BTC

$111,809.33

+

1.71%

ETH

$2,779.53

+

5.32%

USDT

$1.0005

+

0.03%

XRP

$2.4543

+

2.27%

BNB

$669.26

+

1.27%

SOL

$156.97

+

2.11%

USDC

$1.0000

+

0.01%

TRX

$0.2906

+

1.00%

DOGE

$0.1813

+

4.30%

ADA

$0.6311

+

3.06%

HYPE

$42.18

+

5.70%

SUI

$3.2487

+

9.95%

BCH

$505.97

+

0.18%

WBT

$46.34

+

1.52%

LINK

$14.38

+

2.17%

XLM

$0.2924

–

0.23%

LEO

$8.9663

–

0.64%

AVAX

$19.52

+

5.23%

HBAR

$0.1782

+

5.93%

SHIB

$0.0₄1245

+

3.18%

By Oliver Knight, CD Analytics

Updated Jul 10, 2025, 3:40 p.m. Published Jul 10, 2025, 3:40 p.m.

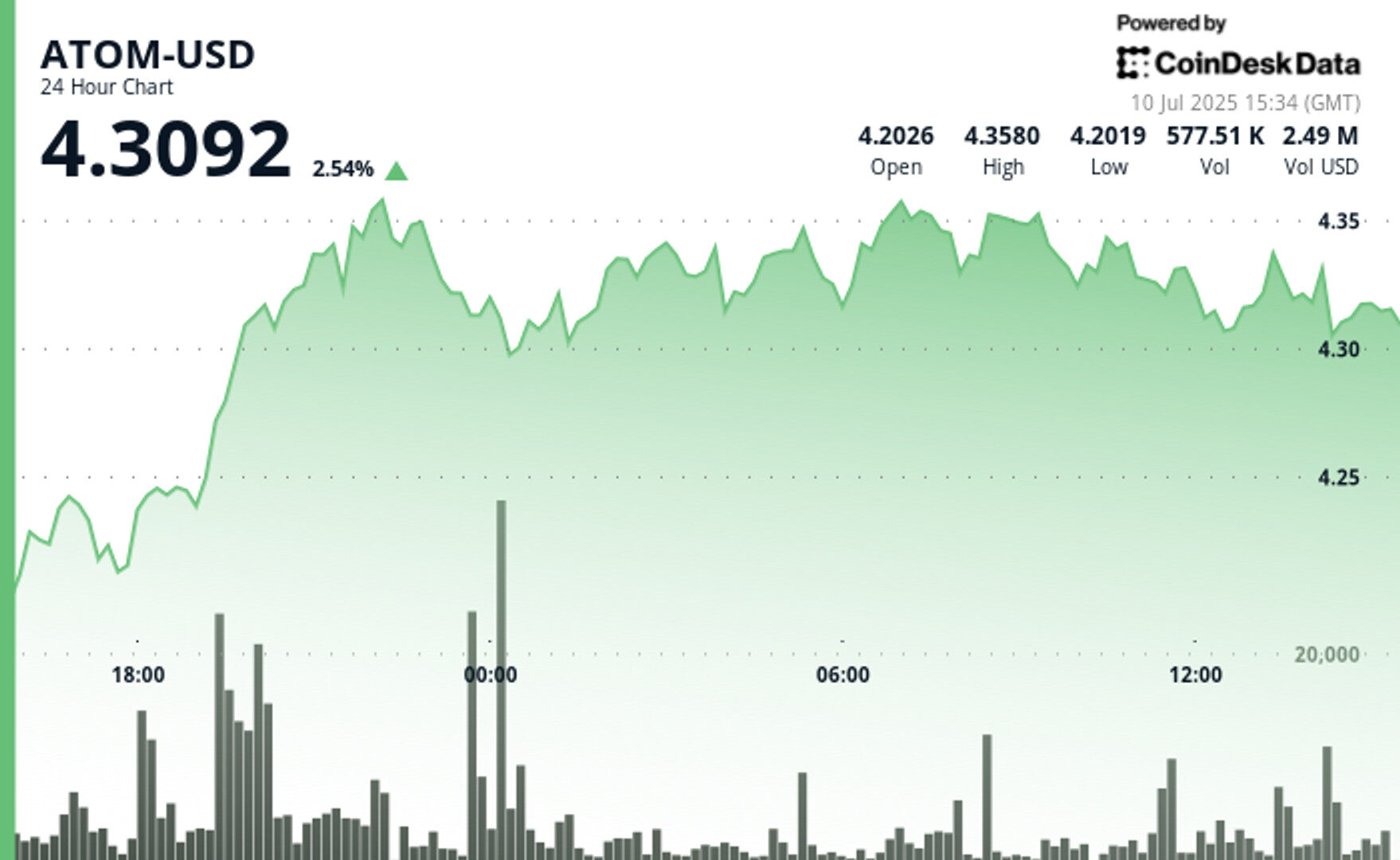

- ATOM surged 3.90% to $4.36 before consolidating at $4.33, breaking the key $4.31 resistance with strong bullish momentum on July 9.

- Trading volume spiked 165% above daily average, confirming optimism as price consolidates between $4.31-$4.35 with declining volume signaling potential breakout setup.

- Technical action shows $4.31-$4.35 range forming, with $4.34 rejection suggesting traders and institutions are reassessing before the next directional move.

ATOM surged 3.90% over the past 24 hours, climbing from $4.20 to $4.36 peak before settling at $4.33. The range reflects strong momentum as bulls push through critical $4.31 resistance at 19:00 GMT on July 9.

Volume spiked 165% above the daily average, confirming bullish sentiment. Price now consolidates between $4.31-$4.35 as traders digest gains. Declining volume signals potential breakout preparation.

STORY CONTINUES BELOW

The price action comes amid a backdrop of optimism after bitcoin

rallied to a new record high on Thursday before consolidating lower.

Technical analysis highlights

- $4.31 resistance breaks on exceptional 1,974,095-unit volume surge.

- Healthy $4.31-$4.35 consolidation follows initial breakout momentum.

- $4.34 rejection in final hour confirms resistance ceiling, retreat to $4.32.

- Volume decline during consolidation suggests next directional move preparation.

- $4.31-$4.34 range trading expected as institutions reassess positioning.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Oliver Knight is the co-leader of CoinDesk data tokens and data team. Before joining CoinDesk in 2022 Oliver spent three years as the chief reporter at Coin Rivet. He first started investing in bitcoin in 2013 and spent a period of his career working at a market making firm in the UK. He does not currently have any crypto holdings.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.