-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

Implied volatility sits at multi-year lows while sideways price action hints at further consolidation ahead of key CPI data.

By James Van Straten|Edited by Oliver Knight

Updated Sep 11, 2025, 11:46 a.m. Published Sep 11, 2025, 10:13 a.m.

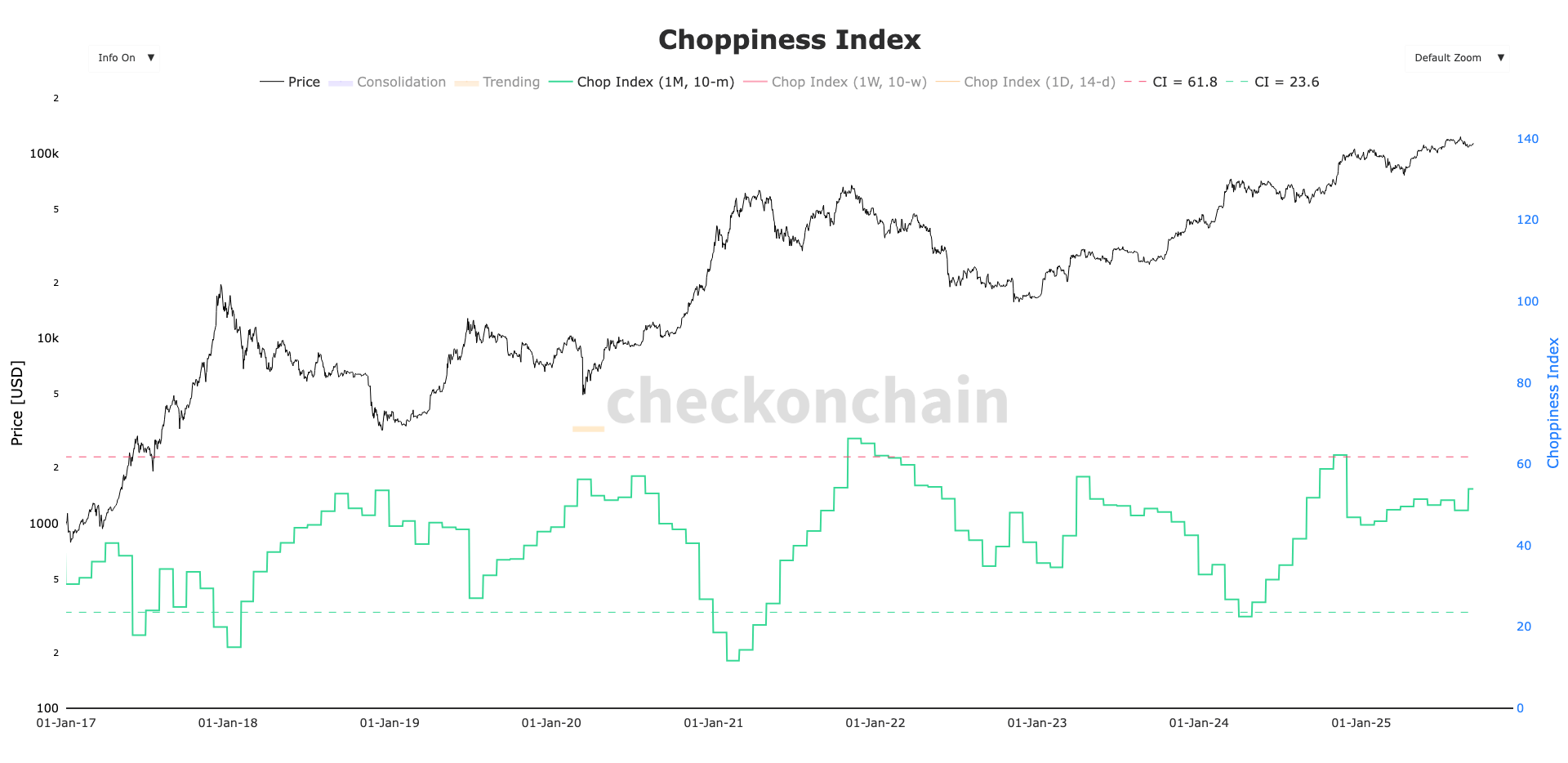

- Bitcoin’s choppiness index has risen to 54 on the one-month timeframe, a level last seen just before the November 2024 election rally.

- With BTC consolidating between $110,000 and $124,000, continued volatility compression suggests a potential breakout trigger from today’s CPI release at 1:30 PM.

Bitcoin’s continued volatility compression has intensified with what analyst Checkmate refers to as the “choppiness index,” a metric that gauges sideways price consolidation.

Previous CoinDesk research has highlighted that bitcoin’s implied volatility remains at multi-year lows, which supports the sideways consolidation in bitcoin’s price.

This choppiness reflects bitcoin’s recent rangebound behavior. For the past few months, bitcoin has traded between $110,000 and its all-time high of $124,000, currently hovering around $113,000.

STORY CONTINUES BELOW

On the one-month timeframe, according to checkonchain, the choppiness index has risen to 54. The last time it exceeded this level was in early November 2024, just before President Trump’s election victory triggered a surge in bitcoin to over $90,000. At that point, the index peaked at 64. The previous instance before that was in early 2023, at the onset of the current bull cycle, when the index stood at 57.

This pattern suggests there may still be room for further consolidation, especially as volatility continues to compress.

The next major macroeconomic catalyst is the U.S. Consumer Price Index (CPI), scheduled for release at 12:30 PM UTC. This could act as a trigger for a volatility breakout or directional price move.

CoinDesk research from February also noted a prolonged period of which similarly preceded the price decline that eventually bottomed out in April around $76,000.

More For You

By Omkar Godbole, Oliver Knight|Edited by Sheldon Reback

6 minutes ago

Market gains may accelerate if the CPI prints below estimates, strengthening the chance of a Federal Reserve rate cut.

What to know:

- While the biggest cryptocurrencies are looking to the U.S. CPI report for guidance, smaller coins like PUMP, AVAX, MNT and HASH have advanced.

- A lower-than-estimated CPI figure could potentially leading to a short squeeze in BTC.

- Provenance Blockchain Foundation introduced a dynamic inflation model for HASH to protect stakers and align incentives.