Aptos (APT) Underperforms Wider Crypto Market. Can It Reach $3.75 Level?

By CD Analytics, Will Canny|Edited by Aoyon Ashraf

Oct 27, 2025, 12:51 p.m.

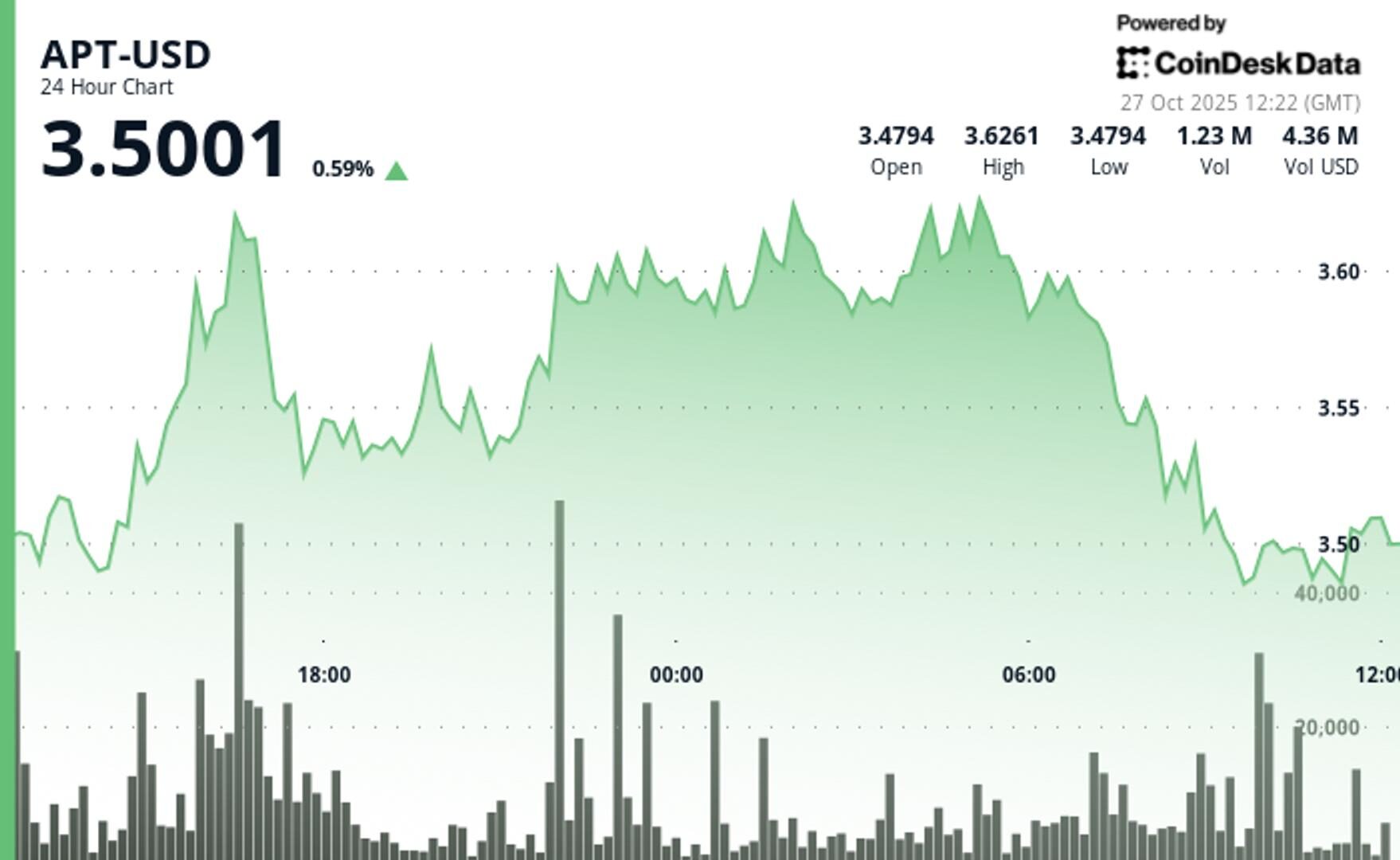

- APT was unchanged over the last 24 hours, trading around $3.50.

- Volume stayed below institutional thresholds despite consolidation at key levels.

- Resistance emerged at $3.60-$3.63 zone after multiple failed breakout attempts.

APT$3.4868 was unchanged over the last 24 hours, trading around $3.50.

A potential breakout above $3.63 resistance targets the $3.75 level for potential 7% upside, according to CoinDesk Research’s technical analysis model.

STORY CONTINUES BELOW

The token underperformed the broader crypto market, and its trading volume remained subdued throughout the period. The broader crypto market gauge, the Coindesk 20 index, was 1.1% higher at the time of publication.

The model showed that APT Price carved out a $0.16 range representing 4.6% of current levels as it advanced from session lows near $3.45.

Volume spiked to 2.48 million shares on Oct. 26, marking a 68% surge above the 24-hour average of 1.47 million, before quickly fading as the price hit resistance at $3.63, according to the model.

Multiple failed breakout attempts at the $3.60-$3.63 zone established this level as a critical technical barrier, the model said.

The combination of modest gains paired with tepid volume typically signals retail-driven activity rather than meaningful institutional flows, suggesting traders remain in a wait-and-see mode at current levels.

Technical Analysis:

- Primary support holds at $3.48-$3.485 after successful defense during the recent pullback, while resistance stays firm at $3.60-$3.63 following multiple rejection attempts

- 24-hour volume averaged 7.9% above the 7-day moving average but missed the 5% institutional engagement threshold, pointing to retail-driven flows rather than significant capital deployment

- V-bottom formation in a 60-minute timeframe suggests a short-term bullish structure, with higher lows from $3.45 to $3.48 confirming near-term uptrend momentum

- Breakout above $3.63 resistance targets the $3.75 level for potential 7% upside, while violation of $3.48 support exposes the $3.40-$3.45 zone

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

By Oliver Knight, Jacob Joseph

32 minutes ago

Crypto markets rallied Monday ahead of the Federal Reserve’s upcoming rate decision, with bitcoin and ether leading gains.

What to know:

- BTC climbed to $115,200 and ETH to $4,160 amid expectations of a Fed interest rate cut on Wednesday.

- Bitcoin’s 30-day implied volatility dropped to 44%, showing reduced market anxiety, while options data indicate a neutral-to-bearish bias in longer-term contracts.

- While older tokens like ZEC, BCH, and DASH saw double-digit gains, newer coins such as plasma (XPL) and aster (ASTER) plunged as enthusiasm and trading volumes waned.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language