Long-term holders and whales continue to offload BTC as profit-taking intensifies and the four-year cycle narrative shows signs of weakening.

By James Van Straten, AI Boost|Edited by Oliver Knight

Updated Oct 16, 2025, 9:24 a.m. Published Oct 16, 2025, 9:24 a.m.

- Long-term holders have sold more than 300,000 BTC since June, with profit-taking accelerating since early October.

- Whales holding more than 10,000 BTC remain the primary distributors, while smaller investors continue to accumulate.

Bitcoin continues to trade sluggishly around the $110,000 level and remains under pressure compared to gold.

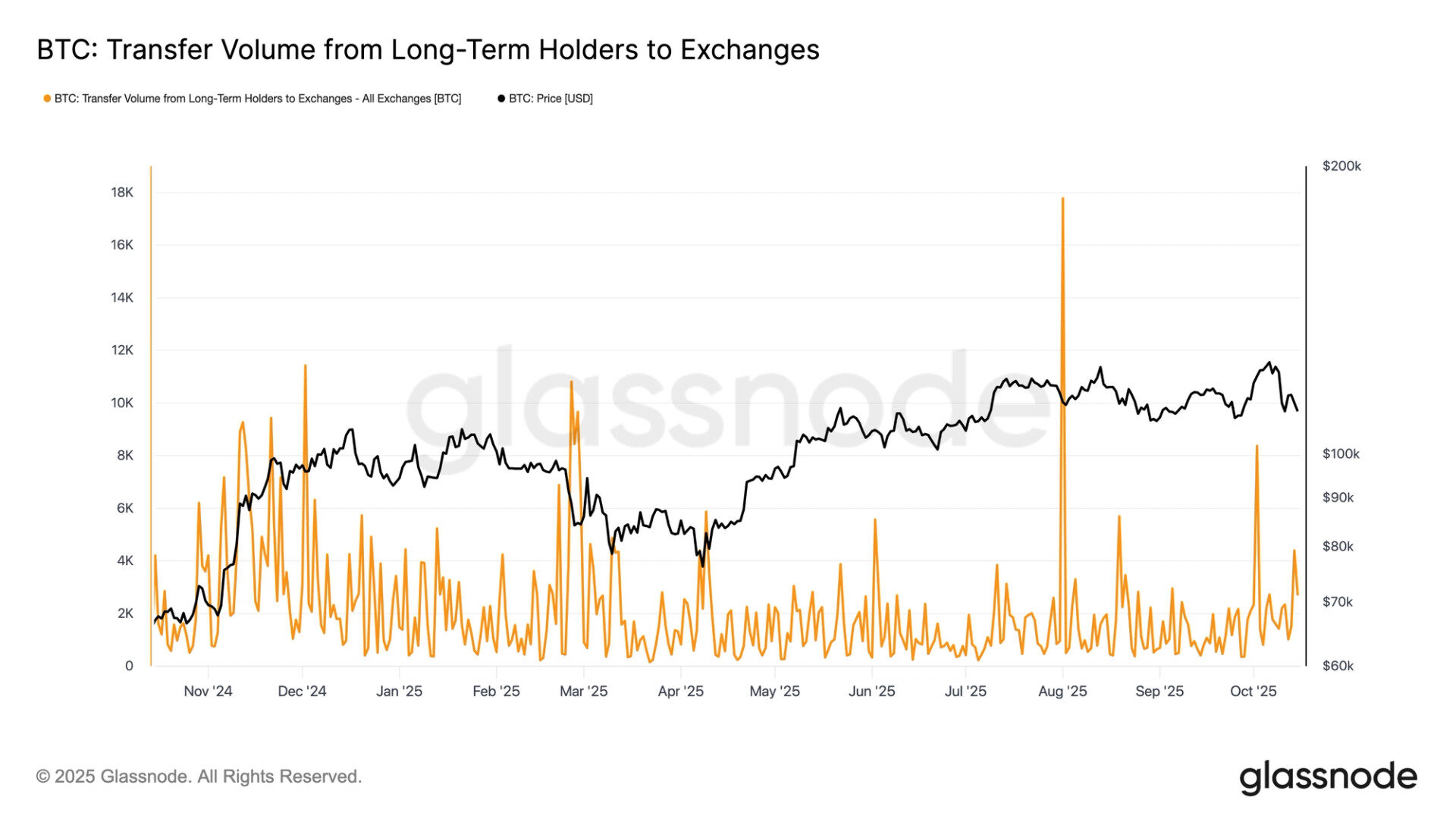

Onchain data from Glassnode shows that selling pressure from long-term holders (LTHs) is intensifying. Glassnode defines LTHs as investors who have held bitcoin for 155 days or more.

STORY CONTINUES BELOW

Currently, LTHs collectively hold approximately 14.5 million BTC, but they continue to reduce their positions. In the past few days alone, this cohort has sold around 100,000 BTC. Since the peak of their holdings, they have offloaded more than 300,000 BTC since the end of June.

Given that nearly all LTHs are currently in profit, the data suggests that significant profit-taking has been underway since the beginning of October.

There are several theories as to why this selling is occurring. Historically, Q4 has been a seasonally strong period for bitcoin, and roughly 18 months after a halving event is typically considered the most bullish phase of the cycle. However, with the current cycle not following this historical pattern, some investors may be exiting positions amid concerns that the four-year cycle theory which has played out in previous cycles might not hold this time.

Glassnode data also highlights that whales are the primary distributors of bitcoin at present. According to the accumulation trend score by cohort, entities holding more than 10,000 BTC are in heavy distribution. Cohorts holding between 1,000 and 10,000 BTC have a neutral stance with a score of 0.5, while all cohorts holding fewer than 1,000 BTC are net accumulators. Whales have consistently been net sellers since August.

AI Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Oct 10, 2025

Combined spot and derivatives volumes fell 17.5% in September, continuing a four-year seasonal trend

What to know:

- Trading activity falls 17.5% in September slowdown: Combined spot and derivatives volumes dropped to $8.12 trillion, marking the first decline after three months of growth. September has now seen reduced trading volume for the fourth consecutive year.

- Open interest reaches record high despite derivatives market share decline: Total open interest surged 3.2% to $204 billion and peaked at an all-time high of $230 billion during the month.

- Altcoins on CME outperform as Bitcoin and Ether futures decline: While CME’s total derivatives volume stayed flat at $287 billion (-0.08%), SOL futures jumped 57.1% to $13.5 billion and XRP futures rose 7.19% to $7.84 billion. BTC and ETH futures fell 4.05% and 17.9% respectively.

More For You

3 hours ago

BTC hovers close to the key support zone of $107K-$110K. The outcome here could set the stage for significant moves.

What to know:

- BTC hovers close to the key support zone of $107K-$110K.

- A potential breakdown could yield March-April like sell-off.