Several of the largest altcoins suffered corrective moves to the downside on Wednesday, suggesting a pause or even end to altcoin season before it ever really got started.

The sharp declines pushed bitcoin dominance back above 60% as the world’s oldest crypto remained relatively stable.

Also notable were more than $200 million worth of long positions liquidated, $43 million of which was on ether (ETH) markets and $32 million on XRP (XRP). Though bouncing a bit of its worst levels of the day, XRP remained lower by 5.2% over the past 24 hours.

SOL and TON were also among those hit hard by the plunge, losing 7% and 11%, respectively.

These sudden drops are related to a lack of liquidity on altcoin trading pairs compared to bitcoin. Two percent market depth on bitcoin for example is around $40 million on either side of the order book on both Binance and Coinbase. For XRP, however, the total is between $5 million and $6 million on either side, meaning that a $6 million market sell order would incur 2% of slippage without accounting for liquidations.

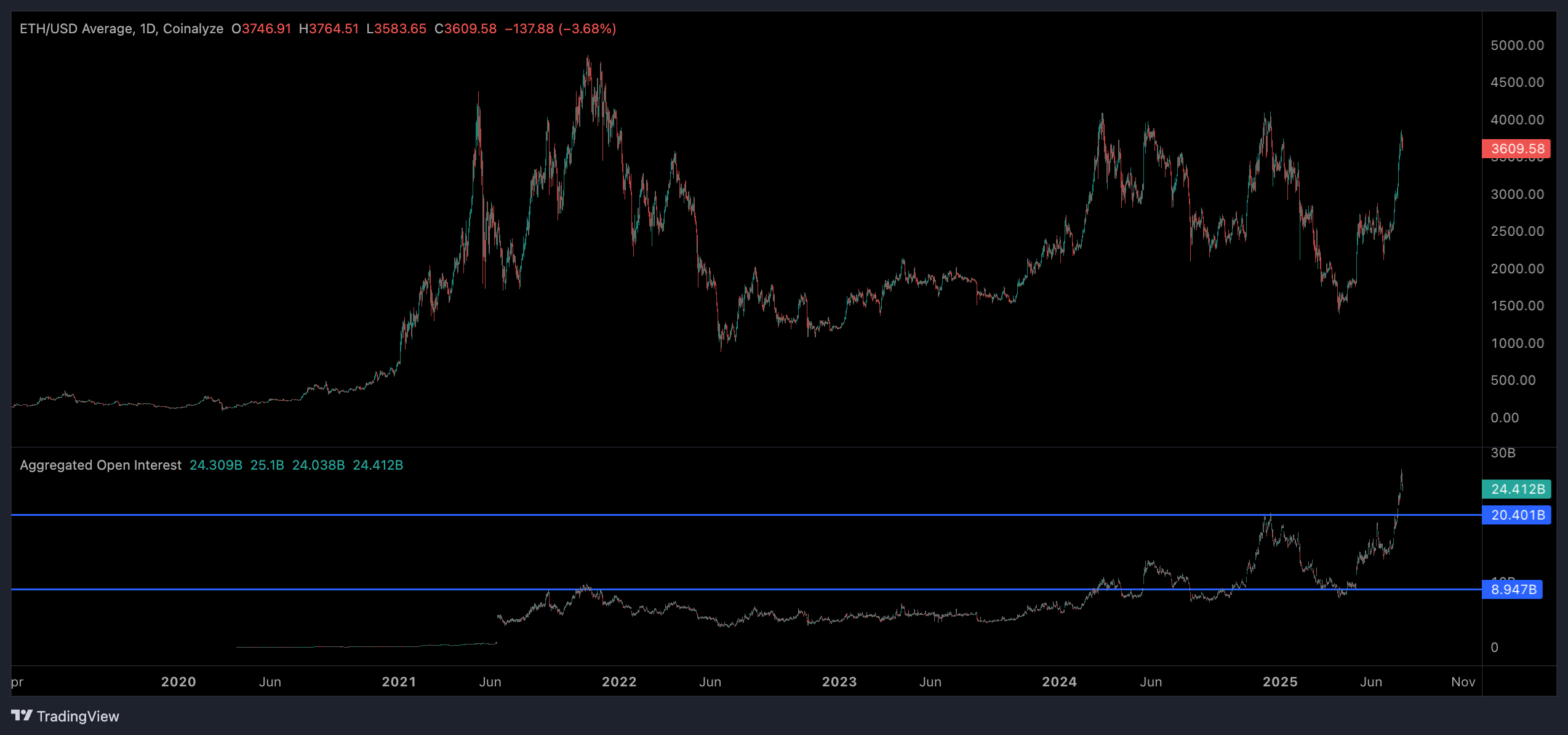

Traders will be eagerly watching to see whether altcoins will bounce following a series of technical breakouts last week. If ETH can hold above $3,470 it would indicate a potentially bullish resolution as that prior point of resistance will have flipped to become support. A break below that level could decimate the altcoin market with more liquidations expected.

Open interest for ETH is still at $24 billion, significantly higher than during its 2021 high when it failed to top $10 billion, indicating that much of the recent move has been driven by leverage.

CoinMarketCap’s altcoin season indicator has also ticked down from 55 out of 100 to 47, demonstrating weakness across the altcoin sector despite a recent rise in retail participation.

A return to altcoin season will likely be seen if bitcoin can form a new record high above $124,000 and begin to consolidate above that point, leaving capital to rotate to more speculative altcoin bets.