Bitcoin Price (BTC) Analysis: High Level of Backwardation Hints at Bottom

So-called “backwardation” — a futures price curve moving lower in value as time gets further out — can be read as a measure of stress in the market.

By James Van Straten|Edited by Stephen Alpher

Dec 3, 2025, 4:54 p.m.

- Backwardation signals that futures prices are now below near term levels, reflecting cautious forward pricing and weakened expectations among institutional traders.

- The structure often emerges during forced de-risking and has historically appeared near major or local bottoms.

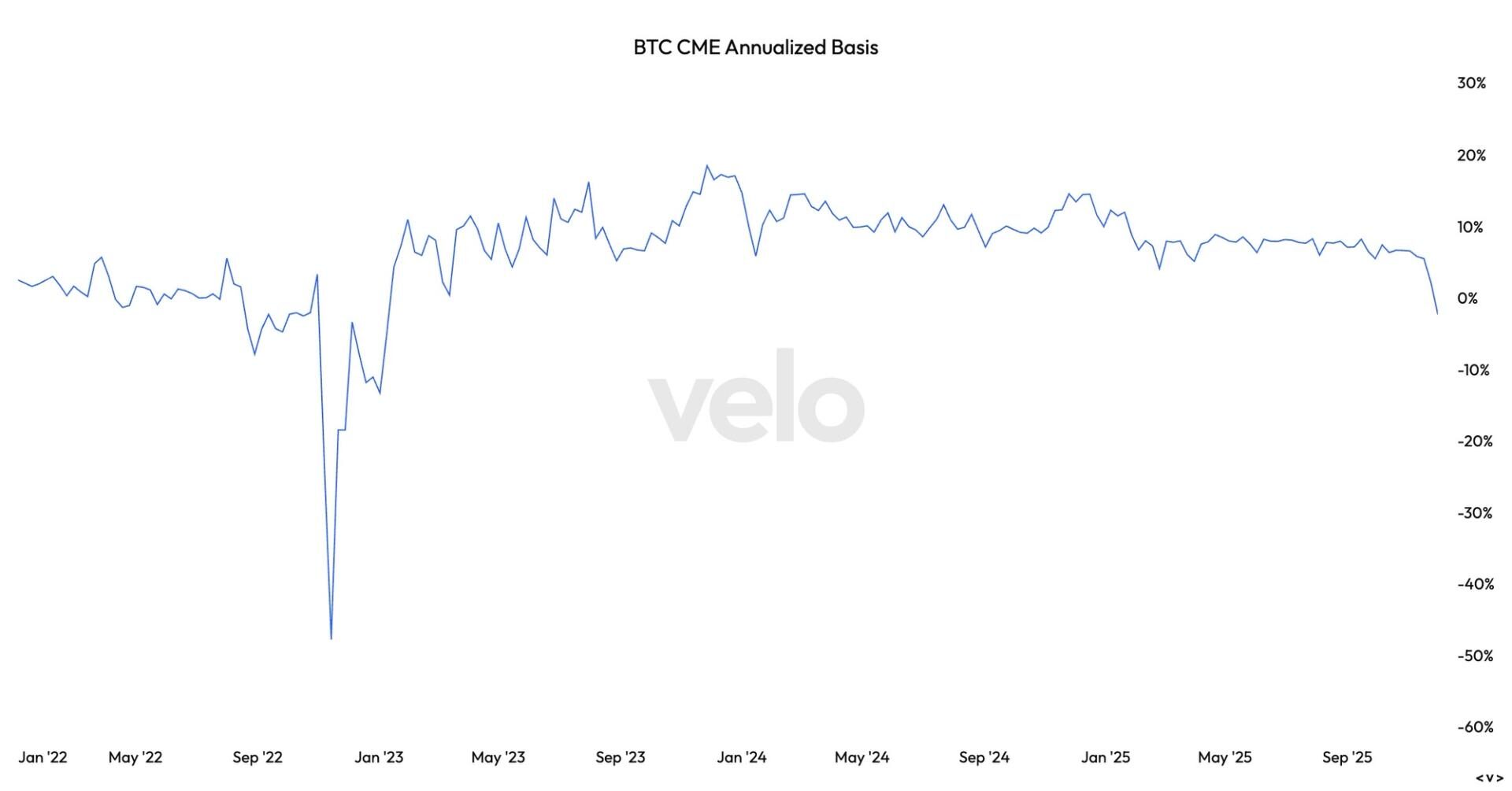

The CME bitcoin annualised basis has fallen to -2.35% its deepest backwardation since the extreme dislocations of the FTX collapse in November 2022, when the basis briefly approached -50%, according to Velo data.

Backwardation describes a futures curve in which contracts that expire sooner trade at a higher price than contracts that expire later. In other words, the market is pricing bitcoin in the future at a lower level than the current or near term price. This creates a downward sloping futures curve and signals that traders expect weaker prices as time passes.

This structure is typically unusual in bitcoin because bitcoin futures almost always trade at a premium, known as contango, reflecting the cost of leverage and strong demand for forward exposure.

The move recently into backwardation first flashed around Nov. 19, just two days before bitcoin bottomed around $80,000 on Nov. 21. In this recent correction a considerable amount of leverage has been flushed from the system, with traders unwinding long futures and institutions reducing exposure.

STORY CONTINUES BELOW

Backwardation has historically appeared at moments of stress or forced de-risking, and previous episodes in November 2022, March 2023, August 2023 and now November 2025 aligned closely with major or local market lows.

However, backwardation does not automatically imply a bullish inflection. As highlighted in earlier CoinDesk research, bitcoin is not comparable to physical commodities like oil where backwardation reflects tight supply. CME futures are cash settled, heavily used by institutions running basis trades, and can slip deeper into negative territory.

In this view, backwardation represents cautious forward pricing and weaker expectations rather than near term spot demand strength.

A large portion of leverage has already evaporated but conditions can always worsen if risk appetite deteriorates further. At the same time, this is the same structure that has repeatedly marked turning points once forced sellers exhaust themselves. Bitcoin is therefore entering a zone where both danger and opportunity have historically emerged.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By CD Analytics, Oliver Knight

38 minutes ago

Trading activity jumps 37% above weekly average despite modest price gains.

What to know:

- Stellar gained from $0.252 to $0.258 over 24-hour period with higher lows pattern.

- Volume spiked 37% above 7-day average signaling increased institutional positioning.

- Technical breakout above $0.2556 resistance confirms amid exceptional volume bursts.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language