Aptos (APT) gains as volume surge signals accumulation

By CD Analytics, Will Canny|Edited by Sheldon Reback

Dec 30, 2025, 1:11 p.m.

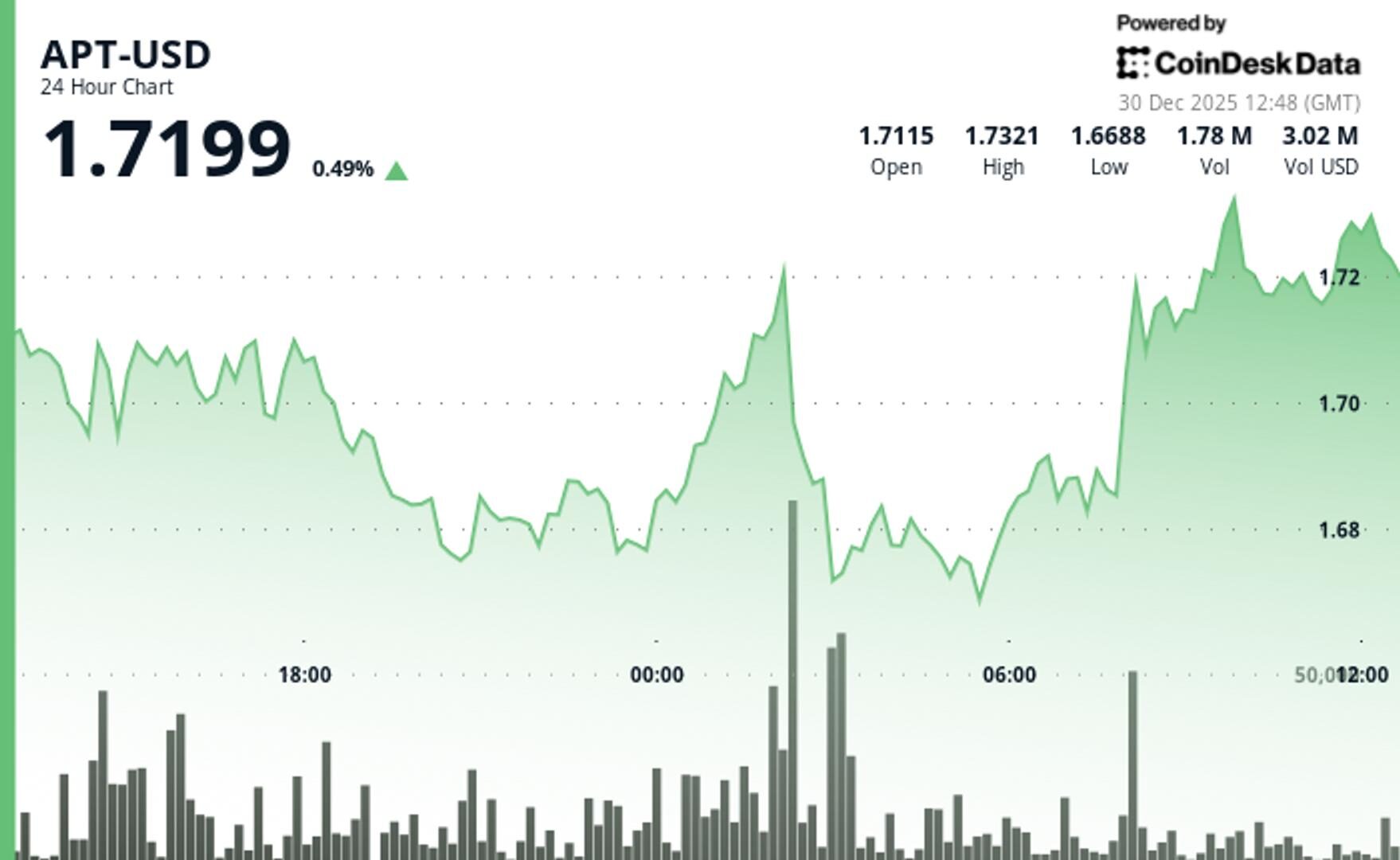

- APT climbed 1.3% to $1.73 as trading volume jumped 12% above weekly averages.

- The token pierced $1.72 resistance on sustained institutional flows.

APT$1.6893 posted rose in the past 24 hours, advancing 1.3% to $1.73.

The token maintained tight correlation with broader crypto markets throughout the period, according to CoinDesk Research’s technical analysis model.

STORY CONTINUES BELOW

The model showed that volume patterns revealed underlying institutional accumulation.

Price action accelerated during the end of the period as APT pierced previous resistance near $1.72 on sustained buying pressure, according to the model.

Multiple volume spikes exceeded 40,000 tokens confirming institutional participation in the breakout move, the model said.

The broader market gauge, the CoinDesk 20 index, was 0.5% higher at publication time.

- Primary support established at $1.67

- Immediate resistance cluster targets $1.735-$1.74 zone

- Breakout above $1.72 validates upward momentum structure

- 24-hour average reached 2.76 million tokens

- Volume expansion of 11.8% above 7-day moving average confirms accumulation pattern

- Price action validates institutional accumulation thesis through volume-price correlation

- Upside targets focus on $1.735-$1.74 resistance cluster

- Downside protection anchored at $1.67 support level

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Dec 19, 2025

L1 tokens broadly underperformed in 2025 despite a backdrop of regulatory and institutional wins. Explore the key trends defining ten major blockchains below.

What to know:

2025 was defined by a stark divergence: structural progress collided with stagnant price action. Institutional milestones were reached and TVL increased across most major ecosystems, yet the majority of large-cap Layer-1 tokens finished the year with negative or flat returns.

This report analyzes the structural decoupling between network usage and token performance. We examine 10 major blockchain ecosystems, exploring protocol versus application revenues, key ecosystem narratives, mechanics driving institutional adoption, and the trends to watch as we head into 2026.

More For You

By Olivier Acuna|Edited by Sheldon Reback

1 hour ago

Analysts aimed high. The market declined to follow.

What to know:

- Despite optimistic forecasts, bitcoin ended the year significantly below its peak, marking its first full-year loss since 2022.

- Bitcoin experienced a flash crash on Oct. 10, dropping nearly 10% shortly after hitting a record high.

- Predictions for bitcoin’s price in 2025 varied widely, with many analysts failing to anticipate the market’s downturn.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language