BTC

$105,456.74

+

4.03%

ETH

$2,418.06

+

7.23%

USDT

$1.0006

–

0.02%

XRP

$2.1922

+

9.35%

BNB

$637.76

+

3.24%

SOL

$144.25

+

7.43%

USDC

$0.9999

–

0.04%

TRX

$0.2724

+

1.97%

DOGE

$0.1641

+

7.74%

ADA

$0.5839

+

7.31%

HYPE

$37.12

+

5.60%

WBT

$48.35

+

1.81%

SUI

$2.8028

+

12.15%

BCH

$464.70

+

2.37%

LINK

$13.16

+

11.03%

LEO

$9.1232

+

1.34%

XLM

$0.2475

+

7.90%

AVAX

$18.17

+

7.56%

TON

$2.8974

+

4.36%

SHIB

$0.0₄1170

+

8.18%

By James Van Straten|Edited by Sheldon Reback

Jun 24, 2025, 9:46 a.m.

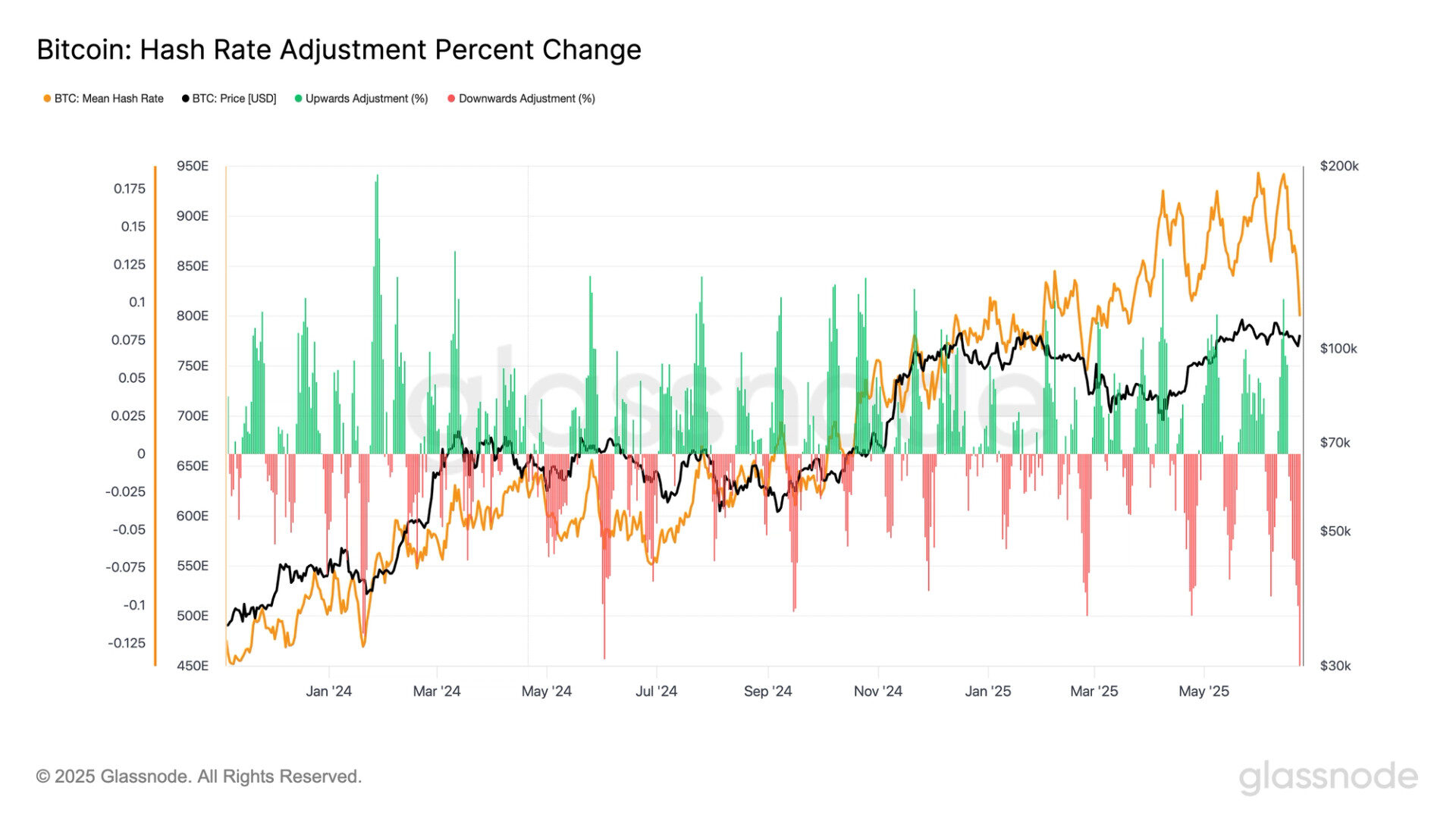

- The hashrate has fallen roughly 30% in two weeks to under 700 EH/s, the steepest drop since China’s 2021 mining ban.

- A 9% downward difficulty adjustment is expected in five days, easing mining conditions and likely boosting miner revenue per exahash.

Mining difficulty on the Bitcoin

blockchain is on course to drop by the most since July 2021 after the amount of mining power securing the network slid about 30% in two weeks.

According to data from Mempool.space, a downward difficulty adjustment of around 9% is projected within the next five days. That would be the most since the China mining ban four years ago, when the hashrate, the total computational power used to mine blocks, plummeted 50% to 58 exahashes per second (EH/s) and bitcoin was trading near $30,000.

STORY CONTINUES BELOW

The difficulty adjusts every 2,016 blocks to ensure that blocks continue to be mined at roughly 10-minute intervals. After the recent decline, the hashrate is now just under 700 EH/s, according to Glassnode data. The largest cryptocurrency by market cap was trading recently around $105,300.

Significant hashrate and difficulty corrections are not unusual during the northern hemisphere’s summer. Elevated electricity prices, driven by higher air conditioning demand and strained power grids, often lead miners to temporarily shut off machines, especially older or less efficient ones. This seasonal pattern has been observed in several previous years.

The anticipated drop in mining difficulty will provide meaningful relief for miners. The hashprice, or miner revenue per exahash, currently sits at $51.9. This metric reflects the estimated daily income in dollars a miner earns per EH/s contributed to the network, based on block rewards and transaction fees.

As difficulty decreases, mining becomes easier, meaning miners can earn more revenue for the same amount of computational effort. Assuming bitcoin’s price and transaction fees remain stable or increase, the hashprice should rise significantly in the coming days, helping to offset recent profitability pressure.

James Van Straten is a Senior Analyst at CoinDesk, specializing in Bitcoin and its interplay with the macroeconomic environment. Previously, James worked as a Research Analyst at Saidler & Co., a Swiss hedge fund, where he developed expertise in on-chain analytics. His work focuses on monitoring flows to analyze Bitcoin’s role within the broader financial system.

In addition to his professional endeavors, James serves as an advisor to Coinsilium, a UK publicly traded company, where he provides guidance on their Bitcoin treasury strategy. He also holds investments in Bitcoin and Strategy (MSTR).