U.S. government to publish economic data on the blockchain and Bitwise filing for a LINK exchange-traded fund (ETF).

STORY CONTINUES BELOW

The cool-off period follows a rally that saw the token booking a 37% gain in August, one of the strongest advances among major cryptos. It also coincides with bitcoin BTC$108,783.53, ether (ETH) and the broader crypto market pulling back since mid-August.

The losses occurred even though the Chainlink Reserve, an automated mechanism that buys tokens on a weekly basis, essentially taking them out of circulation and reducing supply, purchased another 43,937 LINK on Thursday. Since its debut in early August, the mechanism has bought a total of 237,014 tokens, worth $5.5 million at current prices.

- LINK encountered persistent bearish pressure, forming lower highs and lower lows as the broader crypto market is in a consolidation period, CoinDesk Research’s technical analysis model shows.

- Key technical support levels established around $22.28-$22.32.

- Strong volume-backed resistance formed around the $23.10-$23.16 level.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

By Shaurya Malwa|Edited by Oliver Knight

16 minutes ago

The investor, who originally acquired 1 million ETH during the 2014 ICO for $310,000, still holds 105,000 ETH valued at $451 million in two wallets.

What to know:

- An early Ethereum investor has made one of the largest recent staking deposits, moving 150,000 ETH worth $646 million into a staking address.

- The investor, who originally acquired 1 million ETH during the 2014 ICO for $310,000, still holds 105,000 ETH valued at $451 million in two wallets.

- This movement is part of a trend of ICO whales resurfacing, with traders noting the impact of long-dormant supply entering circulation, although the funds were staked rather than sold.