BTC Hashrate Sees Sharpest Post Halving Drop Since 2024 Amid China Machine Shutdowns

By James Van Straten|Edited by Jamie Crawley

Dec 15, 2025, 5:17 p.m.

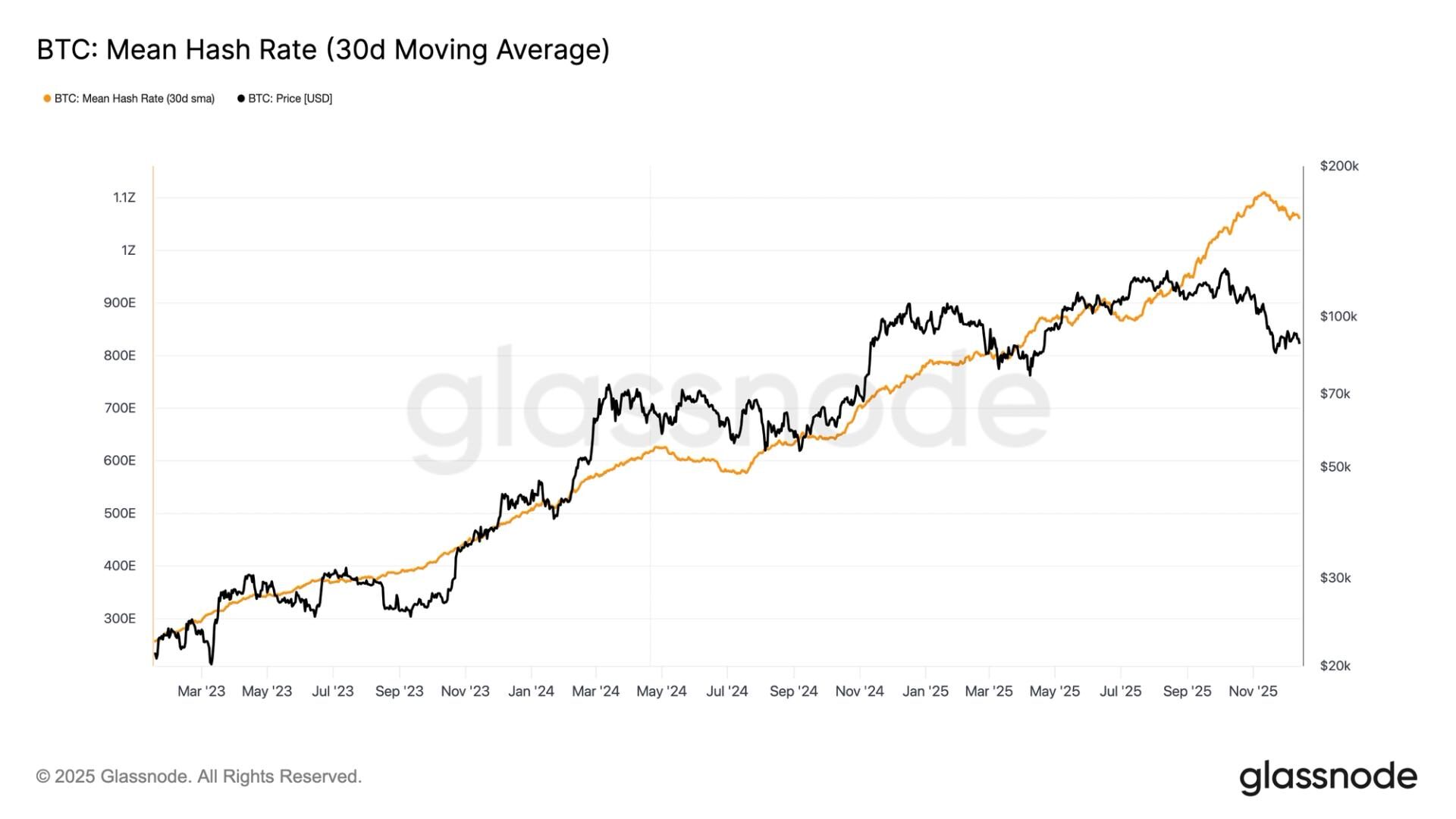

- Bitcoin’s 30-day simple moving average hash rate has fallen from around 1.1 ZH/s to just above 1 ZH/s, marking the largest decline since the April 2024 halving.

- Former Canaan chairman estimates roughly 400,000 mining machines have gone offline in China.

Bitcoin’s BTC$86,235.57 30-day simple moving average (SMA) hashrate has recorded its steepest decline since the April 2024 halving, according to Matthew Sigel, head of digital assets research at VanEck.

The bitcoin hashrate measures the total computational power securing the network.

STORY CONTINUES BELOW

Former Canaan chairman Jack Kong said in a post on X, as many as 400,000 mining machines have recently gone offline in China. Kong said computing power fell by roughly 100 exahashes per second (EH/s) compared to the day before representing an 8% decline. Based on an average of 250 terahash per second, this equates to more than 400,000 mining machines being shut down.

Kong also says that farms in Xinjiang were shutting down one after another, suggesting the U.S. benefited without direct intervention.

The comments come just one month after China resurfaced as the world’s third largest bitcoin mining hub, accounting for roughly 14% of global hashrate.

Glassnode data shows the total hashrate has fallen from approximately 1.1 zettahash per second to just above 1 (ZH/s). The pullback coincides with continued pressure on miner revenues, with hash price hovering near $37 per petahash per second, roughly a five year low.

Bitcoin mining difficulty is currently projected to decline by roughly 3%, offering temporary relief to miner revenues. The metric currently stands at 148.2 trillion (T), just below its all-time high.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By CD Analytics, Francisco Rodrigues|Edited by Stephen Alpher

12 minutes ago

The decline appeared technical, rather than tied to BNB-specific negative news, and was accompanied by a wider crypto market downturn.

What to know:

- BNB dropped over 3% to $850, undercutting key support zones and erasing earlier session gains, despite a brief technical breakout attempt near $888.

- The decline appeared technical, rather than tied to BNB-specific negative news, and was accompanied by a wider crypto market downturn.

- The dip occurred amidst a surge in 24-hour trading volume to $115.7 billion.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language