BTC

$106,566.75

–

0.72%

ETH

$2,423.07

–

0.49%

USDT

$1.0003

+

0.01%

XRP

$2.0733

–

2.34%

BNB

$645.19

+

0.03%

SOL

$141.75

–

0.95%

USDC

$0.9999

+

0.01%

TRX

$0.2715

+

0.07%

DOGE

$0.1588

–

0.94%

ADA

$0.5490

–

1.03%

HYPE

$36.37

–

2.58%

WBT

$45.33

–

4.35%

BCH

$493.54

+

0.21%

SUI

$2.6765

+

1.61%

LINK

$12.89

–

1.78%

LEO

$9.0262

+

0.40%

AVAX

$17.39

+

0.74%

XLM

$0.2339

–

0.88%

TON

$2.8461

+

1.23%

SHIB

$0.0₄1117

–

1.03%

By CD Analytics, Tom Carreras|Edited by Stephen Alpher

Jun 27, 2025, 2:52 p.m.

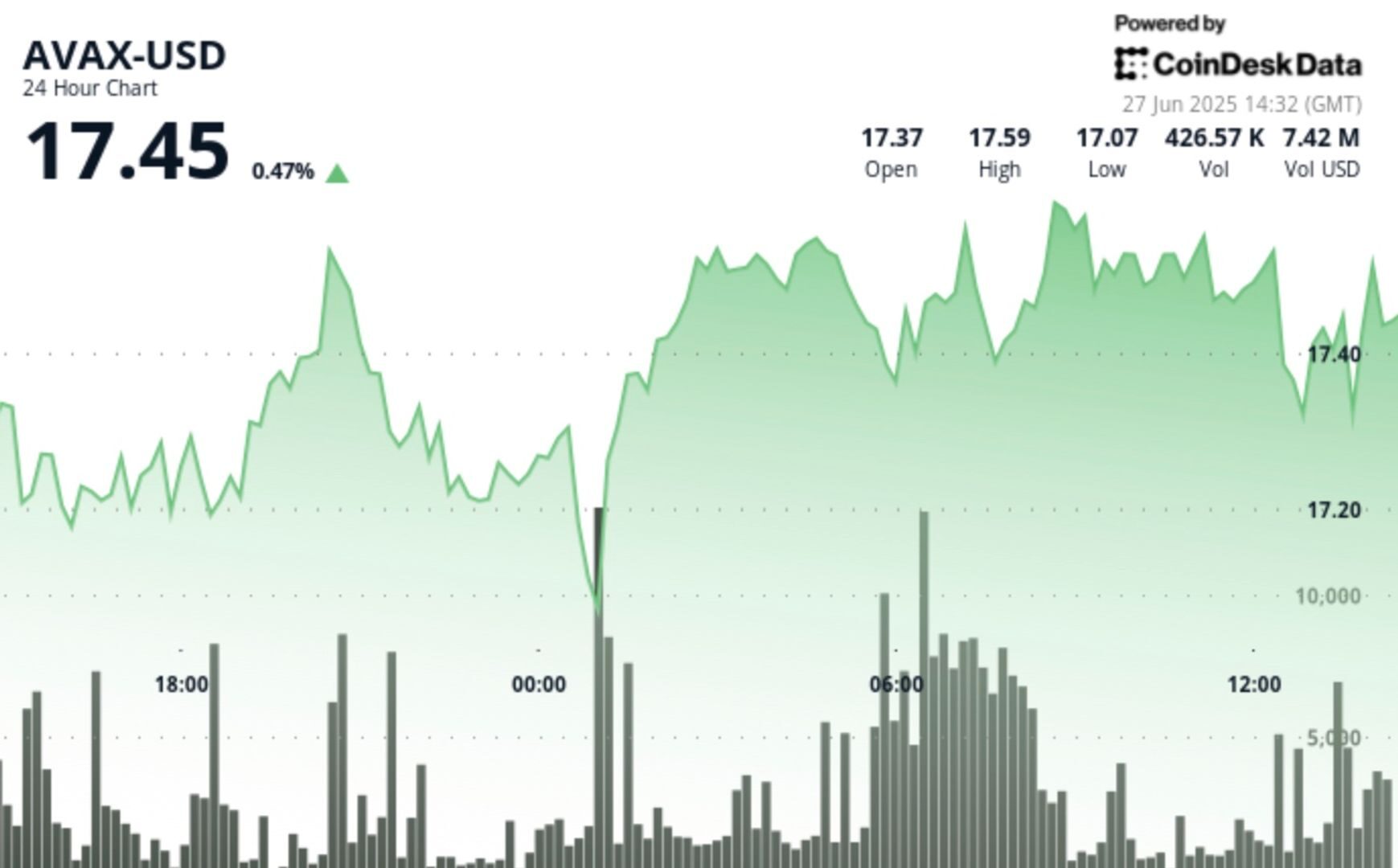

- Avalanche’s token AVAX has broken out of a consolidation phase, establishing strong support levels.

- AVAX is up 0.8% in the last 24 hours, while the CoinDesk 20 index lost 0.4%.

- The token demonstrated resilient price action, with a small uptrend and significant volatility, suggesting potential for continued upward momentum.

Avalanche’s token

recently broke out of a consolidation phase, establishing strong support levels, according to CoinDesk Research’s technical analysis model. The token is up 0.8% in the last 24 hours.

The CoinDesk 20 — an index of the top 20 cryptocurrencies by market capitalization, except for stablecoins, exchange coins and memecoins — lost 0.4% over the same period.

STORY CONTINUES BELOW

Technical Analysis

• AVAX demonstrated resilient price action during the 24-hour period, establishing a small uptrend.

• After initial consolidation between $17.13-$17.35, AVAX broke out with significant volume, forming strong support at $17.07 confirmed by above-average volume during reversal.

• The asset established higher lows throughout the period, with resistance at $17.63 tested multiple times, suggesting accumulation phase completion and potential for continued upward momentum.

• AVAX displayed significant volatility with a strong recovery pattern, rising from $17.37 to $17.45 (0.50% gain).

• After an initial uptrend to $17.46, AVAX experienced a correction to $17.36, forming a double bottom pattern before staging a rally with increasing volume.

• The final minutes showed price bouncing back from $17.37 to $17.46, suggesting renewed buying interest and potential continuation of the broader uptrend.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

Tom writes about markets, bitcoin mining and crypto adoption in Latin America. He has a bachelor’s degree in English literature from McGill University, and can usually be found in Costa Rica. He holds BTC above CoinDesk’s disclosure threshold of $1,000.