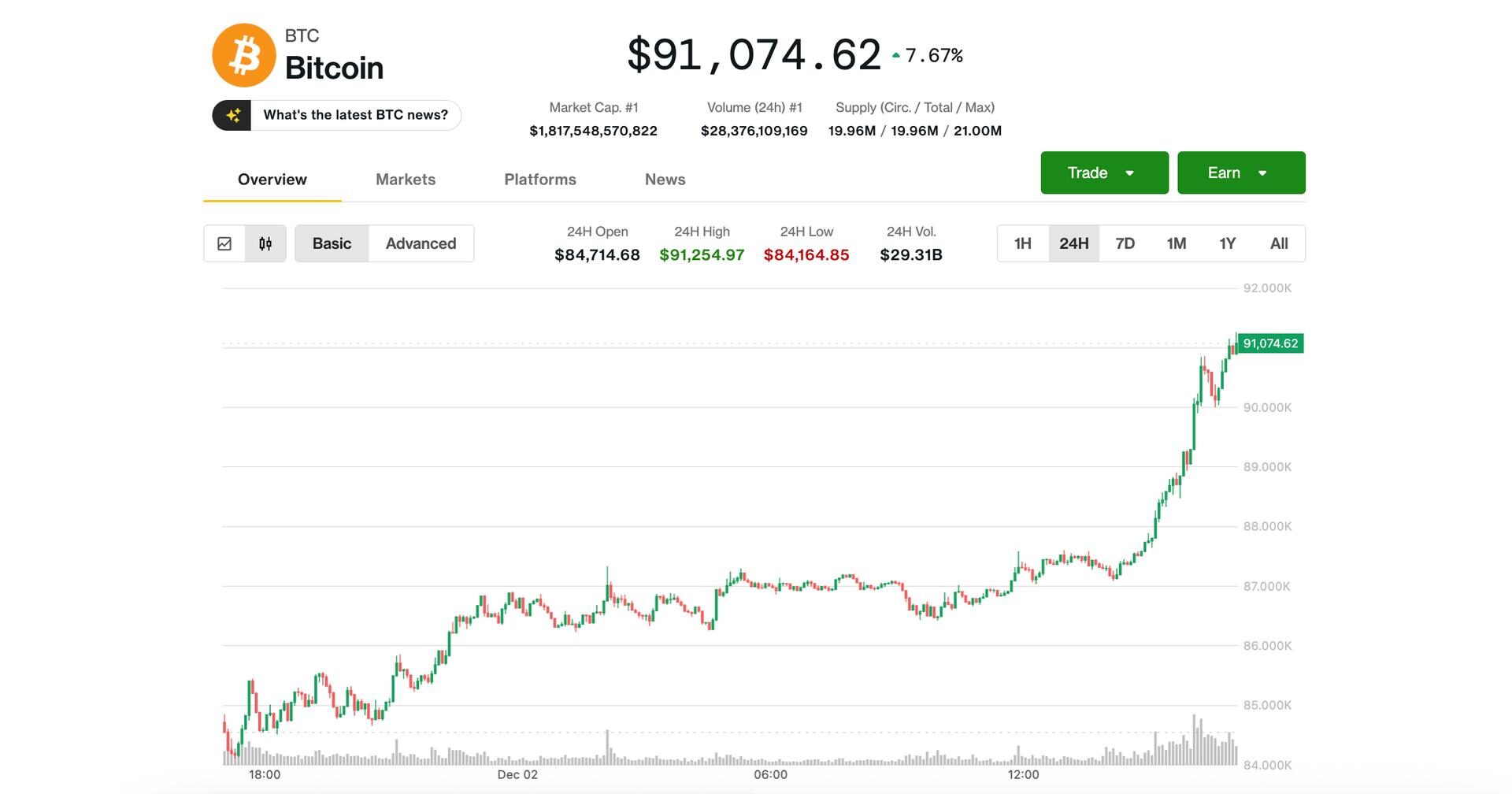

Bitcoin (BTC) Price News: Surges Above $91K as ETH, XRP, SOL Rebound

Helping the mood in crypto were moves by institutional giants Vanguard and Bank of America to open up digital assets to their clients.

By Krisztian Sandor, Helene Braun|Edited by Stephen Alpher

Updated Dec 2, 2025, 4:06 p.m. Published Dec 2, 2025, 4:01 p.m.

- Bitcoin surged above $90,000 on Tuesday, mostly recovering from its Sunday night/Monday morning plunge to below $84,000.

- Boosting sentiment was Vanguard’s move to allow its massive client base to have access to crypto ETFs as well as Bank of America green-lighting its wealth managers to suggest up to a 4% BTC allocation to BTC.

- One analyst spied support in the $80,000-$85,00 zone, while another warned of potential risks from rising Japanese yields.

Bitcoin BTC$87,058.23 surged back above $90,000 during Tuesday’s U.S. morning hours, erasing most of its steep plunge from Sunday to Monday to below $84,000. The largest cryptocurrency was recently trading at $91,180, up 8% over the past 24 hours, helping lifting the broader digital asset markets.

Ethereum’s ether ETH$2,806.95 bounced above $3,000, gaining 9% during the same period. Large-cap altcoins also followed the advance: XRP$2.0183, Solana’s SOL SOL$127.20, DOGE$0.1358 were up 7%–10%, recovering from their recent lows.

STORY CONTINUES BELOW

The gains occurred as $11 trillion asset management giant Vanguard dropped its longstanding fatwa against crypto and will now allow its clients to have access to digital asset ETFs. Alongside, Bank of America has given the okay for its wealth managers to recommend a 1%-4% allocation to the spot bitcoin ETFs.

Mark Connors, founder and chief macro strategist of bitcoin investment advisory Risk Dimensions and former global head of risk advisory at Credit Suisse warns that a rise in Japan’s 10-year yield could pull capital away from global markets, with crypto — especially bitcoin — being hit hardest due to its proximity to Asian capital flows and exposure to leverage. Binance, which handles nearly half of all crypto volume and allows leverage of up to 50x, is particularly vulnerable to yen and yuan volatility.

Connors also pointed out that bitcoin appears to be leading the S&P 500 lower. That pattern could continue until both the Federal Reserve and Bank of Japan hold their policy meetings later this month. If markets weaken further, he expects some form of intervention, as has often happened during periods of stress in recent years.

Still, not all signals point to weakness. Jasper De Maere, desk strategist at Wintermute, said bitcoin derivatives show a “clear lean toward bullish, short-vol behaviour.” Traders are selling downside puts around the $80,000–$85,000 level while selectively buying upside further out.

“The mix suggests a market that treats $80,000–85,000 as supported and is comfortable leaning long into year-end while earning carry on the way,” De Maere said. In other words, despite near-term pressure, traders appear positioned for a recovery.

Read more: On Thin Ice: Crypto Daybook Americas

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By Helene Braun, AI Boost|Edited by Sheldon Reback

44 minutes ago

The debut marks the first U.S. ETF tied to Chainlink, which secures tens of billions of dollars in onchain value across DeFi and gaming.

What to know:

- LINK rose 8% Tuesday as Grayscale introduced the first U.S. ETF tracking the Chainlink token.

- The ETF, trading under the ticker GLNK, offers indirect exposure to the token through traditional brokerage accounts, but does not provide the same investor protections as registered funds.

- LINK is down 39% year-to-date, reflecting broader weakness across the crypto market.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language