-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

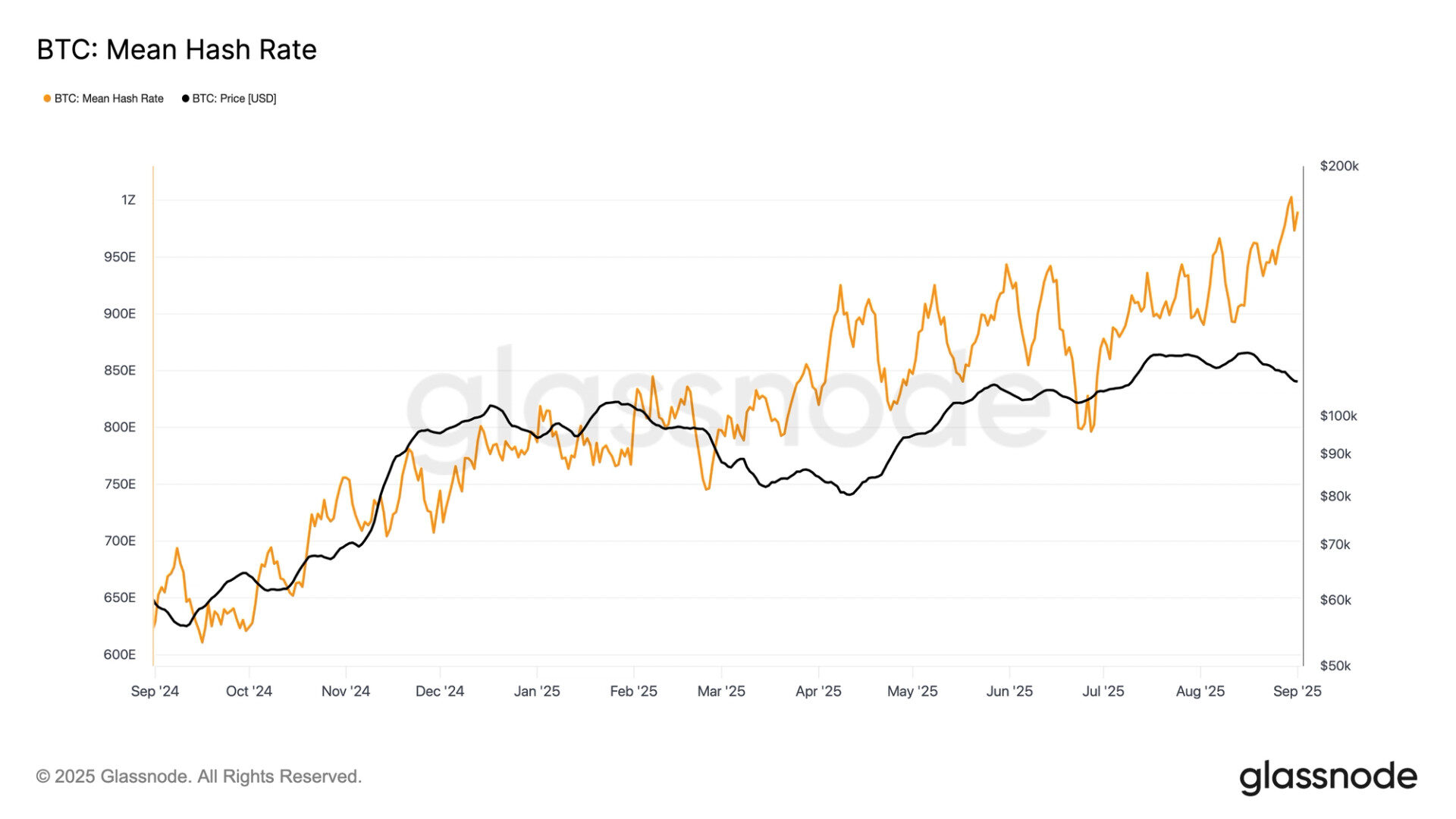

Milestone reached on the seven day moving average highlights accelerating network growth and sets stage for a major difficulty adjustment.

By James Van Straten|Edited by Parikshit Mishra

Sep 2, 2025, 11:10 a.m.

- Hashrate briefly touched 1 ZH/s earlier this year, but this is the first time the level has held on a seven day moving average.

- A difficulty adjustment of more than 7% is expected within days, the second largest increase of 2025.

Bitcoin’s hashrate has reached 1 zettahash per second (1 ZH/s) on a seven day moving average for the first time, setting a new all time high, according to Glassnode data.

The hashrate is the average estimated number of hashes per second produced by miners securing the network. Using a seven day moving average is important because it smooths out natural block time variability.

STORY CONTINUES BELOW

The network has briefly touched 1 zettahash several times this year, but this is the first time it has been sustained on the seven day moving average.

To put this in perspective, 1 zettahash equals 1,000 exa hashes (EH/s). Bitcoin first crossed the 1 EH/s threshold in 2016, and in 2025 the network’s hash rate has climbed from around 800 EH/s at the start of the year to 1 ZH/s today.

This rapid increase in computing power is expected to trigger a significant difficulty adjustment of over 7% in the next two days, which would mark the second largest upward adjustment of the year.

Difficulty adjustments occur roughly every two weeks and ensure that new blocks are added to the blockchain approximately every 10 minutes, regardless of how much total mining power is online. Following this change, difficulty will rise to 138.96 trillion (T).

More For You

By James Van Straten|Edited by Sheldon Reback

2 hours ago

CME open interest and futures premiums have slumped this year. Looser monetary policy may change the picture.

What to know:

- CME bitcoin futures open interest has dropped from over 212,000 BTC to 130,000 BTC this year, while the annualized basis has stayed below 10%.

- A Fed rate cut in September could boost liquidity and risk appetite, setting the stage for a rebound in the basis trade.