BTC

$103,578.72

–

0.39%

ETH

$2,422.41

–

2.78%

USDT

$1.0003

+

0.02%

XRP

$2.1202

–

0.87%

BNB

$637.25

–

0.93%

SOL

$140.52

–

2.43%

USDC

$1.0000

+

0.02%

TRX

$0.2729

+

0.07%

DOGE

$0.1604

–

3.54%

ADA

$0.5768

–

1.15%

HYPE

$33.98

–

4.59%

WBT

$48.94

–

0.36%

BCH

$473.05

–

1.91%

SUI

$2.6441

–

4.29%

LINK

$12.48

–

2.49%

LEO

$8.9236

+

0.73%

XLM

$0.2412

–

1.95%

AVAX

$17.15

–

3.20%

TON

$2.9312

–

1.28%

SHIB

$0.0₄1120

–

2.58%

By Siamak Masnavi, CD Analytics|Edited by Aoyon Ashraf

Updated Jun 21, 2025, 2:11 p.m. Published Jun 21, 2025, 2:02 p.m.

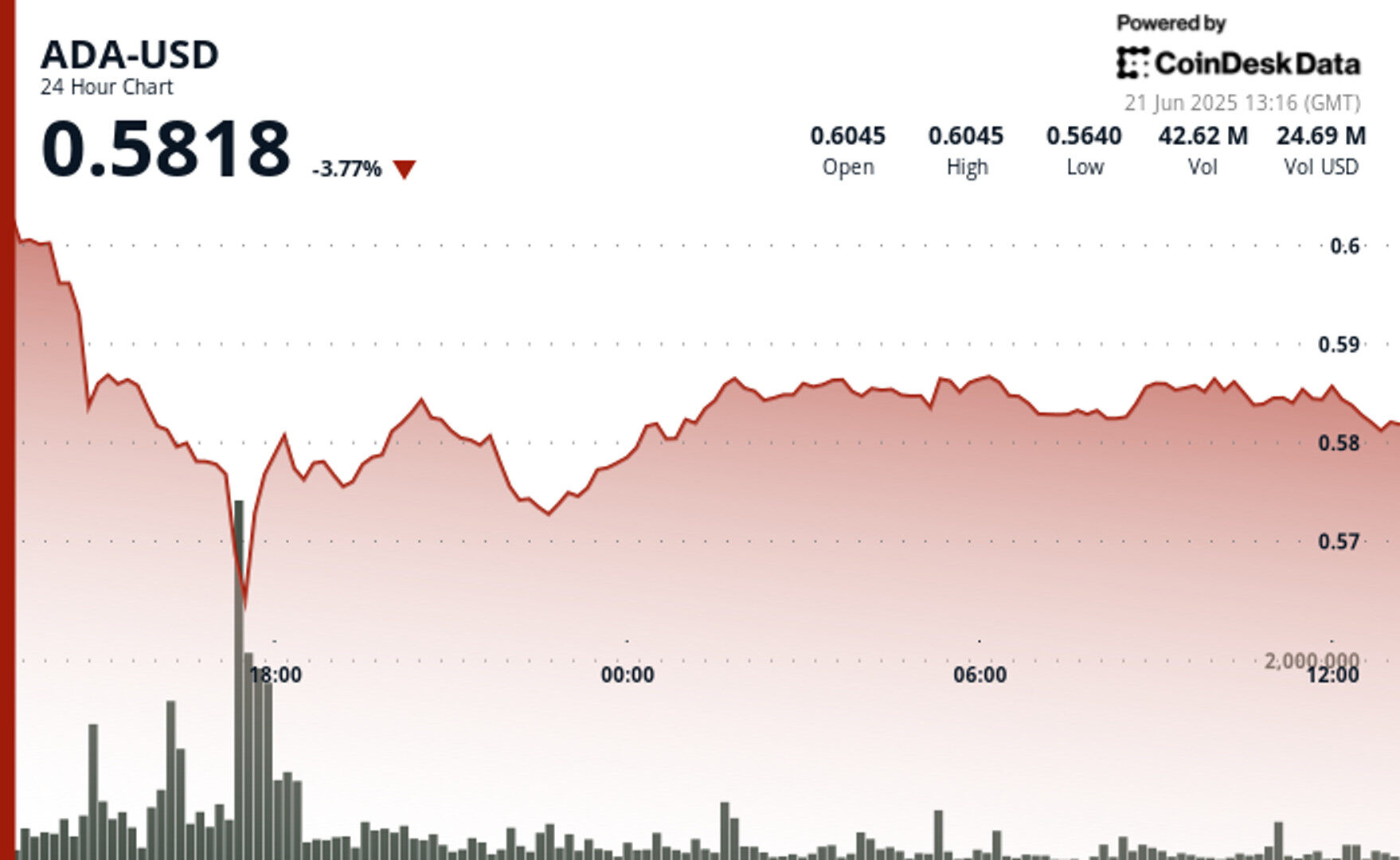

- ADA dropped 3.77% in 24 hours, falling to $0.5818 as volatility and global macroeconomic uncertainty pressured prices.

- Cardano-based Leios upgrade aims to dramatically boost network throughput and scalability, with IOG reaffirming its vision on June 19.

- Trading volume surged 38.39% above the 7-day average, suggesting strong market activity as ADA formed support near $0.582.

Cardano’s ADA

token came under pressure Saturday, falling to $0.5818 and extending its weekly losses despite renewed focus on the network’s Leios upgrade. ADA declined 3.77% over the past 24 hours, with volume spiking 38.39% above the 7-day average, according to CoinDesk Research’s technical analysis model.

On Thirsday, Input Output Global (IOG), the research arm behind Cardano, reiterated its vision for the upcoming Leios upgrade via a thread on X. The team explained that Leios is designed to optimize transaction processing and resource utilization, especially during peak block activity. The design introduces new mechanisms like endorsements to maintain security and data availability while boosting overall throughput.

STORY CONTINUES BELOW

Leios was first introduced in November 2022 as a new family variant of Cardano’s Ouroboros consensus protocol. At the time, IOG highlighted that existing designs such as Praos and Genesis faced fundamental scalability limits — not due to bandwidth or CPU, but due to algorithmic dependencies that constrained throughput. Leios seeks to address these limits with a major architectural overhaul, including faster chain sync, tiered transaction fees, and greater service prioritization.

