-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

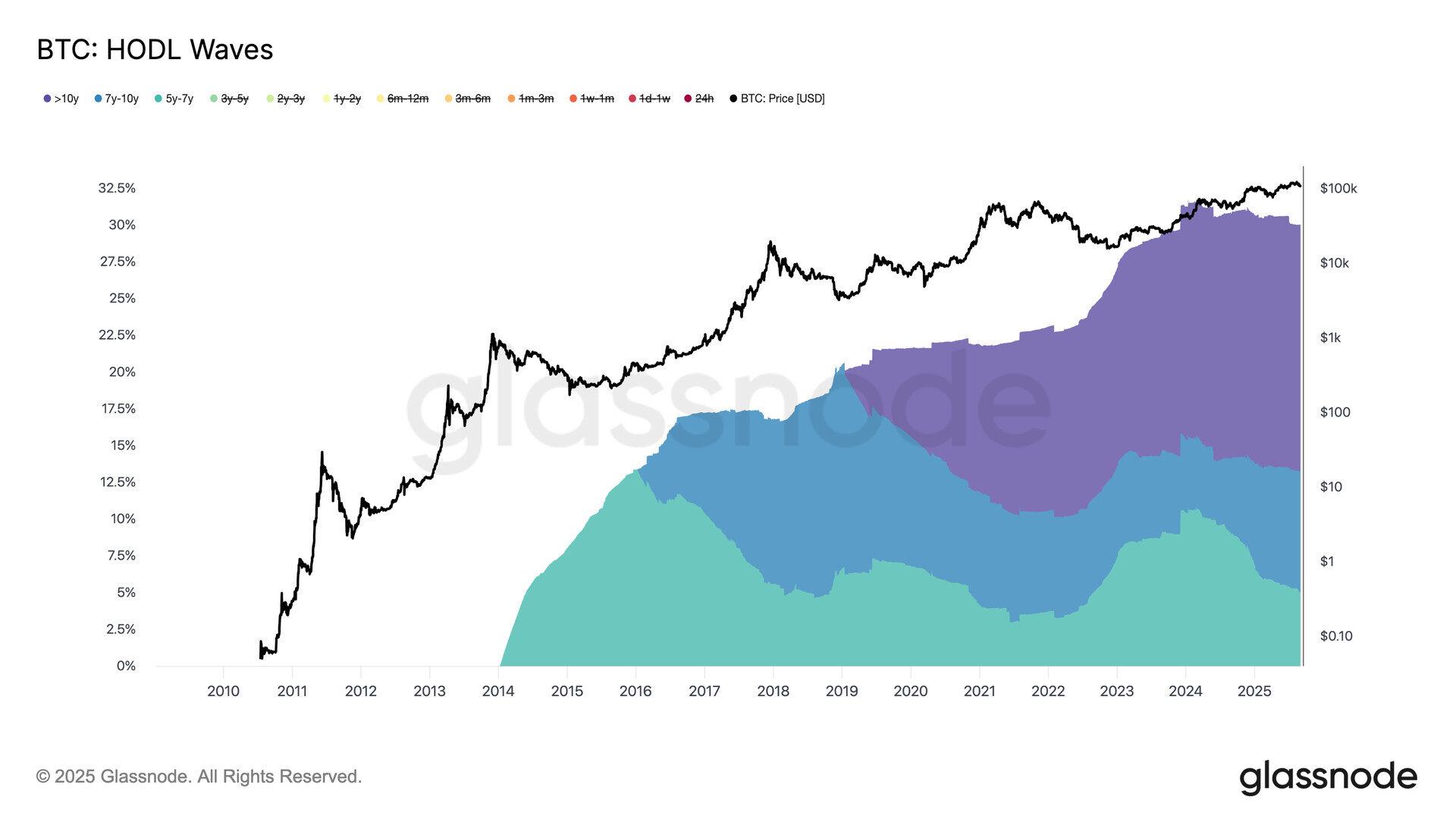

Glassnode data shows long-term holders growing their share of supply, challenging the narrative of widespread OG distribution.

By James Van Straten|Edited by Parikshit Mishra

Sep 3, 2025, 11:24 a.m.

- 7 to 10 year holders now control 8.1% of supply, the highest level since 2019, while 10 plus year holders have grown to 17%.

- Mid-term holders (5 to 7 years) are steadily distributing, with their share falling from 10% to 5% since early 2023.

Glassnode’s HODL Waves visualize the distribution of bitcoin BTC$111,580.71 supply across different age bands. Each colored band represents the percentage of BTC last moved within the time frame shown in the legend.

The recent narrative around bitcoin’s declining price has focused on OG whales (long-time holders with large balances) selling their coins. This is partly true, as highlighted by Galaxy facilitating an 80,000 BTC transaction and other notable movements over the past few months. Bitcoin also crossed the milestone of $100,000 within the past 12 months, a level that likely triggered selling for many investors.

STORY CONTINUES BELOW

However, Glassnode’s data suggests this selling is not the dominant story. Coins held for 7 to 10 years now account for over 8.1% of supply, the highest level since 2019. While total circulating supply has continued to shrink, the growth in this cohort indicates old supply is accumulating at a faster rate than coins being sold.

The 10 plus year cohort reinforces this trend. They now control about 17% of supply, and their share has only increased over time.

By contrast, the 5 to 7 year holders have seen a decline. They held around 10% of supply at the start of 2023, but this has dropped to just 5%. Many of these coins were acquired during the 2019 to 2020 period, most notably when bitcoin traded near $3,000 during the Covid crash. This group appears to be distributing steadily.

In short, while OG coins are indeed being sold, the broader narrative of widespread old-wallet selling seems to be overstated. The data shows a more nuanced picture, with older cohorts continuing to grow their share of supply even as some mid-term holders take profits.

More For You

By Oliver Knight, Jacob Joseph|Edited by Sheldon Reback

21 minutes ago

Almost $250 million worth of derivatives positions were liquidated in the past 24 hours despite a relative lack of volatility.

What to know:

- Bitcoin and the CoinDesk 20 Index are little changed Wednesday, with ether and sol outpacing the largest cryptocurrency.

- Open interest climbed to $114 billion, with positive funding rates across most tokens. Liquidation clusters for BTC point to key pressure levels at $110K and $112.2K.

- Bitcoin dominance fell from 61% to 57% in the past month, underscoring the shift toward altcoins and echoing past cycles where dominance dipped as low as 39%.