BTC

$105,705.27

+

0.36%

ETH

$2,638.19

+

0.41%

USDT

$1.0001

–

0.01%

XRP

$2.2287

–

0.92%

BNB

$665.09

–

0.49%

SOL

$154.22

–

1.32%

USDC

$0.9995

+

0.00%

DOGE

$0.1922

–

0.78%

TRX

$0.2735

+

0.75%

ADA

$0.6899

–

0.17%

HYPE

$35.29

–

3.46%

SUI

$3.2064

+

0.16%

LINK

$14.01

–

1.21%

AVAX

$20.49

–

2.74%

XLM

$0.2689

–

1.10%

LEO

$9.0596

+

2.53%

BCH

$404.45

–

0.17%

TON

$3.2555

+

2.38%

SHIB

$0.0₄1296

–

0.10%

HBAR

$0.1697

–

0.41%

By CD Analytics, Oliver Knight|Edited by Parikshit Mishra

Jun 5, 2025, 12:13 p.m.

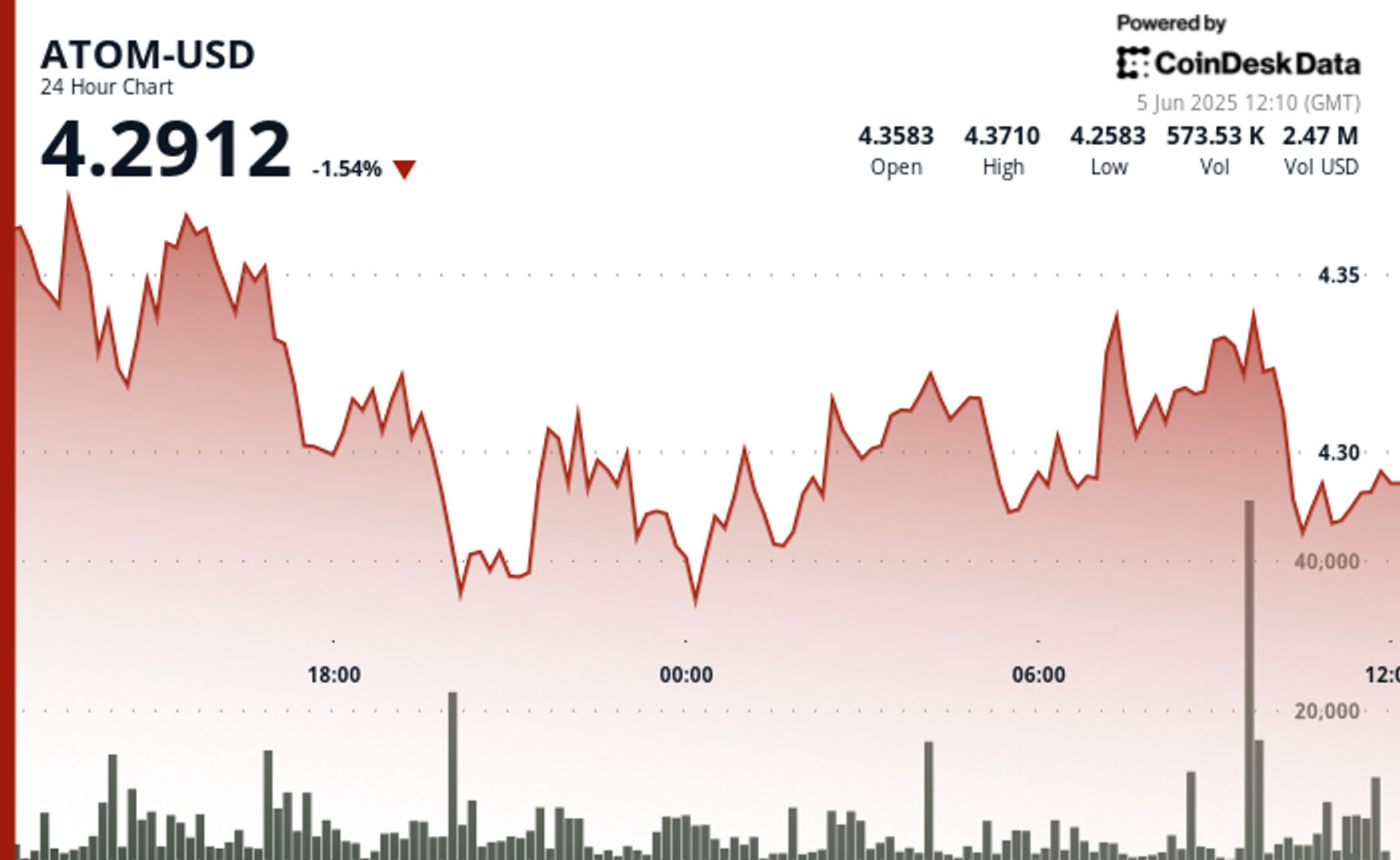

- ATOM experienced a 5% price decline before finding strong support at the $4.25 level, triggering a recovery rally.

- Escalating US-China trade tensions and potential ECB rate cuts created mixed signals across cryptocurrency markets.

- High-volume buying at support levels suggests institutional or whale accumulation despite broader market uncertainty.

The cryptocurrency market continues navigating choppy waters amid complex global economic developments.

ATOM has established crucial support around $4.25 after experiencing a 4.7% decline, with significant buying volume suggesting potential recovery.

STORY CONTINUES BELOW

This price action comes as major economies implement conflicting trade policies, creating ripple effects across financial markets worldwide.

Central banks’ shifting monetary stance on inflation could provide breathing room for digital assets, though ongoing geopolitical tensions continue to create market uncertainty that impacts both traditional and cryptocurrency investments.

- Price formed a clear support zone around $4.25-$4.27, validated by high volume buying at the 20:00 timeframe where volume spiked to 1.42M.

- Recovery pattern emerged in the final hour, with ATOM climbing from $4.295 to $4.314, representing a 0.45% gain.

- Price action formed a clear uptrend with higher lows and higher highs between 07:10-07:21, peaking at $4.338.

- Volume analysis reveals significant buying interest during the uptrend phase, particularly at 07:15 and 07:20 timeframes where volume exceeded 25,000 units.

- Final 15 minutes showed renewed bullish momentum with price establishing support at $4.309 and closing near the hourly high.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

Oliver Knight is the co-leader of CoinDesk data tokens and data team. Before joining CoinDesk in 2022 Oliver spent three years as the chief reporter at Coin Rivet. He first started investing in bitcoin in 2013 and spent a period of his career working at a market making firm in the UK. He does not currently have any crypto holdings.