-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By Will Canny|Edited by Aoyon Ashraf

Aug 17, 2025, 6:00 p.m.

- Bitcoin mining profitability increased in July as the world’s largest cryptocurrency outperformed the rise in the network hashrate, the report said.

- The bank said U.S.-listed miners accounted for 26% of the total network compared to 25% in June.

- Jefferies noted that IREN mined the most bitcoin in July, followed by MARA.

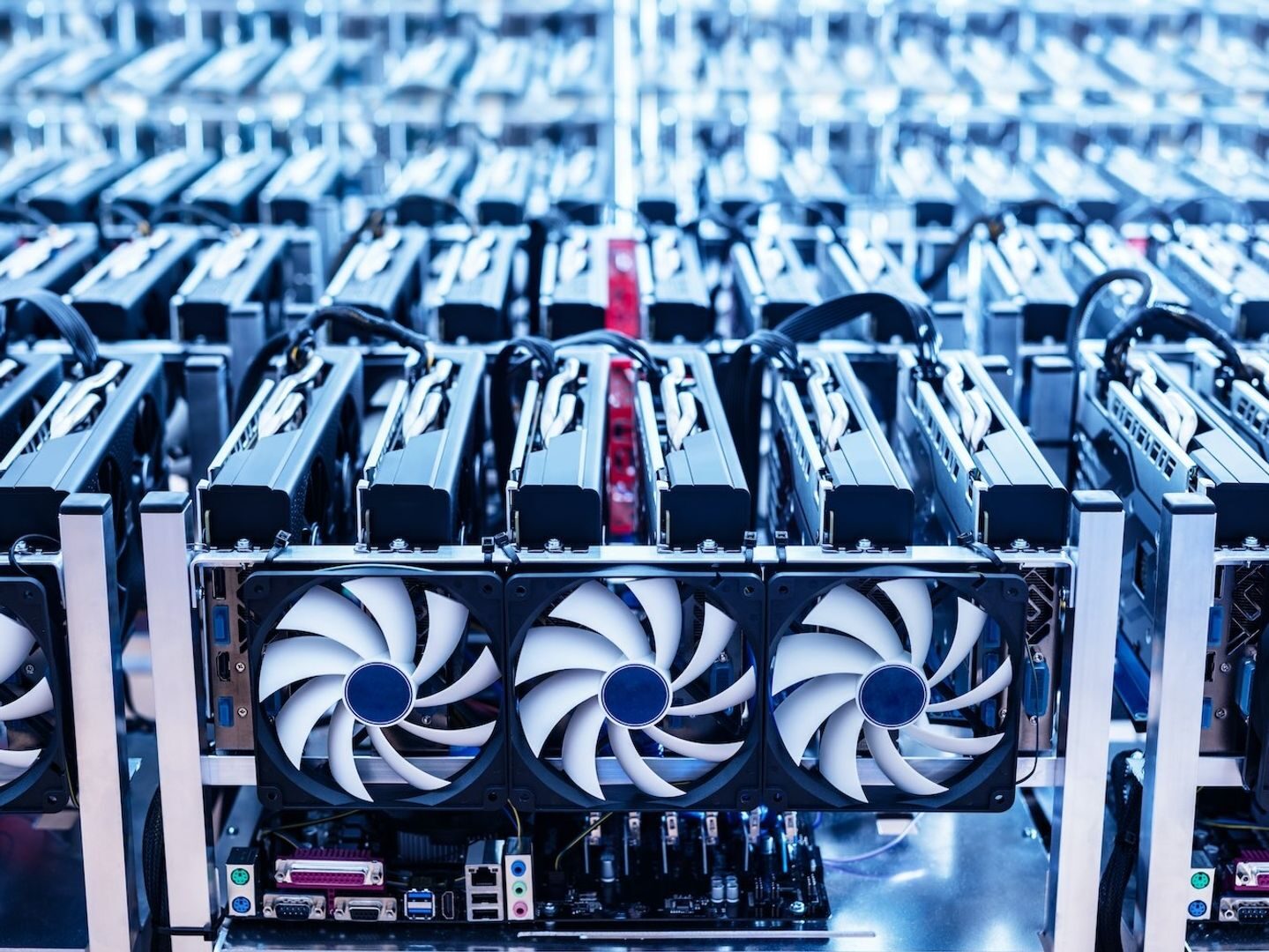

Bitcoin

mining profitability increased 2% in July as the price of the world’s largest cryptocurrency rose 7% while the network hashrate jumped 5%, investment bank Jefferies said in a research report on Friday.

“We see positive BTC price momentum as most favorable for Galaxy’s (GLXY) digital assets business, while miners fight a rising network hashrate,” analyst Jonathan Petersen wrote.

STORY CONTINUES BELOW

The hashrate refers to the total combined computational power used to mine and process transactions on a proof-of-work blockchain, and is a proxy for competition in the industry and mining difficulty. It is measured in exahashes per second (EH/s).

U.S.-listed mining companies mined 3,622 bitcoin in July, versus 3,379 coins the month before, the report said, and these firms accounted for 26% of the total network compared to 25% in June.

IREN (IREN) mined the most bitcoin, with 728 tokens, followed by MARA Holdings (MARA) with 703 BTC, the bank noted.

Jefferies said MARA’s energized hashrate remains the largest of the sector, at 58.9 EH/s at the end of July, with CleanSpark (CLSK) second with 50 EH/s.

Revenue per exahash/second also increased. “A hypothetical one EH/s fleet of BTC miners would have generated ~$57k/day in revenue during July, vs ~$56k/day in June and ~$50k a year ago,” the analyst wrote.

Read more: Bitcoin Miner MARA Steps Into HPC With Majority Stake in EDF Subsidiary: H.C. Wainwright

Will Canny is an experienced market reporter with a demonstrated history of working in the financial services industry. He’s now covering the crypto beat as a finance reporter at CoinDesk. He owns more than $1,000 of SOL.

More For You

By Siamak Masnavi, AI Boost|Edited by Aoyon Ashraf

27 minutes ago

LINK surged 18% to $26.05, outpacing peers as analysts highlight undervaluation, strong chart signals and Chainlink’s August product announcements.

What to know:

- LINK rose 18% in 24 hours to about $26.05, the top percentage gainer among the 50 largest cryptocurrencies.

- Analysts say momentum could carry toward $30 but warn against chasing; others call LINK undervalued given its role as core infrastructure.

- Sentiment is buoyed by earlier August catalysts: Chainlink’s new onchain reserve that converts revenue to LINK, and an Intercontinental Exchange (ICE) data integration for institutional-grade feeds.