BTC Fear and Greed Index Signals Prolonged Market Anxiety

Investor sentiment has remained at “fear” levels for a week as bitcoin consolidates, hinting at potential market exhaustion.

By James Van Straten, AI Boost|Edited by Sheldon Reback

Oct 22, 2025, 9:47 a.m.

- The Fear and Greed Index has stayed in fear territory for seven consecutive days, a pattern that has historically preceded local bottoms.

- On-chain data shows elevated choppiness levels, suggesting the market may continue to consolidate before making its next major move.

The Fear and Greed Index has been stuck on “fear” for seven consecutive days, a state that — coupled with a bitcoin BTC$108,016.58 price constrained between between $103,000 and $115,000 for almost two weeks — may indicate a period of prolonged crypto market anxiety.

The index measures market sentiment on a scale from 0 (extreme fear) to 100 (extreme greed), reflecting investors’ emotions that often drive irrational behavior: fear during declines and greed during rallies. The current reading is 24, according to Coinglass data.

STORY CONTINUES BELOW

Historically, prolonged periods of fear often coincide with local bottoms as sellers become exhausted, while excessive greed tends to precede market corrections. Over the past 30 days, the market has been in greed territory for only seven days, which coincided with bitcoin’s all-time high of $126,000 in the first week of October.

The market has been in a state of fear since Oct. 11, the day after the largest liquidation event in crypto history.

The last extended fear period occurred in March and April during President Donald Trump’s tariffs episode, when bitcoin bottomed around $76,000. For most of 2025, bitcoin has been consolidating around $100,000, fluctuating roughly 20% above or below that level.

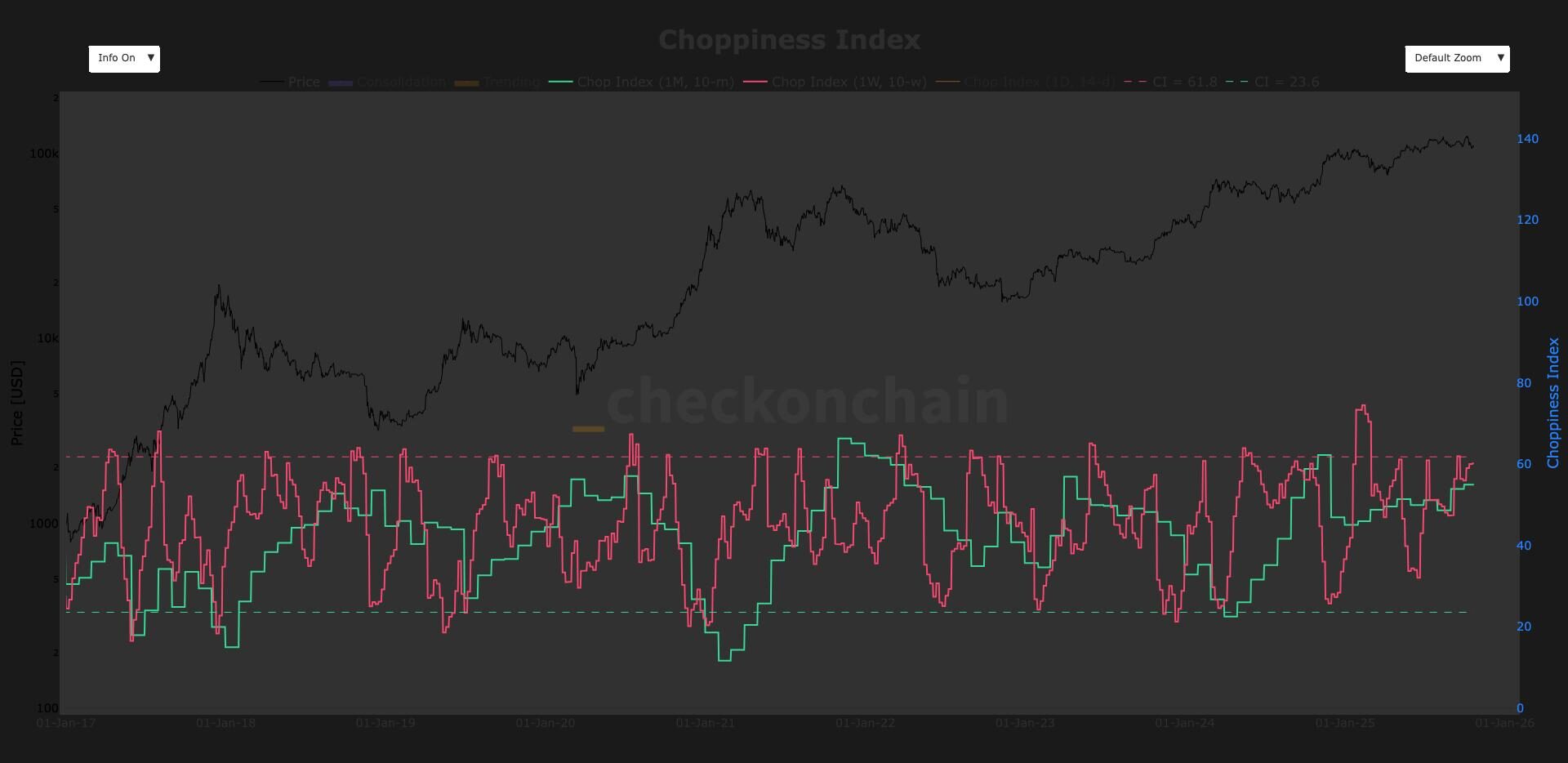

Data from Checkonchain supports this consolidation view, showing the choppiness index at 60 on a weekly basis. That is among one of the highest readings historically, and high readings are indicative of a period of sideways movement followed by a strong directional move.

The monthly index is at 55, with previous peaks above 60 marking the November 2021 and 2024 highs. This suggests current fear and consolidation may persist before the next significant move.

AI Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

By Sam Reynolds|Edited by Jamie Crawley

2 hours ago

Hong Kong beats the U.S. to listing a Solana ETF, though J.P. Morgan expects inflows to be modest compared to its BTC and ETH counterparts.

What to know:

- Hong Kong’s securities regulator has approved the first Solana spot ETF, expanding its crypto offerings beyond Bitcoin and Ether.

- The ChinaAMC Solana ETF will trade on the Hong Kong Stock Exchange starting Oct. 27 in HKD, RMB, and USD.

- U.S. regulators have delayed approving a Solana ETF due to a government shutdown affecting the SEC.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language