-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

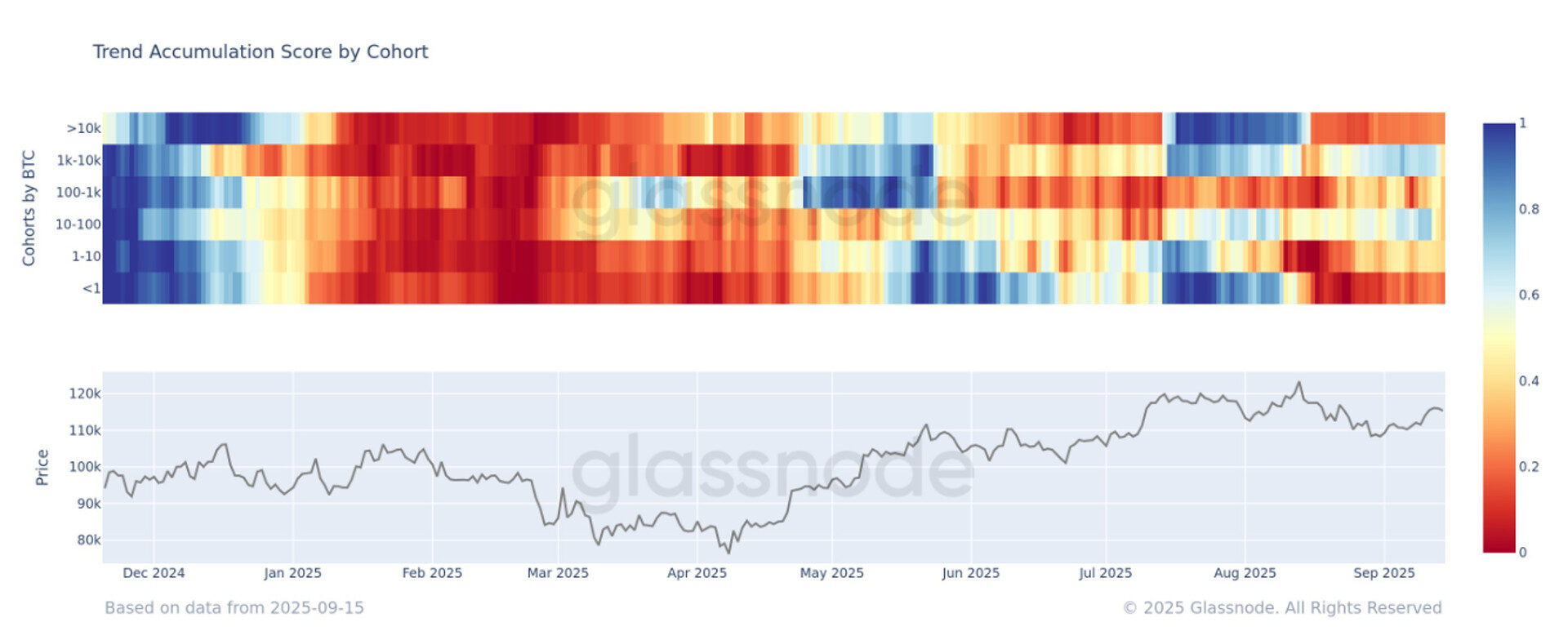

Glassnode data shows all wallet groups are back in distribution mode, while regional trading patterns highlight Asia’s strength and Europe’s weakness.

By James Van Straten, AI Boost|Edited by Sheldon Reback

Sep 15, 2025, 9:25 a.m.

- Wallet cohorts from under 1 BTC to over 10,000 BTC flipped back to net selling after last week’s rally.

- Asia sessions have lifted bitcoin around 10% in recent months, while European sessions have pulled it lower by more than 10%.

Glassnode data shows that all wallet cohorts have returned to distribution mode, with a net selling of bitcoin, according to the Accumulation Trend Score breakdown by wallet cohort.

This metric disaggregates the Accumulation Trend Score to show the relative behavior of different groups of wallet. It measures the strength of accumulation for each balance size based on both the entities’ size and the volume of coins acquired over the past 15 days. (For more details on the methodology, see this Academy entry.)

STORY CONTINUES BELOW

- A value closer to 1 signals accumulation by that cohort.

- A value closer to 0 signals distribution.

Exchanges, miners and other similar entities are excluded from the calculation.

Currently, all cohorts, from wallets holding less than one bitcoin to those holding more than 10,000, are net sellers. This follows last week’s rally, when some whales — most notably the 10-100 BTC and 1,000-10,000 BTC cohorts were buying. They have since flipped back to selling.

Bitcoin was recently hovering near $117,000 after Asia’s trading session pushed it up from $115,000 dollars over the weekend. Over the past three months, Asia has consistently driven bitcoin roughly 10 percent higher, according to Velo data. In contrast, the European trading session has been marked by pullbacks, which has been seen on Monday so far. In addition, bitcoin is down more than 10% in the EU market over the past three months.

Overall, the market remains in consolidation, a trend likely to persist through September. On current data, the $107,000 marked at the start of September still appears to be the most probable bottom.

AI Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

By James Van Straten, AI Boost|Edited by Parikshit Mishra

37 minutes ago

AI mining stocks extend gains as Tesla jumps on Elon Musk’s share purchase.

What to know:

- Bitfarms, IREN and Hive extend sharp gains, highlighting strength in AI-driven mining equities.

- Tesla rallies on Musk’s multi-million share purchase while bitcoin treasuries show mixed performance.