BTC Longs Jump 20% on Bitfinex as Traders Buy the Dip During Latest Correction

By James Van Straten|Edited by Oliver Knight

Updated Nov 24, 2025, 11:21 a.m. Published Nov 24, 2025, 11:21 a.m.

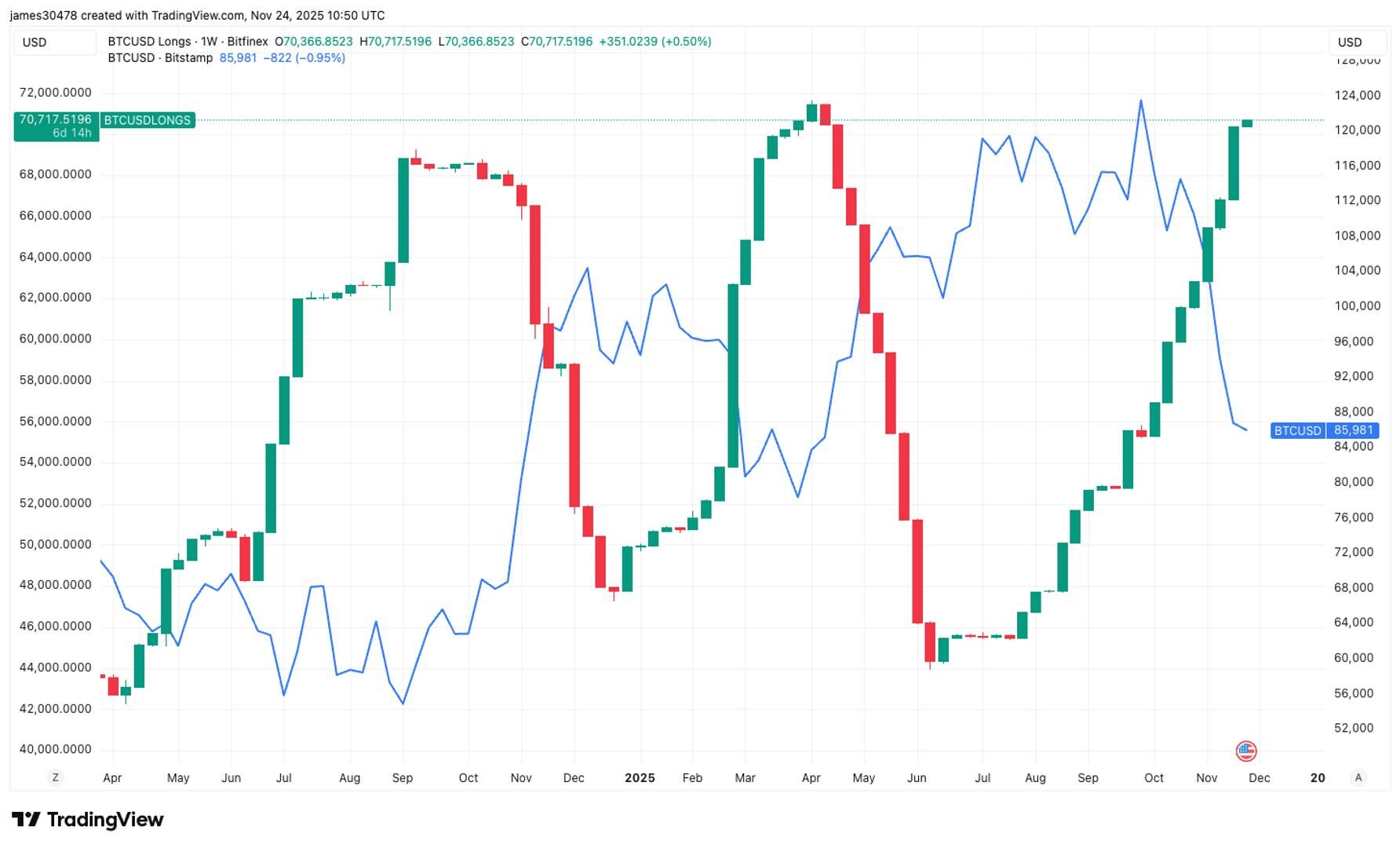

- Margin longs on Bitfinex are up 42% in three months while BTC is down 26%, indicating persistent accumulation despite significant market weakness.

- The position has reached the 70,000 BTC level three times since 2024 and each previous occurrence aligned with a major market bottom, adding weight to this latest build up.

Bitcoin BTC$86,387.84 has logged six down weeks out of the past seven, falling roughly 35% from $126,500 in October to around $81,000 before slightly recovering to above $85,000.

Throughout this correction, traders on Bitfinex continued to accumulate, lifting the amount of bitcoin bought with borrowed funds to 70,714 BTC. This is up from 50,000 BTC at the start of August.

STORY CONTINUES BELOW

According to TradingView data, margin longs have climbed 42% over the past three months while bitcoin has fallen 26%, highlighting continued confidence even as bitcoin is on track for its weakest monthly performance since June 2022.

This marks the third time since September 2024 that the Bitfinex whale has expanded their margin long position to around 70,000 BTC. The previous two instances aligned with major market bottoms.

The first occurred in August 2024 during the yen carry trade unwind when bitcoin fell toward $49,000, followed by a reduction in the position as bitcoin rallied to $100,000 after President Trump won the election in November 2024.

The second occurred in April 2025 during the tariff tantrum when bitcoin dropped to about $76,000, then rebounded toward $120,000 in June as the whale reduced exposure. Over the past five years, the bitfinex whale has also timed key reversals in the 2022 bear market and gradually reduced their long exposure throughout the 2023 rally.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By Oliver Knight, Omkar Godbole|Edited by Sheldon Reback

23 minutes ago

Bitcoin’s struggle to reclaim the $90,000 range leaves the broader crypto market vulnerable, with altcoins suffering sharp liquidity-driven underperformance.

What to know:

- The Fear and Greed Index sits at 12/100, signaling “extreme fear.”

- Altcoin liquidity remains thin, with shallow market depth in tokens like TON and DOT exacerbating volatility and forced selling.

- Bitcoin faces a critical test, with rejection below $95,000 potentially confirming a fourth lower high, while a drop toward $81,000 risks another broad market sell-off.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language