BTC

$108,434.04

–

0.44%

ETH

$2,535.00

–

0.94%

USDT

$1.0001

–

0.01%

XRP

$2.3359

+

2.69%

BNB

$659.11

–

0.56%

SOL

$151.39

+

0.00%

USDC

$0.9998

–

0.00%

TRX

$0.2869

+

0.41%

DOGE

$0.1684

–

0.92%

ADA

$0.5839

–

0.19%

HYPE

$39.63

+

0.73%

SUI

$2.9000

–

0.23%

BCH

$494.66

–

0.10%

WBT

$44.92

–

0.07%

LINK

$13.52

+

0.71%

LEO

$8.9796

–

0.25%

XLM

$0.2542

+

4.29%

AVAX

$18.02

–

0.75%

TON

$2.7809

–

4.48%

SHIB

$0.0₄1161

–

1.85%

By Oliver Knight, CD Analytics

Updated Jul 7, 2025, 2:42 p.m. Published Jul 7, 2025, 2:42 p.m.

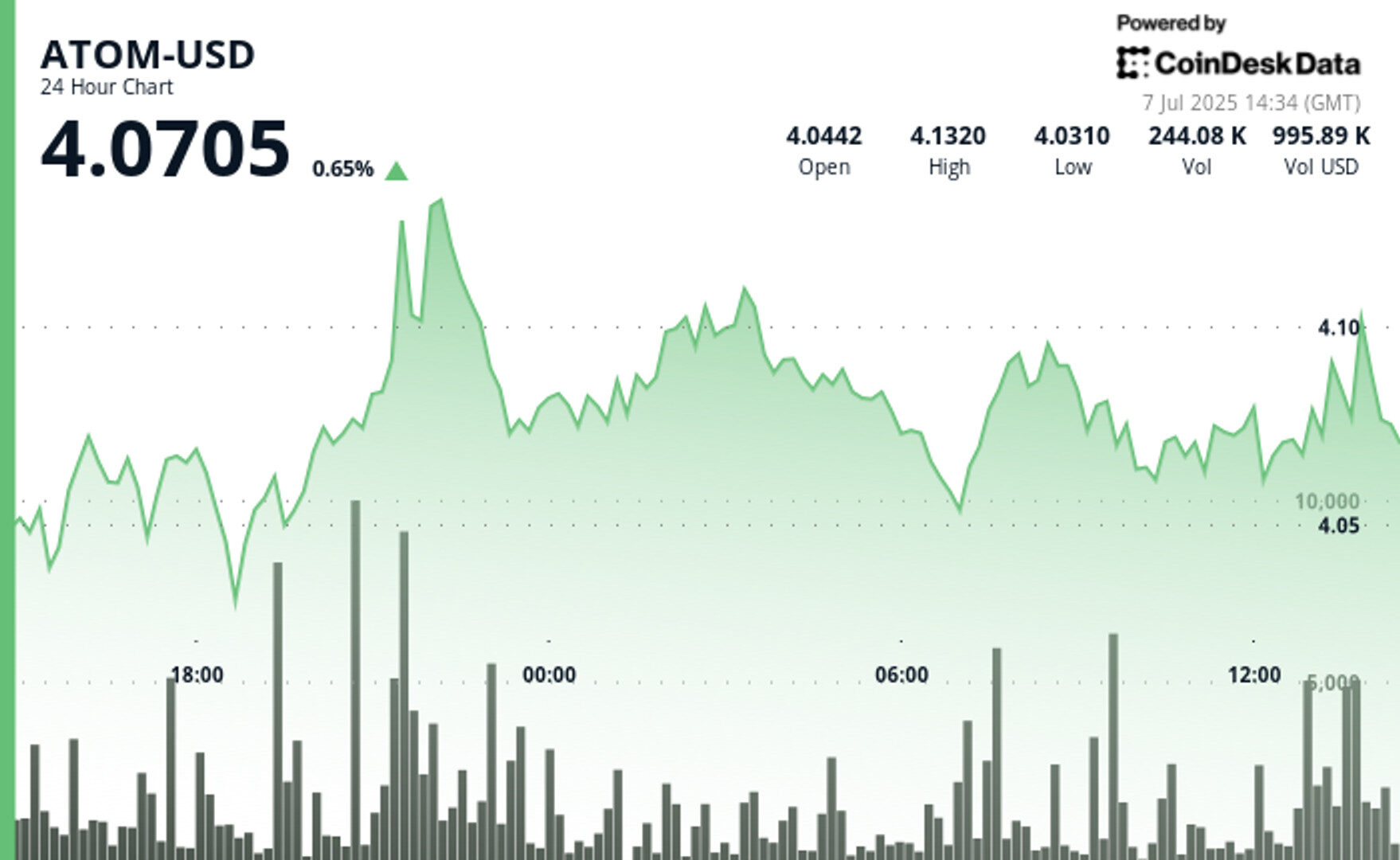

- Cosmos (ATOM) rose 1.23% from $4.05 to $4.10 in 24 hours, driven by a volume surge and strong support at key levels, signaling continued upside potential.

- A breakout above $4.10 with tripled trading volume and clear buyer interest around $4.03–$4.05 reinforces bullish sentiment.

- The CD20 index whipsawed within a 1.18% range, reflecting broader market indecision amid profit-taking and renewed buying activity.

The Cosmos ecosystem token

demonstrated significant bullish momentum during a recent 24-hour period from 6 July 15:00 to 7 July 14:00, climbing from $4.05 to $4.10 with strong buyer support at key levels.

The move comes as bitcoin ambles its way back to the $110,000 level of resistance, a point it rejected from last week causing a day of decline across the altcoin market.

STORY CONTINUES BELOW

ATOM is now well poised to continue to the upside as trading volume tripled over the past 24 hours, indicating optimism from traders.

Technical Analysis

- ATOM-USD climbed from $4.05 to $4.10, representing a 1.23% gain during the 24-hour period from 6 July 15:00 to 7 July 14:00.

- A significant breakout occurred at 21:00 on 6 July when volume surged to over 1 million units (3x the hourly average), pushing price through the $4.10 resistance level.

- Price established a trading range of $0.097 (2.4%) with a high of $4.13.

- Strong buyer interest confirmed at support zones between $4.03-$4.05, suggesting continued upward momentum.

- During the 60-minute period from 7 July 13:05 to 14:04, ATOM exhibited a bullish breakout at 13:57-13:59, with price surging from $4.09 to $4.10 on elevated volume exceeding 20,000 units per minute.

- Clear support zone established at $4.07-$4.08 during mid-period consolidation before the final rally.

- Price pushed up 0.5% from period low to high ($4.07 to $4.10).

- Closing hour showed profit-taking with price settling at $4.09, still maintaining most gains and forming a higher low compared to opening price.

CD20 Index Whipsaws as Market Indecision Intensifies

CD20 Volatility Signals Market Uncertainty The CD20 displayed notable volatility over the last 24 hours from 6 July 15:00 to 7 July 14:00, with a significant range of $21.06 (1.18%) between the low of $1772.50 and high of $1793.57.

After reaching a peak during the early hours of 7 July, the index experienced a sharp correction, dropping to $1772.50 at 13:00 before staging a recovery to close at $1780.94, suggesting market indecision as traders navigate between profit-taking and renewed buying interest.

Oliver Knight is the co-leader of CoinDesk data tokens and data team. Before joining CoinDesk in 2022 Oliver spent three years as the chief reporter at Coin Rivet. He first started investing in bitcoin in 2013 and spent a period of his career working at a market making firm in the UK. He does not currently have any crypto holdings.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.