BTC

$120,028.63

+

1.19%

ETH

$3,013.57

+

0.76%

XRP

$2.9534

+

3.34%

USDT

$0.9999

–

0.03%

BNB

$692.65

+

0.32%

SOL

$164.16

+

0.92%

USDC

$0.9999

+

0.02%

DOGE

$0.1995

–

0.58%

TRX

$0.3013

–

1.08%

ADA

$0.7391

–

0.20%

HYPE

$47.71

–

1.45%

XLM

$0.4580

–

1.36%

SUI

$3.8594

+

10.35%

LINK

$15.92

+

1.01%

HBAR

$0.2406

–

0.31%

BCH

$505.45

–

0.21%

WBT

$45.72

–

0.74%

AVAX

$21.48

+

0.28%

LEO

$8.9956

–

0.37%

SHIB

$0.0₄1336

–

0.04%

By Krisztian Sandor, CD Analytics|Edited by Stephen Alpher

Jul 14, 2025, 4:31 p.m.

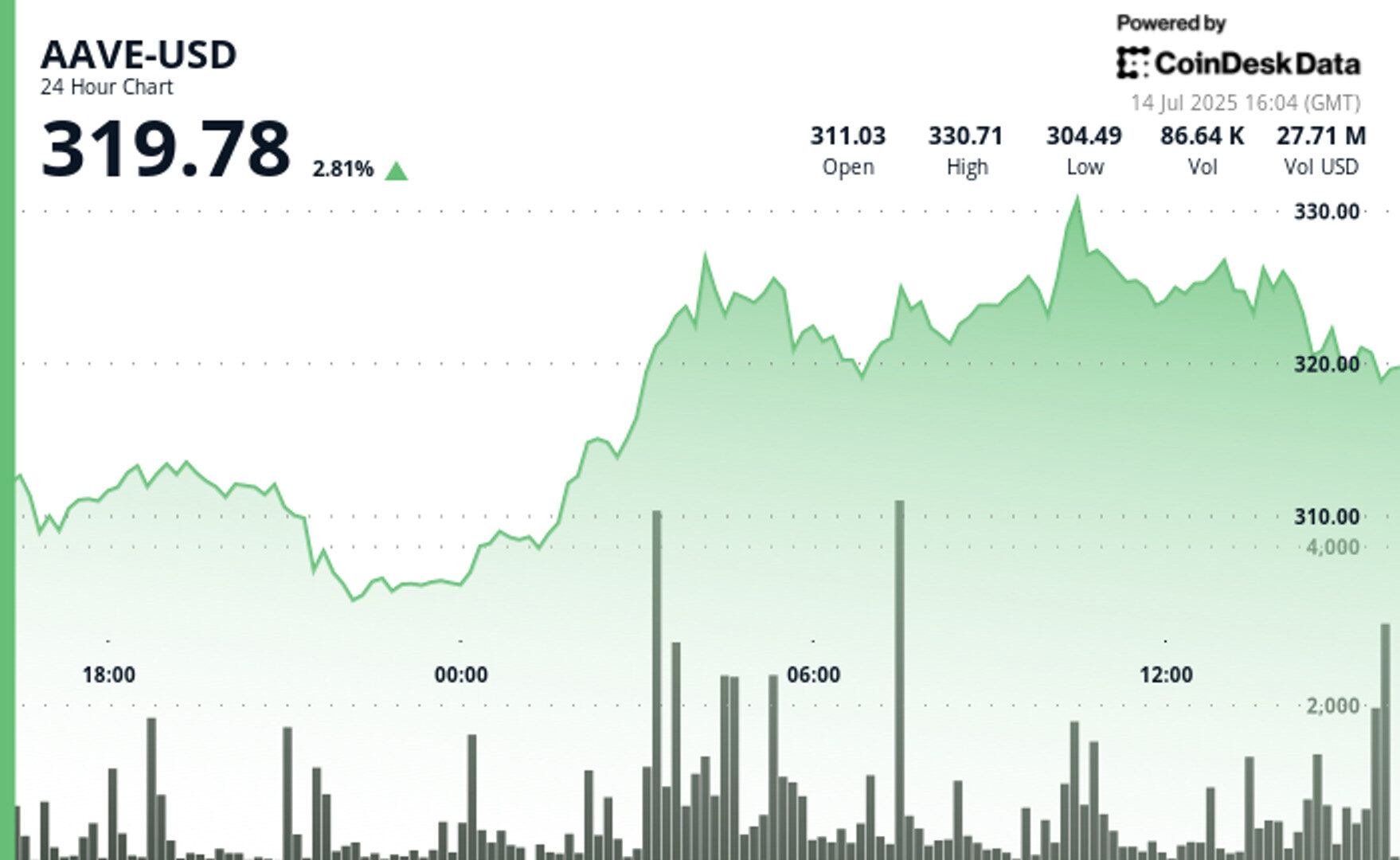

- DeFi lender Aave’s token (AAVE) surged as high as $330 Monday, marking an 8% weekend gain amid a broader crypto rally.

- The gains happened as Aave reached a record $50 billion in deposits, solidifying its position as the leading DeFi lending platform.

- The platform could benefit from upcoming U.S. crypto and stablecoin regulations, asset manager 21Shares said.

Native token of decentralized finance (DeFi) lending platform Aave

surged to its strongest price in several months on Monday

The bluechip DeFi token topped $330 during the session before cooling off at $316, gaining 8% over the weekend.

STORY CONTINUES BELOW

The rally came as the DeFi sector is heating up amid a broader crypto rally, with bitcoin

conquering fresh records above $120,000.

Aave is the dominant player in DeFi lending, and has just hit $50 billion in deposits on the protocol, a fresh record level.

The platform also poised to be one of the biggest gainers of advancing U.S. crypto regulations, analysts said.

“Aave is the biggest lending platform in decentralized finance (DeFi), and it could be a major winner from the GENIUS Act,” digital asset manager 21Shares said in a Monday report.

The platform currently holds 5% of all stablecoin supply to earn a yield, more than any other DeFi protocol, the report noted. It also issues its own, overcollateralized stablecoin GHO

, which has a $312 million supply.

Aave also aim to benefit from the growing institutional participation and tokenization wave with the upcoming Horizon project that will let institutions borrow stablecoins by posting tokenized real-world assets such as money market funds as collateral, the report added.

CoinDesk’s market analytics model highlighted a bullish structure for AAVE.

- Trading volume spikes to 159,078 units during morning session, confirming institutional accumulation and sustained buying pressure.

- Support base forms at $304.25-$305.63 during initial decline, providing foundation for subsequent rally phase.

- Resistance cluster develops around $327.40 where multiple rejection attempts create volume-weighted ceiling.

- Psychological support at $320.00 attracts consistent demand throughout consolidation period.

Krisztian Sandor is a U.S. markets reporter focusing on stablecoins, tokenization, real-world assets. He graduated from New York University’s business and economic reporting program before joining CoinDesk. He holds BTC, SOL and ETH.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.