Aptos’ APT declines amid slump in wider crypto markets

By Will Canny, CD Analytics|Edited by Sheldon Reback

Dec 23, 2025, 4:52 p.m.

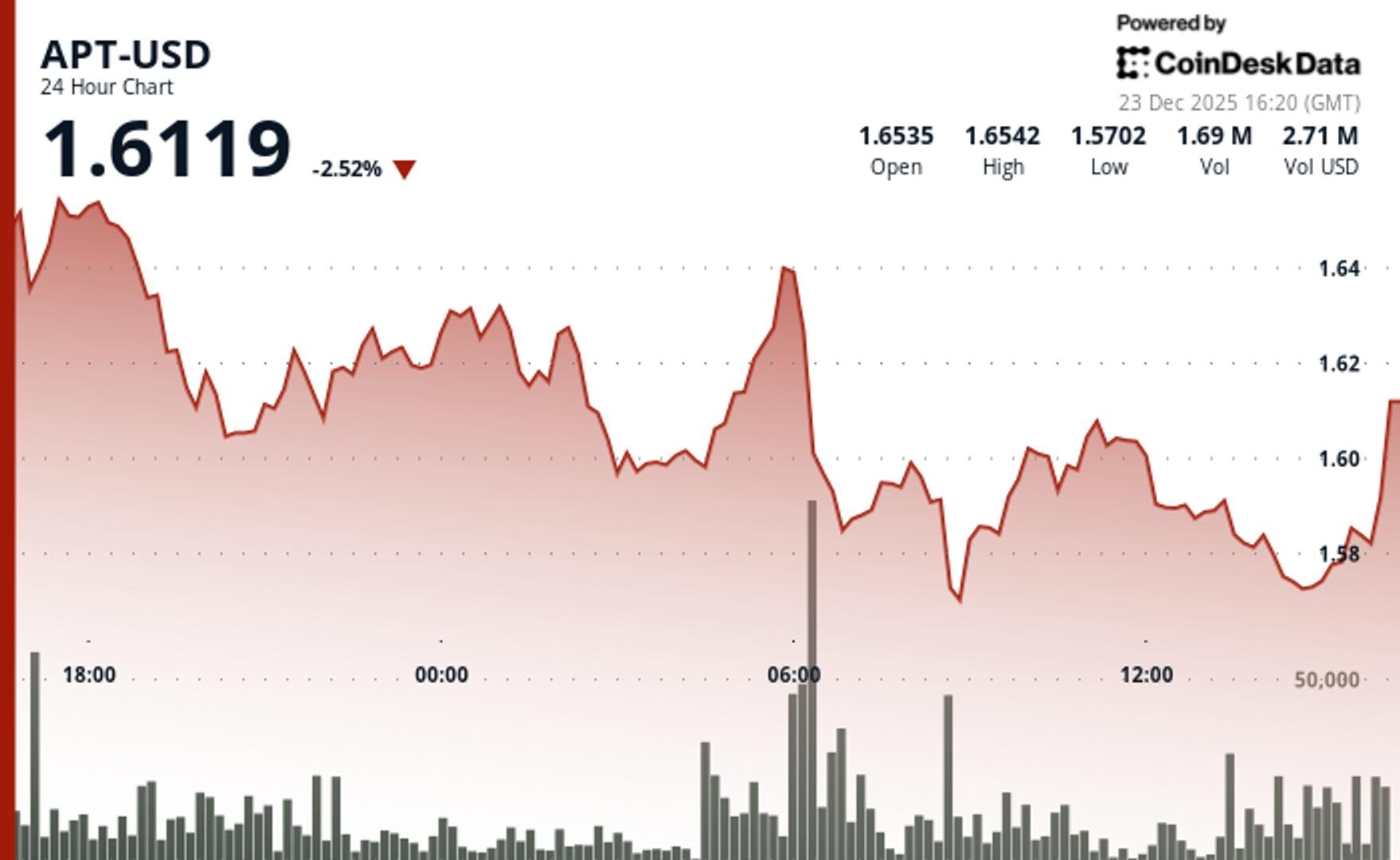

- APT dropped 2.8%

- Trading volume was 35% above monthly average.

- The elevated activity validated genuine repositioning despite APT’s relative weakness against larger digital assets.

APT$1.5929 fell 2.8% over 24 hours as the layer-1 token faced headwinds from sector rotation with traders favoring bigger cryptocurrencies over mid-cap alternatives.

APT traded within a 10 cent range, declining from $1.66 to $1.57 before staging a late-session recovery, according to CoinDesk Research’s technical analysis model.

STORY CONTINUES BELOW

The model showed that volume rose 35% above the 30-day average, signaling institutional participation rather than retail noise.

The elevated activity validated genuine repositioning despite APT’s relative weakness against larger digital assets. Selling pressure dominated morning hours as growth-oriented blockchain narratives faced broader market skepticism, according to the model.

The token’s resilience at key support levels suggested accumulation emerged during weakness, the model said.

The broader market gauge, the CoinDesk 20 index also declined, and was 2.8% lower at publication time.

- Primary support established at $1.57-$1.575 after successful defense during selloff

- Key resistance remains at $1.64 level where morning rejection occurred

- Exceptional volume spike of 7.3 million at 06:00 breakdown confirmed distribution

- Final hour breakout volume of 93,449 validated bullish reversal pattern

- Overall 35% volume increase above 30-day average signaled institutional interest

- Bearish trend with lower highs dominated morning session trading

- Immediate upside target at $1.64 resistance with $1.575 stop-loss level

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Dec 19, 2025

L1 tokens broadly underperformed in 2025 despite a backdrop of regulatory and institutional wins. Explore the key trends defining ten major blockchains below.

What to know:

2025 was defined by a stark divergence: structural progress collided with stagnant price action. Institutional milestones were reached and TVL increased across most major ecosystems, yet the majority of large-cap Layer-1 tokens finished the year with negative or flat returns.

This report analyzes the structural decoupling between network usage and token performance. We examine 10 major blockchain ecosystems, exploring protocol versus application revenues, key ecosystem narratives, mechanics driving institutional adoption, and the trends to watch as we head into 2026.

More For You

By Helene Braun|Edited by Stephen Alpher

40 minutes ago

The crypto merchant bank’s head of research said bitcoin’s price in 2020 dollar terms peaked out this year at $99,848.

What to know:

- Bitcoin’s October price spike above $126,000 didn’t break the $100,000 barrier when adjusted for inflation, according to Galaxy Digital’s Alex Thorn.

- Measured in 2020 dollars, bitcoin’s high this year was $99,848, said Thorn.

- U.S. inflation rose about 24% from 2020 to 2025, making nominal price comparisons across years potentially misleading.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language