-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By CD Analytics, Oliver Knight

Updated Aug 14, 2025, 3:54 p.m. Published Aug 14, 2025, 3:54 p.m.

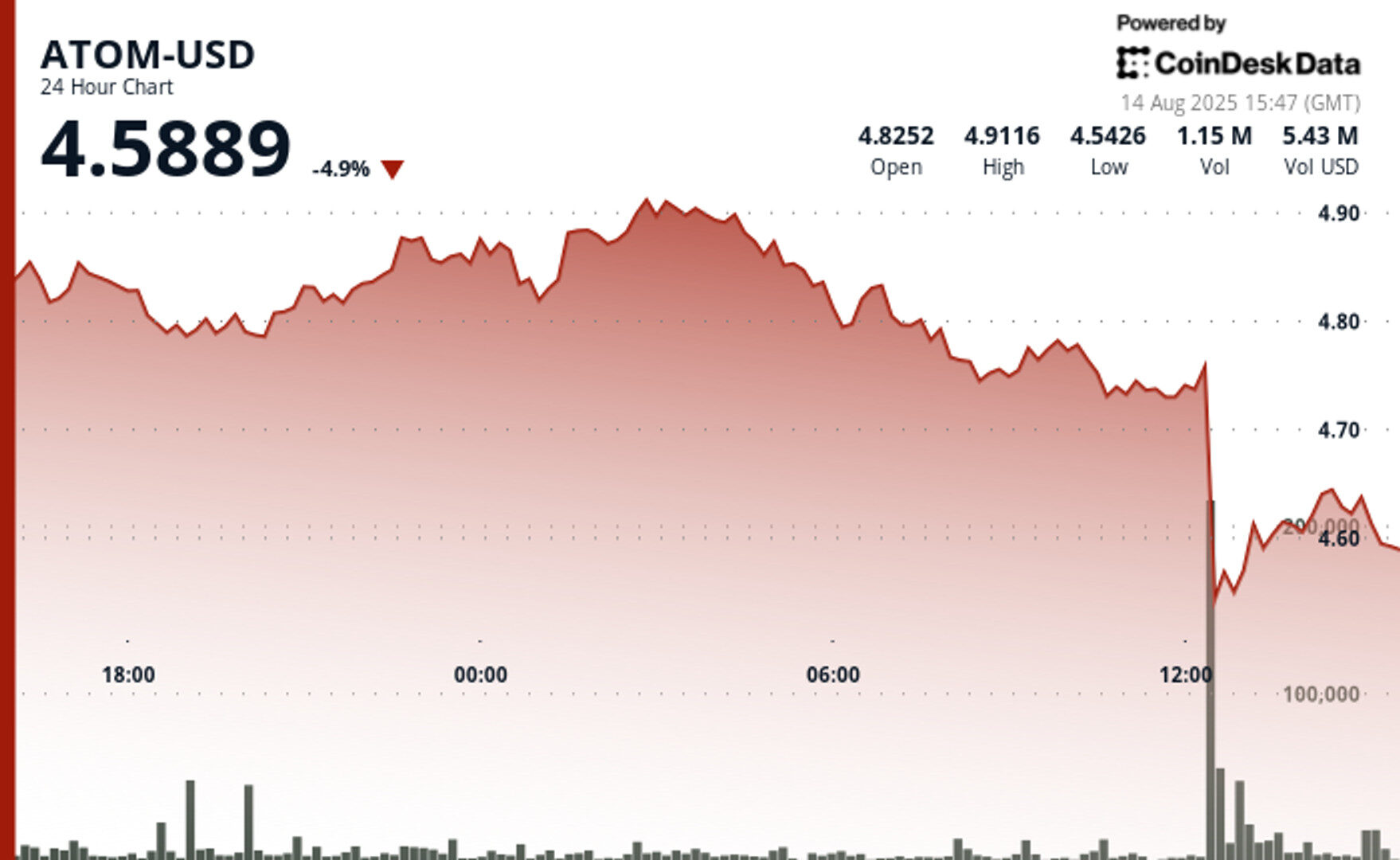

- ATOM-USD traded between $4.49 and $4.91 over the 24-hour period, with volume spiking to 5.62M units—322% above average—signaling intense market activity and possible capitulation during a sharp midday selloff to $4.53.

- Buyers stepped in post-selloff to establish a firm support base near $4.60, stabilizing prices and restoring confidence in the Cosmos ecosystem.

- The asset consolidated between $4.59–$4.62 during the recovery phase, with $4.60 as critical support and $4.91 remaining the main resistance target.

ATOM-USD saw sharp volatility between 13 August 15:00 and 14 August 14:00, trading between $4.49 and $4.91 with volume spiking to 5.62M units—over 322% above average. After holding in the $4.82–$4.85 range and briefly hitting $4.91, the asset faced an aggressive selloff from 06:00 on 14 August, bottoming at $4.53 at 12:00 on heavy volume, signaling potential capitulation.

Buyers quickly stepped in, establishing fresh support near $4.60 and restoring confidence in the Cosmos ecosystem. This price level became a key threshold as selling pressure eased and trading stabilized.

STORY CONTINUES BELOW

During the 60-minute recovery window from 13:20 to 14:19 on 14 August, ATOM rose from $4.60 to $4.61, peaking at $4.64 before consolidating in a tight $4.59–$4.62 range. This confirmed $4.60 as a support base, suggesting a potential launch point for future gains.

While resilience is evident, resistance at $4.91 remains untested. Holding $4.60 will be crucial for maintaining bullish momentum, with any breakdown risking renewed downside pressure.

- Price range of $0.42 representing 9% volatility between $4.91 maximum and $4.49 minimum.

- Volume spike to 5.62 million units, exceeding 24-hour average of 1.33 million by 322%.

- Resistance level established at $4.91 during early morning hours of 14 August.

- Support base formation around $4.60 following recovery from $4.53 low.

- Consolidation pattern between $4.59-$4.62 range indicating potential stabilization.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

Oliver Knight is the co-leader of CoinDesk data tokens and data team. Before joining CoinDesk in 2022 Oliver spent three years as the chief reporter at Coin Rivet. He first started investing in bitcoin in 2013 and spent a period of his career working at a market making firm in the UK. He does not currently have any crypto holdings.

More For You

By Helene Braun, AI Boost|Edited by Sheldon Reback

59 minutes ago

Cathie Wood’s firm spread the new holdings across three different funds, ARKK, ARKW and ARKF as the stock continues to surge on its second day of trading.

What to know:

- Ark Invest bought more than 2.5 million Bullish shares across three ETFs, including ARKK, ARKW and ARKF.

- Bullish stock has surged nearly 100% since its NYSE debut, outperforming a declining crypto market.

- The move follows the Cathie Wood-led company’s earlier large stakes in newly public Circle and smaller holdings in eToro.