Implied volatility hits a 2.5-month high as price momentum and historical patterns point to a strong Q4

By James Van Straten|Edited by Omkar Godbole

Oct 10, 2025, 7:49 a.m.

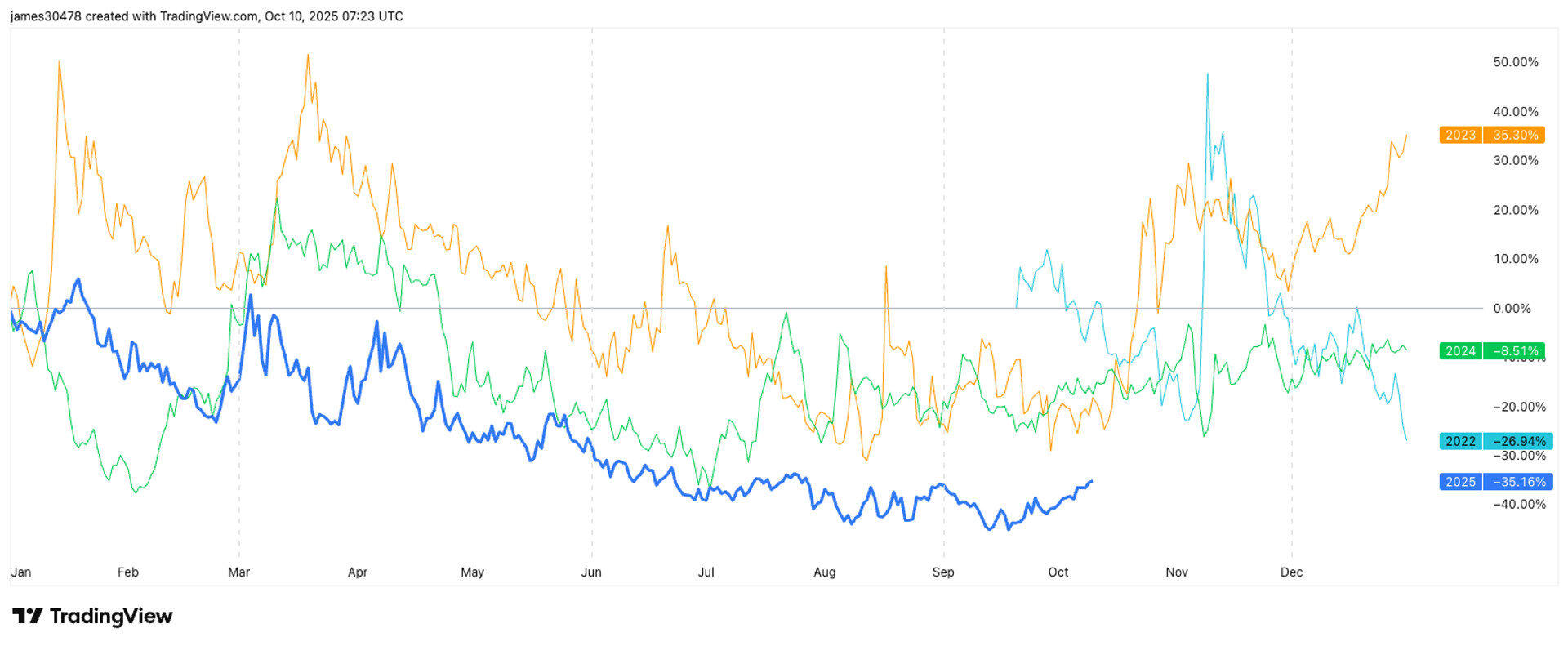

- Bitcoin’s implied volatility (IV) has surged to a 2.5-month high above 42, mirroring similar seasonal spikes seen in October 2023 and 2024.

- Historically, the second half of October and November deliver some of Bitcoin’s best returns, with average gains of 6% and over 45% respectively.

Bitcoin’s BTC$121,325.66 implied volatility (IV) gauge has climbed to a 2.5-month high, consistent with the seasonal trends.

Volmex’s bitcoin implied volatility index, BVIV, which represents the annualized expected price turbulence over four weeks, has topped 42%, the highest since late August, according to data source TradingView.

STORY CONTINUES BELOW

IV measures the market’s expectations for future price swings based on options pricing. Higher IV suggests traders are anticipating larger price movements ahead.

The BVIV rose early this month alongside an upswing in BTC’s price and has continued to climb despite the latest pullback from the record high of over $126,000 to around $120,000.

BVIV’s historical data shows that the index tends to spike around this time of year. Both 2023 and 2024 saw significant volatility increases in October, highlighting a recurring seasonal pattern.

CoinDesk Research notes that 2025’s volatility setup closely mirrors 2023, when it wasn’t until the second half of October that IV began its next major leg higher, rising from an annualized 40% to over 60%.

It’s the same for the spot price. Historically, the second half of October delivers stronger returns than the first.

According to data from Coinglass, bitcoin has averaged roughly 6% gains each week over the next two weeks, which are among the most bullish periods of the year. November is typically the best performing month, historically delivering more than 45% returns on average.

Expectation over the coming weeks is that IV increases from this current range.

Since late last year, BTC’s IV has tended to rise more often than not during price pullbacks in a classic Wall Street like dynamics. The inverse relationship is evident from the persistent downtrend in IV since late last year and the broader uptrend in prices.

As bitcoin matures as an asset, the law of diminishing returns suggests price gains will gradually shrink, and volatility will also decline over time. Zooming out, the BVIV model shows a clear long-term downtrend in implied volatility since the metric was first introduced.

More For You

Sep 9, 2025

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

By Shaurya Malwa|Edited by Omkar Godbole

1 hour ago

What stands out is how capital is rotating into the once-forgotten privacy sector at the exact moment broader liquidity is still searching for a narrative.

What to know:

- Privacy tokens are experiencing a resurgence, with Zcash leading gains with 40% rally.

- Key developments seem to have galvanized investor interest in privacy coins.

- The shift towards privacy tokens coincides with broader market conditions, including regulatory discussions and economic uncertainties.