The upgrade is not just a tweak to the existing system but a substantial redesign. While implementation will demand considerable changes, its benefits could be transformative. IOG Co-Founder and CEO Charles Hoskinson said on X on May 10 that he expects Leios to go live on the Cardano mainnet in 2026, a timeline that was reportedly accelerated from an initial 2028 projection.

Meanwhile, long-term holders continue to withdraw ADA from centralized exchanges, signaling conviction in the asset’s future.

Technical Analysis Highlights

- ADA traded within a 7.15% 24-hour range, declining from $0.605 to a low of $0.562 before partial recovery.

- The 17:00 hour saw a high-volume support zone form around $0.562–$0.576, with volume peaking at 175M.

- Price stabilized between $0.582–$0.588 resistance and $0.573–$0.582 support, signaling consolidation.

- Decreasing volume patterns suggest a potential accumulation phase.

- In the last hour, ADA dropped from $0.585 to $0.582 within a descending channel.

- A sharp sell-off at 12:48 breached the $0.583 support; price later consolidated near $0.582.

- Volume spikes at 12:39 and 12:48 (over 1 million units each) marked key inflection points during the session.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Siamak Masnavi is a researcher specializing in blockchain technology, cryptocurrency regulations, and macroeconomic trends shaping the crypto market. He holds a PhD in computer science from the University of London and began his career in software development, including four years in the banking industry in the City of London and Zurich. In April 2018, Siamak transitioned to writing about cryptocurrency news, focusing on journalism until January 2025, when he shifted exclusively to research on the aforementioned topics.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.