BTC

$101,575.44

–

1.13%

ETH

$2,250.71

–

1.00%

USDT

$1.0008

+

0.02%

XRP

$1.9983

–

1.33%

BNB

$619.60

–

1.75%

SOL

$134.03

+

0.59%

USDC

$1.0004

+

0.03%

TRX

$0.2669

–

2.16%

DOGE

$0.1522

–

2.19%

ADA

$0.5434

–

0.50%

HYPE

$35.21

+

4.14%

WBT

$47.57

–

1.92%

BCH

$452.48

–

2.68%

SUI

$2.5010

–

1.18%

LEO

$9.0015

+

0.77%

LINK

$11.83

–

0.56%

XLM

$0.2301

–

1.45%

AVAX

$16.91

+

1.48%

TON

$2.7635

–

2.14%

SHIB

$0.0₄1082

+

0.14%

By James Van Straten|Edited by Parikshit Mishra

Jun 23, 2025, 9:53 a.m.

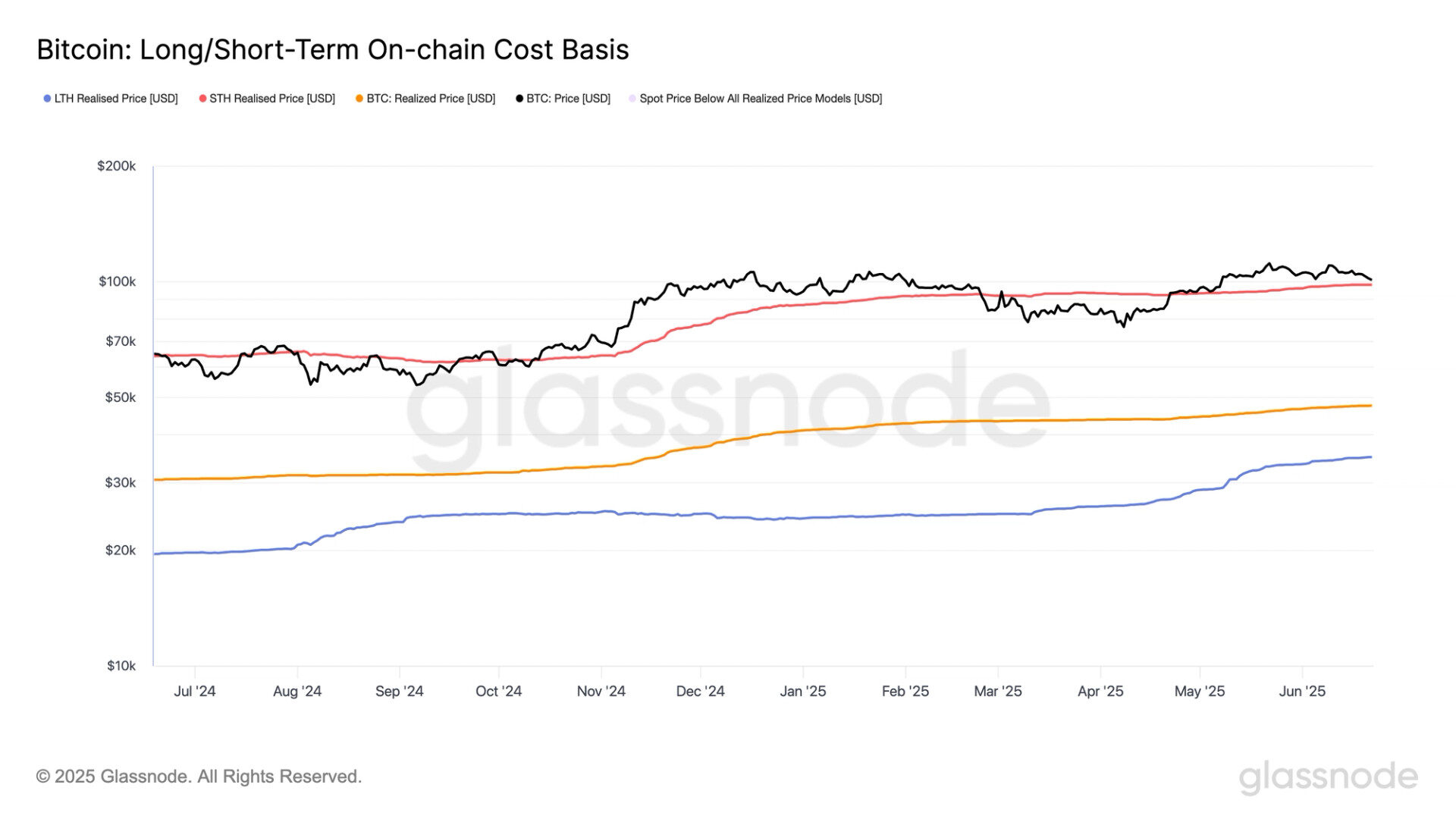

- Short term holder realized price at $98,200 marks a key threshold for short-term market sentiment; trading above it historically aligns with bullish trends.

- Despite selling pressure in the weekend stemming from the conflicts in the Middle East, Bitcoin surged past $101K signaling resilience if it can hold above support.

The short-term holder realized price (STH RP) for bitcoin

currently sits at $98,200, representing the average on-chain acquisition price for bitcoin BTC held outside of exchange reserves and moved within the last 155 days.

This metric, derived using on-chain heuristics, helps distinguish between short and long-term holders and provides insight into market sentiment, according to Glassnode data.

STORY CONTINUES BELOW

Realized price refers to the average acquisition price for the entire circulating bitcoin supply, based on the last time each coin moved on-chain. STH RP narrows this down to more recently active coins, which are statistically more likely to be spent. These are often the most sensitive to market volatility.

Over the weekend, bitcoin dipped amid geopolitical tensions, driven by escalating conflict between Israel and Iran, and growing fears of escalation between U.S. and Iran. With traditional markets closed, investors responded by selling liquid assets like bitcoin not necessarily out of desire, but necessity.

Historically, when bitcoin trades above the STH RP, it typically signals a bullish trend. Conversely, trading below the STH RP is often associated with bearish or consolidation phases.

For example, from June to October 2024, ahead of the U.S. presidential election, bitcoin remained below the STH RP which was around $62,000 at the time. Similarly, in February to April 2025, prices again fell under this threshold which was around $92,000.

Bitcoin has rebounded strongly, climbing back above $100,000 and now trading around $101,000. For bullish momentum to continue, it will be crucial for BTC to remain above the $98,200 STH RP level.

James Van Straten is a Senior Analyst at CoinDesk, specializing in Bitcoin and its interplay with the macroeconomic environment. Previously, James worked as a Research Analyst at Saidler & Co., a Swiss hedge fund, where he developed expertise in on-chain analytics. His work focuses on monitoring flows to analyze Bitcoin’s role within the broader financial system.

In addition to his professional endeavors, James serves as an advisor to Coinsilium, a UK publicly traded company, where he provides guidance on their Bitcoin treasury strategy. He also holds investments in Bitcoin and Strategy (MSTR).