-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

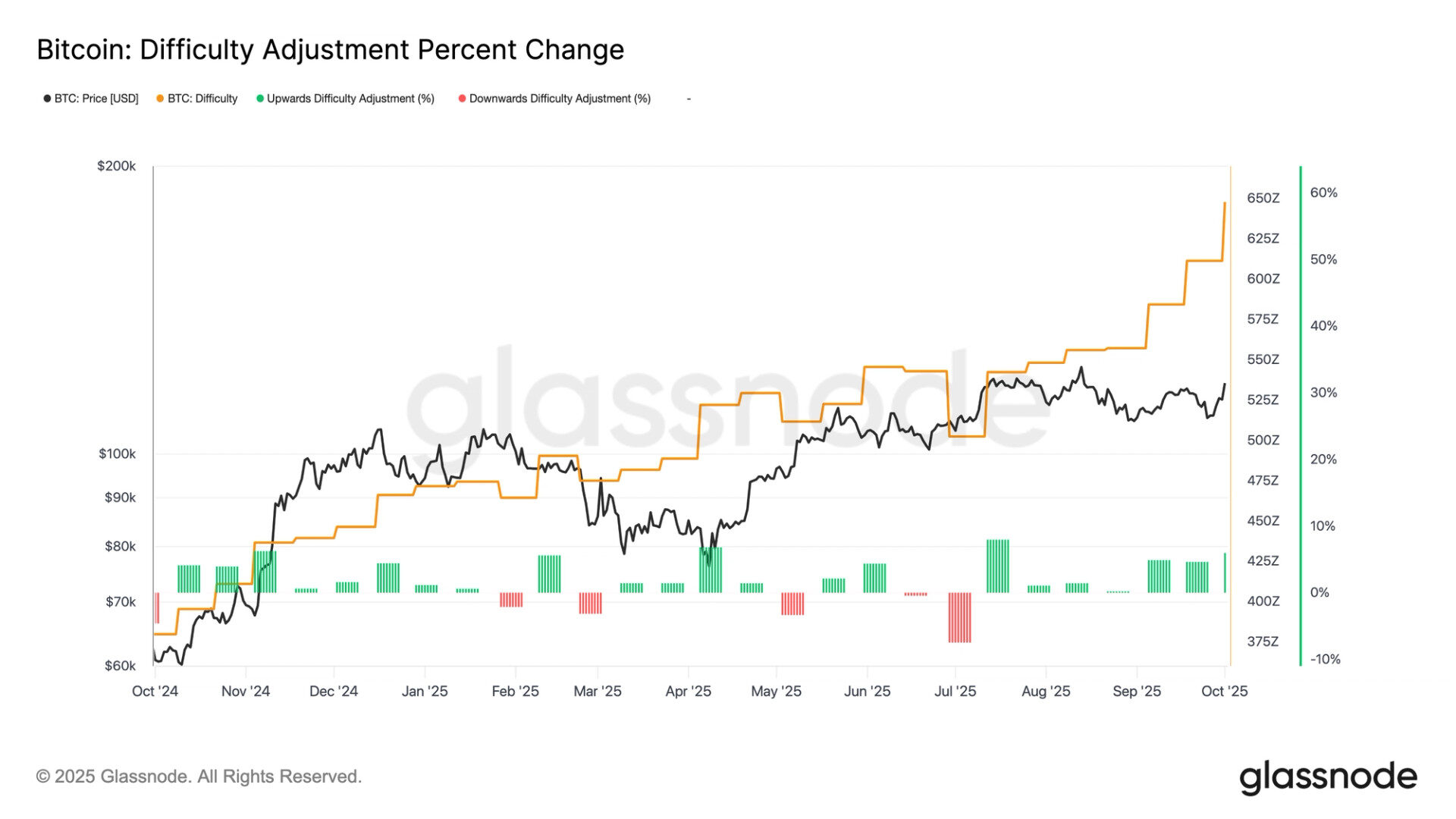

A soaring hash rate has pushed difficulty to 150.84T, leaving miners facing shrinking profitability.

By James Van Straten|Edited by Sam Reynolds

Updated Oct 2, 2025, 9:28 a.m. Published Oct 2, 2025, 9:28 a.m.

- Bitcoin’s hash rate has climbed above 1.05 ZH/s, driving the seventh straight difficulty increase.

- Hashprice hovers below $50 per petahash despite Bitcoin’s price rebound, as low fees and high difficulty weigh on miners.

Bitcoin’s mining difficulty climbed 5% to a record 150.84 trillion on Wednesday, marking the seventh straight upward adjustment, according to Glassnode.

Difficulty, which resets every 2016 blocks (approximately every two weeks), measures how challenging it is for miners to find new blocks and maintains the average block time at around 10 minutes.

STORY CONTINUES BELOW

The increase reflects continued growth in the network’s hash rate, now above one zettahash at 1.05 ZH/s. A higher hash rate signals more machines competing to secure the network, boosting security while raising the bar for profitability.

That pressure is showing up in hashprice, miner revenue per unit of hashrate ,which has slipped under $50 per petahash per second, Luxor data shows.

The metric briefly touched $52 when bitcoin traded above $118,000 earlier this summer, but has since drifted lower as difficulty rose and prices softened.

For miner margins to improve, one of three levers would need to move: higher fees, which remain at multi-year lows, a rebound in bitcoin’s price, or a slowdown in network hash rate.

Despite record difficulty and falling hashprice, mining stocks have rallied alongside bitcoin’s surge above $118,500, with Cipher Mining (CIFR) up more than 51% over the past month, Bit Digital (BTBT) gaining 25%, and Marathon Digital (MARA) climbing nearly 16%

More For You

Sep 9, 2025

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

4 hours ago

Shutdowns that delay data and weaken fiscal visibility often encourage central banks to act more cautiously, while rising yields in Japan hint at policy shifts that could ripple through global funding markets.

What to know:

- Despite a U.S. government shutdown and stress in Japan’s bond market, digital assets remained resilient, with traders anticipating looser global liquidity conditions.

- Crypto markets are showing signs of decoupling from broader macroeconomic caution, as expectations grow for policymakers to ease financial conditions.

- Bitcoin and other cryptocurrencies experienced gains, contributing to a rise in the market capitalization of digital assets to over $2.37 trillion.