-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By James Van Straten|Edited by Sheldon Reback

Sep 1, 2025, 1:45 p.m.

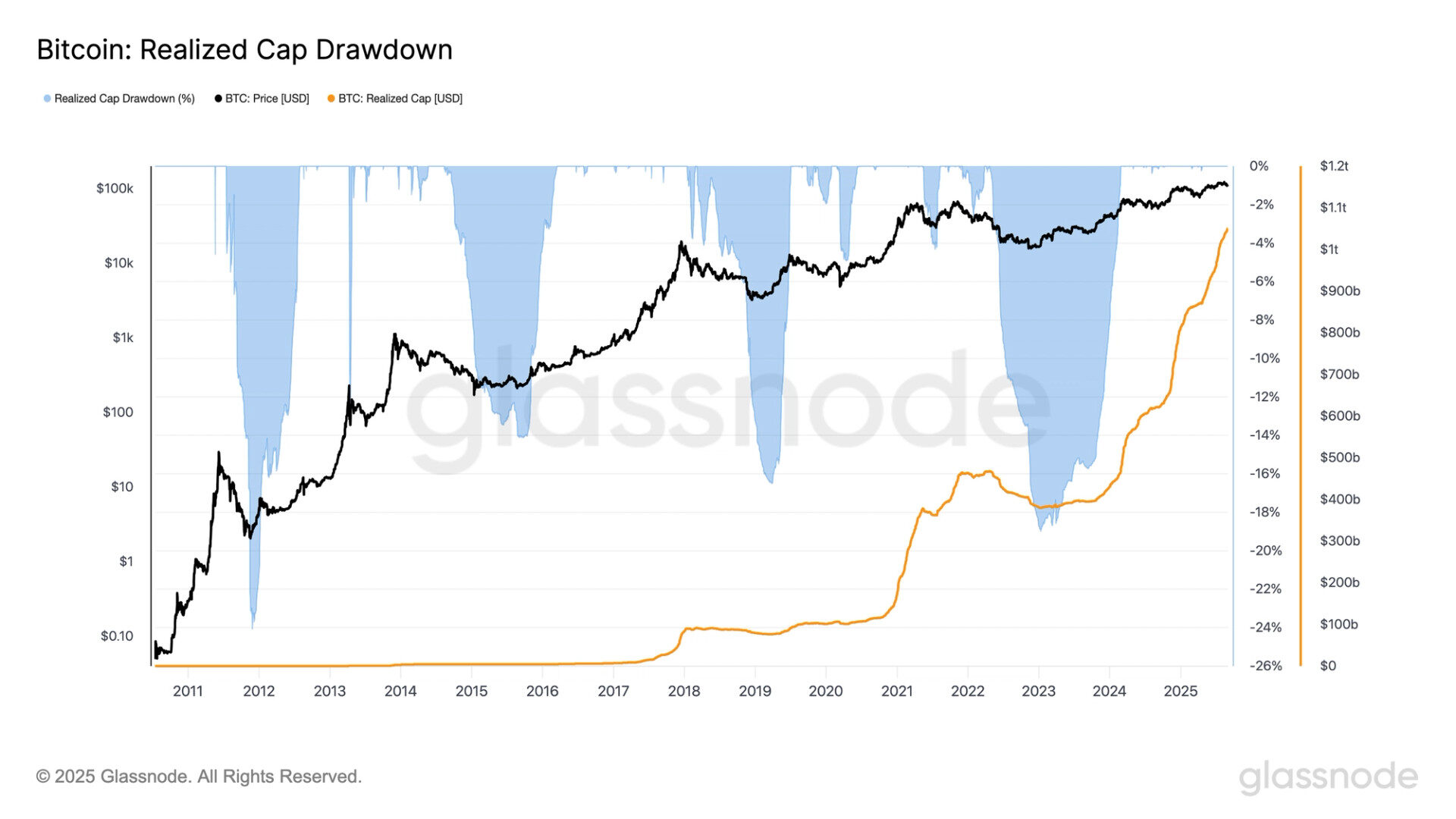

- Bitcoin’s realized cap, which values tokens only when they move, rose past $1 trillion in July and now sits at a record $1.05 trillion.

- The increase contrasts with a drop in market cap, which revalues all tokens based on the spot price.

- The measure provides an insight into the conviction of bitcoin holders in their investment.

Bitcoin’s (BTC) realized capitalization, an on-chain metric that measures the value of coins at the price they last transacted, has continued rising even as the spot price drops, signaling investor conviction to the network and an indication the economic backbone of the largest cryptocurrency is strengthening.

After first crossing $1 trillion in July, Glassnode data shows that realized cap now sits at a record $1.05 trillion, despite the spot price slipping around 12% from its all-time peak near $124,000. While market capitalization falls as the spot price declines because it prices every coin at the current level, realized cap adjusts only when coins are spent and repriced on-chain.

STORY CONTINUES BELOW

Under the realized cap model, dormant holdings, long-term holders and lost coins act as stabilizers, preventing large drawdowns even when short-term price action turns negative. The result is a measure that better reflects true investor conviction and the depth of capital committed to the blockchain.

In previous cycles, realized cap suffered much steeper drawdowns. During the 2014–15 and 2018 bear markets, it fell by as much as 20% as prolonged capitulation forced large volumes of coins to be repriced lower. Even in 2022, the metric experienced a drawdown near 18%, according to Glassnode data.

This time, in contrast, realized cap is gaining despite a double-digit price correction. This highlights how the present market is absorbing volatility with a far more resilient underlying base.

More For You

By Shaurya Malwa, CD Analytics

47 minutes ago

DOGE defended $0.21 and rebounded to $0.22 as volumes jumped (~808.9M). We map the key levels, why $0.225 matters, and what would confirm $0.25.

What to know:

- DOGE experienced a volatile session with a significant rebound, trading 808.9M tokens, indicating increased institutional activity.

- The price fluctuated between $0.21 and $0.22, with $0.21 acting as a strong support level.

- Traders are monitoring for a breakout above $0.225 to signal a potential rally towards $0.25.