BTC

$108,844.57

–

0.32%

ETH

$2,551.43

–

1.49%

USDT

$1.0002

–

0.00%

XRP

$2.2393

–

1.83%

BNB

$659.79

–

0.17%

SOL

$150.56

–

1.69%

USDC

$0.9998

–

0.01%

TRX

$0.2859

+

0.68%

DOGE

$0.1670

–

2.84%

ADA

$0.5824

–

2.79%

HYPE

$38.76

–

3.78%

SUI

$2.9264

–

2.78%

WBT

$44.58

+

2.20%

BCH

$481.76

–

3.59%

LINK

$13.38

–

3.20%

LEO

$9.0280

+

0.21%

AVAX

$18.14

–

2.91%

XLM

$0.2403

–

1.94%

TON

$2.8245

–

1.85%

SHIB

$0.0₄1160

–

1.96%

By James Van Straten|Edited by Parikshit Mishra

Jul 4, 2025, 11:51 a.m.

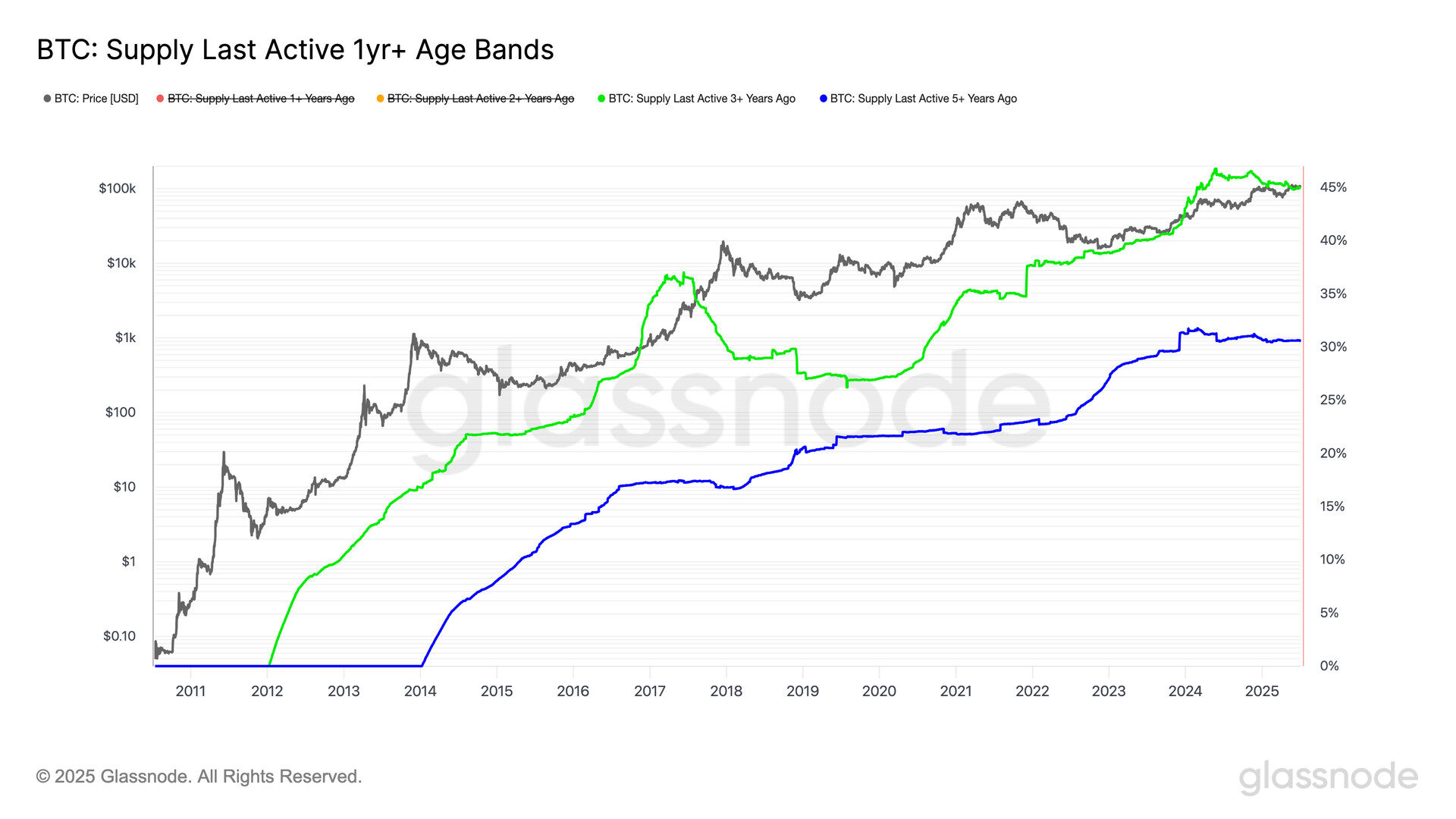

- Roughly 45% of supply hasn’t moved in at least three years, same as February 2024.

- Five-year unmoved supply stable at 30% since May 2024.

According to Glassnode, long-term holders (LTHs) are defined as investors who have held bitcoin

for at least 155 days.CoinDesk Researchindicates that one reason bitcoin has ye to reach new all-time highs has been selling pressure from these long-term holders.

However, zooming out, Glassnode data shows that the percentage of bitcoin’s circulating supply that has not moved in at least three years currently stands at 45%, which is the same level observed in February 2024, one month after the launch of the US exchange-traded fund.

STORY CONTINUES BELOW

Three years ago, in July 2022, the market was in the midst of the leverage crisis triggered by the collapse of 3AC and Celsius during the last bear market, when bitcoin was priced at $20,000, which shows the conviction of LTHs.

Meanwhile, the share of circulating supply that has not moved in at least five years is at 30% and has remained flat since May 2024.

So, even though long-term holders are selling, as they typically do when prices climb higher, these data points suggest that the broader cohort has not significantly changed its aggregate behavior for over a year now, implying that many are waiting for higher prices before making further moves.

Read more: Bitcoin Whales Wake Up From 14-Year Slumber to Move Over $2B of BTC

James Van Straten is a Senior Analyst at CoinDesk, specializing in Bitcoin and its interplay with the macroeconomic environment. Previously, James worked as a Research Analyst at Saidler & Co., a Swiss hedge fund, where he developed expertise in on-chain analytics. His work focuses on monitoring flows to analyze Bitcoin’s role within the broader financial system.

In addition to his professional endeavors, James serves as an advisor to Coinsilium, a UK publicly traded company, where he provides guidance on their Bitcoin treasury strategy. He also holds investments in Bitcoin and Strategy (MSTR).