-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By James Van Straten, AI Boost|Edited by Parikshit Mishra

Aug 27, 2025, 10:08 a.m.

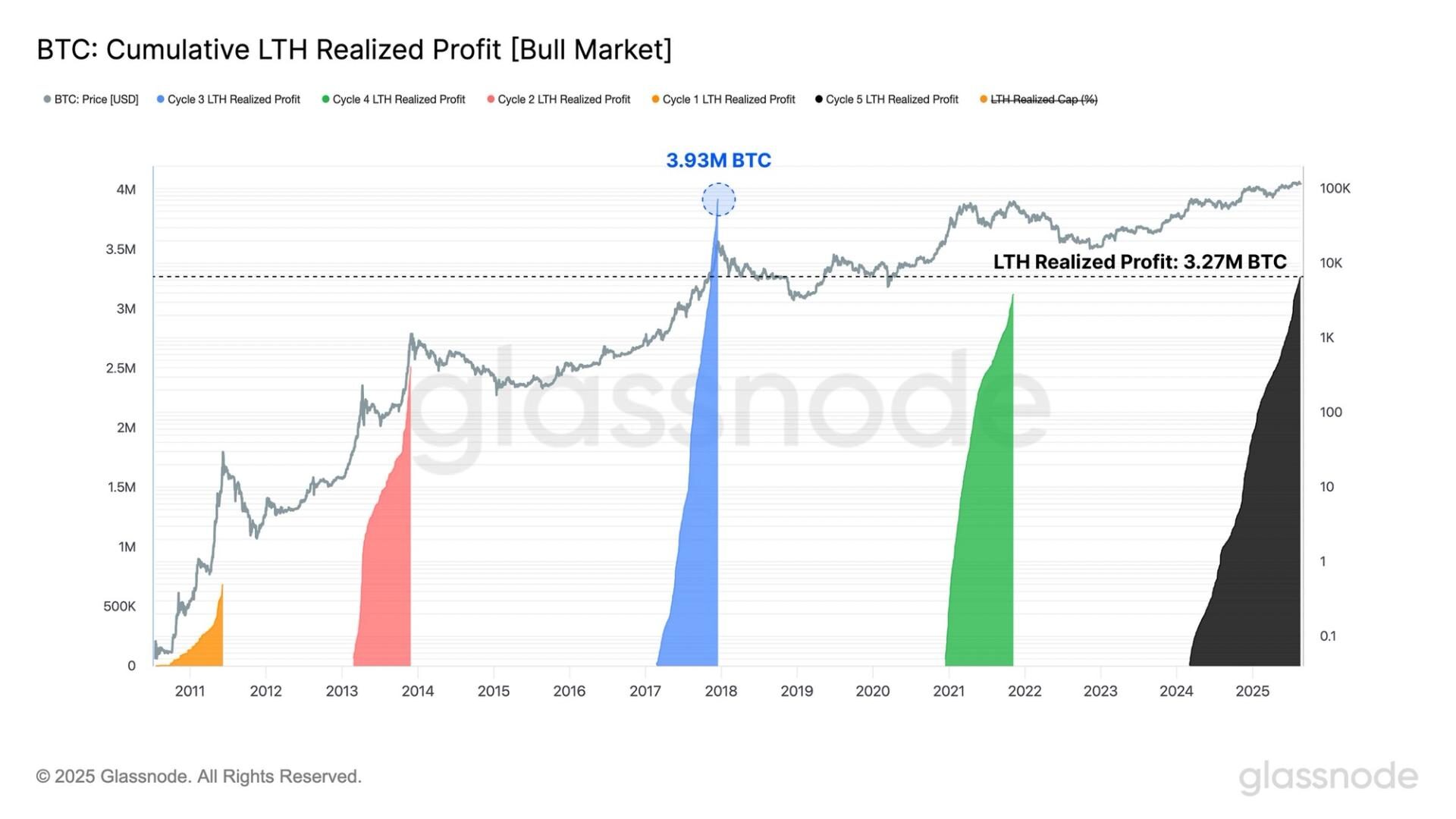

- Since early 2024, LTHs have realized 3.27M BTC in profits, surpassing 2021 but still short of the 2017 peak of 3.93M BTC.

- Roughly 100K BTC has recently come up for sale, driven by legacy coin movements, Galaxy listings, and renewed ETF-fueled liquidity.

Bitcoin BTC$111,076.43 long-term holders (LTHs) have already realized more profit in this cycle than in all but one previous cycle (2016 to 2017), according to data from on-chain analytics platform Glassnode.

This underscores elevated sell-side pressure and, when combined with other signals, suggests the market has entered the late phase of the cycle”.

STORY CONTINUES BELOW

Since the start of 2024, LTHs (defined as investors who have held bitcoin for at least 155 days) have realized 3.27 million BTC in profits. This figure has now surpassed the 2021 bull run (just over 3 million BTC) and is far ahead of the 2013 cycle. However, it still trails the 2017 bull run, when realized profits reached 3.93 million BTC.

For context, bitcoin’s average price was around $1,000 in 2015, compared with today’s levels which are roughly 100 times higher. This highlights that the market has absorbed a significantly larger dollar value of realized profits. The sell-side supply has been enormous, with ongoing rotation of capital, including from long-dormant “OG” coins.

Recent market activity illustrates this dynamic: approximately 80,000 BTC was listed for sale at Galaxy, while another 26,000 BTC recently became active.

Altogether, about 100,000 BTC has come up for sale and the market has seen a slight correction, which shows how liquid the market has become. Exchange-traded funds (ETFs) have played a role in facilitating this rotation, while trading volumes have also expanded broadly across the market.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

James Van Straten is a Senior Analyst at CoinDesk, specializing in Bitcoin and its interplay with the macroeconomic environment. Previously, James worked as a Research Analyst at Saidler & Co., a Swiss hedge fund, where he developed expertise in on-chain analytics. His work focuses on monitoring flows to analyze Bitcoin’s role within the broader financial system.

In addition to his professional endeavors, James serves as an advisor to Coinsilium, a UK publicly traded company, where he provides guidance on their Bitcoin treasury strategy. He also holds investments in Bitcoin and Strategy (MSTR).

“AI Boost” indicates a generative text tool, typically an AI chatbot, contributed to the article. In each and every case, the article was edited, fact-checked and published by a human. Read more about CoinDesk’s AI Policy.

More For You

By James Van Straten, AI Boost|Edited by Sheldon Reback

57 minutes ago

International offering, warrant exercises, bond redemption and suspension notice highlight a sweeping capital strategy shift.

What to know:

- Metaplanet to issue up to 555m new shares overseas, targeting ¥130.3b ($880m) mainly for Bitcoin purchases.

- 27.5m shares issued via warrant exercises, ¥5.25b bonds redeemed early, and suspension of further exercises announced.