Onchain capital allocator Grove shared plans to boost Ripple USD, USDC stablecoin liquidity on Aave’s institutional lending arm Horizon for tokenized asset-backed borrowing.

By CD Analytics, Krisztian Sandor|Edited by Stephen Alpher

Oct 20, 2025, 6:21 p.m.

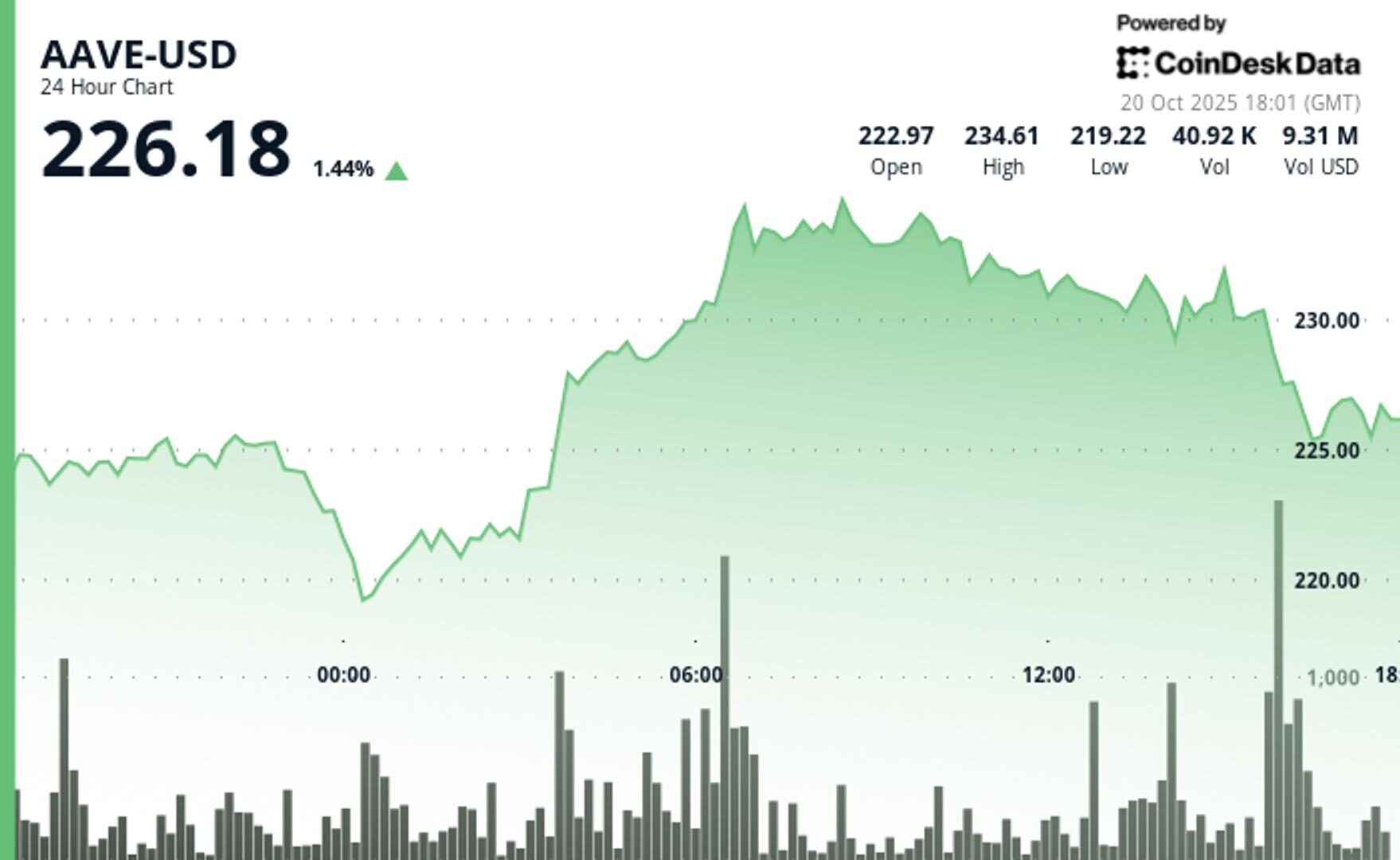

- AAVE was one of the strongest performers from the Friday lows, up over 10% by Monday.

- Resistance emerged at around $231 amid multiple failed attempts to break through.

- Grove announced plans to supply stablecoin liquidity to Aave’s Horizon market, underscoring the protocol’s growing momentum in tokenized real-world asset lending.

The governance token of decentralized finance lender Aave AAVE$227.13 stood out as one of the strongest performers through the weekend as crypto assets bounced from the Friday lows.

The token advanced was up over 10% on Monday to briefly top $230, only trailing oracle network Chainlink’s native token LINK$18.80 among the CoinDesk 20 Index members.

STORY CONTINUES BELOW

AAVE pared gains amid short-term profit taking emerged later in the Monday session, consolidating above $225, CoinDesk Research’s analysis model noted.

Apart from the price action, Aave is gaining momentum in the fast-growing tokenized asset lending market. Grove, an onchain capital allocator closely related to Sky (SKY), laid out plans to supply RLUSD$1.0001 and Circle’s USDC$1.0000 stablecoins to Horizon, Aave’s new institutional lending market where qualified borrowers post tokenized real-world assets as collateral for loans.

The integration, pending governance approval, could deepen liquidity for institutions borrowing against assets like U.S. Treasury tokens. Horizon already supports collateral from issuers like Superstate and Centrifuge, with Chainlink LINK$18.80 providing valuation data and third-party risk assessments from Llama Risk and Chaos Labs.

If approved, Grove’s contribution could help turn tokenized assets into real working capital.

- Bullish momentum holds despite pullback from highs as token maintains uptrend above key support.

- Multiple failed attempts above $231.00 highlight persistent overhead resistance.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

By Will Canny, AI Boost|Edited by Stephen Alpher

5 hours ago

The company’s move to bring data center development in-house strengthens its AI and mining strategy, and accelerates monetization, said analyst Mark Palmer

What to know:

- Benchmark raised its price target on Bitdeer Technologies to $38 and reiterated its but rating on the stock, citing its shift to in-house AI data center development.

- The company is accelerating buildouts at its Clarington, Ohio and Tydal, Norway sites to expand into AI/HPC while scaling bitcoin mining.

- The stock remains undervalued, trading at 4.3x FY26 EV/revenue vs. an 8.6x peer average, analyst Mark Palmer said.