-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By James Van Straten|Edited by Parikshit Mishra

Aug 18, 2025, 10:05 a.m.

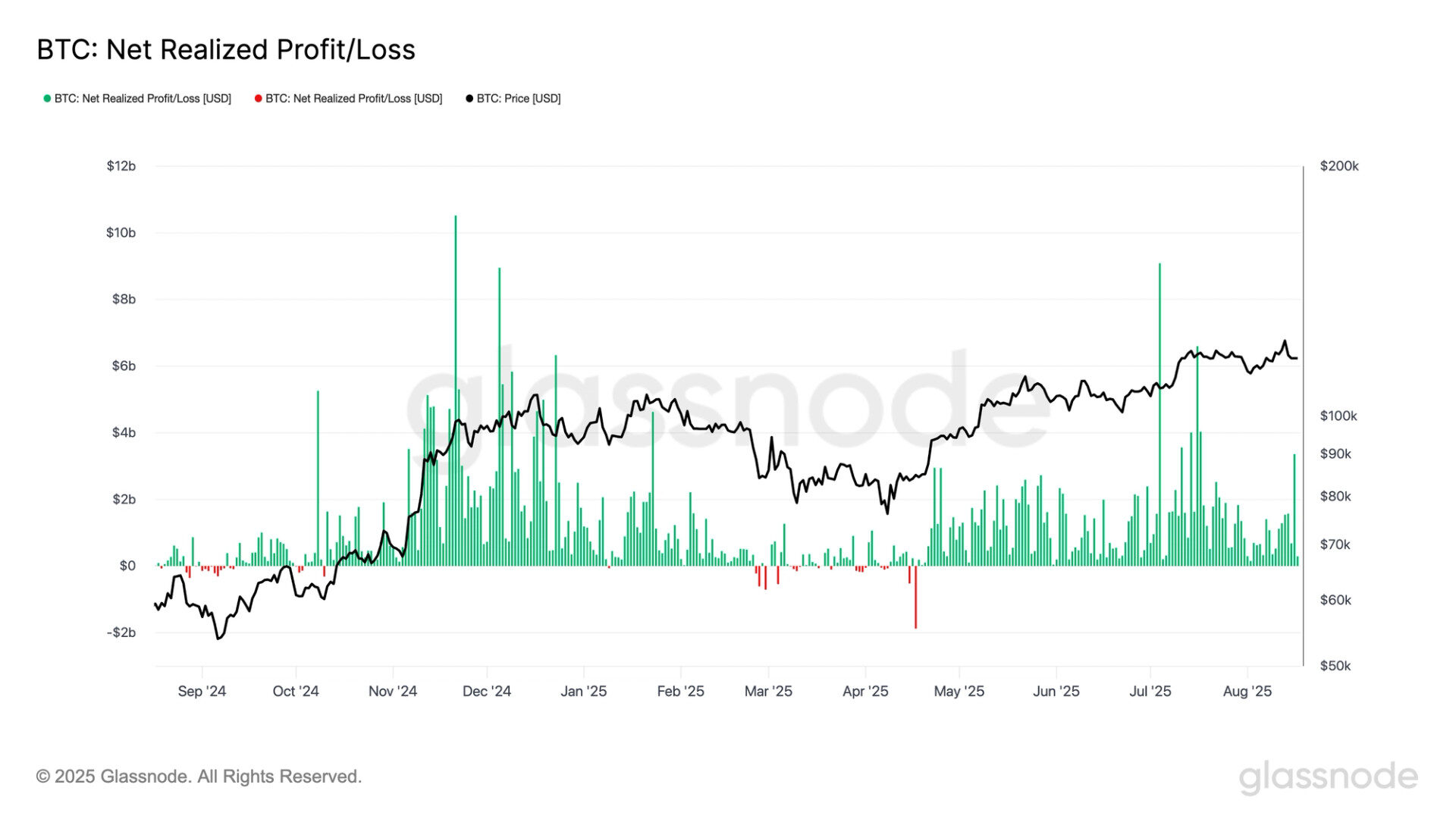

- Approximately $3.3B realized in profits on Saturday alone, the highest since July.

- Four ATHs in 2025, with corrections shrinking from 30% to 8%

Bitcoin

has fallen more than 7% dipping below $115,000, since hitting its all-time high of over $124,000, as traders booked in over $3.5 billion of realized profits across the weekend, according to Glassnode data.

Saturday alone saw $3.3 billion in profit taking, the largest single-day figure since mid-July and one of the highest in 2025.

STORY CONTINUES BELOW

For most of this year, profit has been realized almost daily, with only around 10 sessions showing net losses. The trend reflects BTC’s steady climb from $90,000 at the start of 2025.

Since hitting a low of $76,000 in April, profit taking has accelerated, especially as the $100,000 milestone triggered renewed selling pressure.

This latest downturn follows bitcoin’s all-time high of $124,000 earlier in August. Each correction this year from all-time highs, has been smaller than the last, suggesting more resilience as the market matures: January’s drawdown reached 30%, May’s was 12%, July’s 9%, and August’s pullback now sits at 8%.

Read more: Metaplanet Expands Bitcoin Treasury by 775 BTC, Assets Outweigh Debt 18-Fold

James Van Straten is a Senior Analyst at CoinDesk, specializing in Bitcoin and its interplay with the macroeconomic environment. Previously, James worked as a Research Analyst at Saidler & Co., a Swiss hedge fund, where he developed expertise in on-chain analytics. His work focuses on monitoring flows to analyze Bitcoin’s role within the broader financial system.

In addition to his professional endeavors, James serves as an advisor to Coinsilium, a UK publicly traded company, where he provides guidance on their Bitcoin treasury strategy. He also holds investments in Bitcoin and Strategy (MSTR).

More For You

By James Van Straten|Edited by Parikshit Mishra

39 minutes ago

Tokyo-listed firm now holds 18,888 BTC worth $1.95B, with NAV multiple at record low despite strong balance sheet.

What to know:

- Shares closed 4% higher at 900 yen Monday, even as bitcoin dipped to $115,500.

- $2.18B BTC stack over-collateralizes $117M in 0% bonds by 18.67x, the company’s sole liability