Bitcoin Magazine

Bitcoin Price Crashes to $86,000 As Extreme Fear Hits the Market

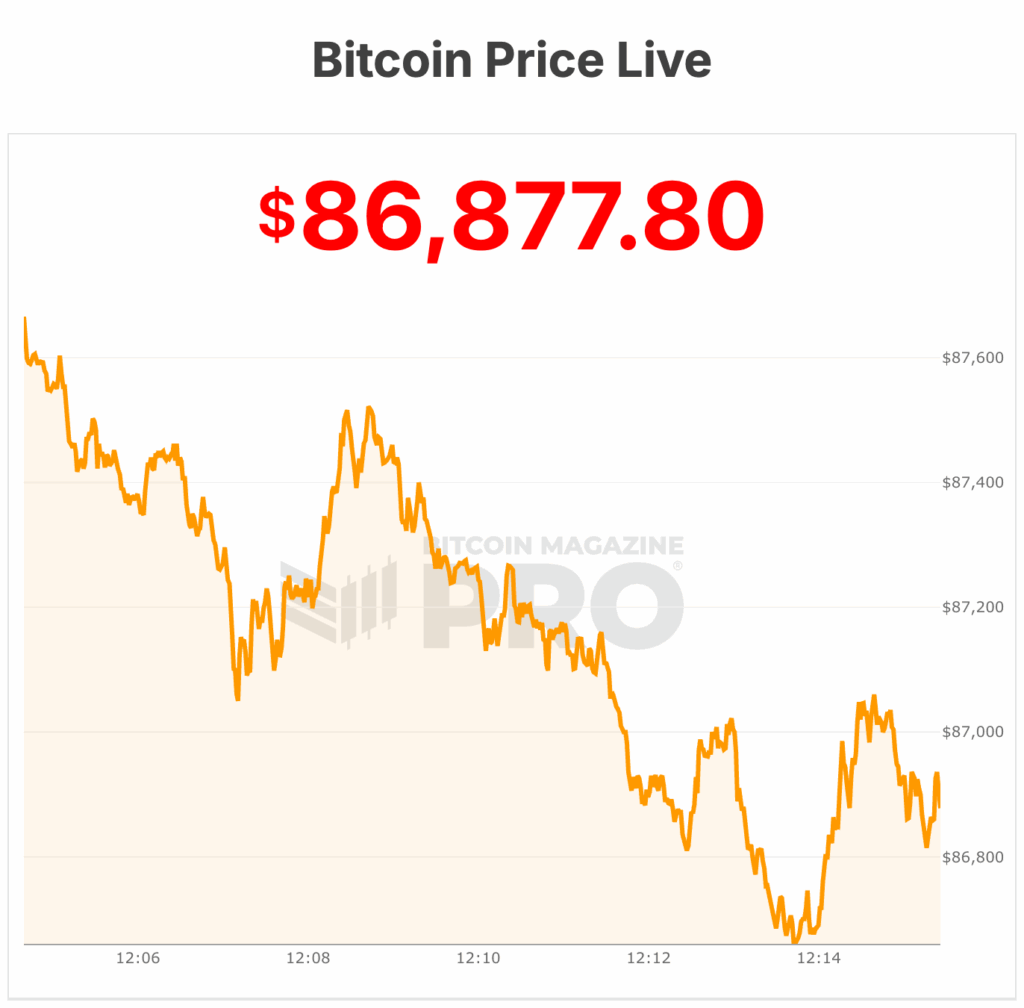

Bitcoin price is trading at lows of $85,980, down over 1% over the past 24 hours, with a 24-hour trading volume of $87 billion.

The top cryptocurrency is currently 5% below its seven-day high of $92,944 but is currently making new seven-day and seven-month lows. With a circulating supply of 19,950,600 BTC out of a maximum of 21 million, the global Bitcoin market cap is $1.78 trillion, reflecting a 1% decline over the past day.

The bitcoin price traded above $92,000 overnight but sharply dumped in early eastern-time zone trading to lows in the $86,000s range.

The Bitcoin Fear and Greed Index currently sits in “Extreme Fear.”

The U.S. labor market showed unexpected strength in September, according to data released by the Bureau of Labor Statistics after a six-week delay due to the government shutdown.

Nonfarm payrolls increased by 119,000, more than double economists’ forecast of 50,000, although the unemployment rate ticked up to 4.4% from 4.3%.

August’s reading was revised to a 4,000-job loss. This report, normally released in early October, marks the resumption of official economic data and will be followed by further updates in mid-December.

The labor data added to a broader backdrop of optimism in U.S. markets. Bitcoin price gained modestly overnight to the $92,000 range following Nvidia’s stronger-than-expected third-quarter earnings report. The chipmaker posted $57 billion in revenue, defying concerns of an AI-driven market bubble.

The Nvidia report buoyed risk assets globally. Nasdaq futures rose 1.9%, Asian indices climbed, and S&P 500 futures gained 1%. The 10-year Treasury yield held at 4.11%, while the U.S. dollar posted small gains.

For crypto markets, tech-driven liquidity remains a key driver, and Nvidia’s performance reassured investors that AI investments by major corporations—Amazon, Microsoft, Meta—will continue for the foreseeable future.

Bitcoin’s price dump is a common occurrence after a challenging month, during which the bitcoin price dipped toward $87,000 amid a $3 billion withdrawal from U.S. spot Bitcoin ETFs.

However, inflows returned on Wednesday, with ETFs attracting $75 million, according to DefiLlama.

Bitcoin price outlook

Last week, the Bitcoin price closed the week at $94,290, plunging below the key $96,000 support level and erasing gains made earlier in 2025.

The break of this major support indicated a sharp shift in market sentiment, with bears taking clear control of price action. Bitcoin’s inability to hold above $96,000 meant that the likelihood of a sustained bull market had diminished significantly.

Following the loss of the $96,000 support, Bitcoin’s next significant support was identified near the 0.382 Fibonacci retracement from the 2022 bottom to the October 2025 high.

Bitcoin Magazine analysts have highlighted a high-volume node between $83,000 and $84,000 as another potential floor. Below these levels, the next major support zone is traced to the 2024 consolidation range, between $69,000 and $72,000, suggesting substantial room for further declines if Bitcoin continues to weaken.

Resistance above Bitcoin’s $94,000 level has become substantial. Any minor bounce from current lows faces immediate obstacles at $98,000, with a potential short squeeze pushing the price to $101,000.

However, strong resistance remains in the $106,000 to $109,000 range, with additional levels at $114,000 and $116,000 forming a near-impenetrable barrier for bulls. BM analysts conclude that only a close above $116,000 would require a re-evaluation of market structure and could indicate a shift toward bullish momentum.

Market sentiment remains extremely bearish as Bitcoin has fallen over 25% from its October highs. A broadening wedge pattern, though not yet definitively broken to the downside, offers minimal hope for bulls.

The best-case scenario for Bitcoin is a short-lived rally to $106,000 before rolling over to new lows. Bears appear firmly in control, and any upside will likely encounter heavy resistance.

Bitcoin price is currently at $86,877.

This post Bitcoin Price Crashes to $86,000 As Extreme Fear Hits the Market first appeared on Bitcoin Magazine and is written by Micah Zimmerman.