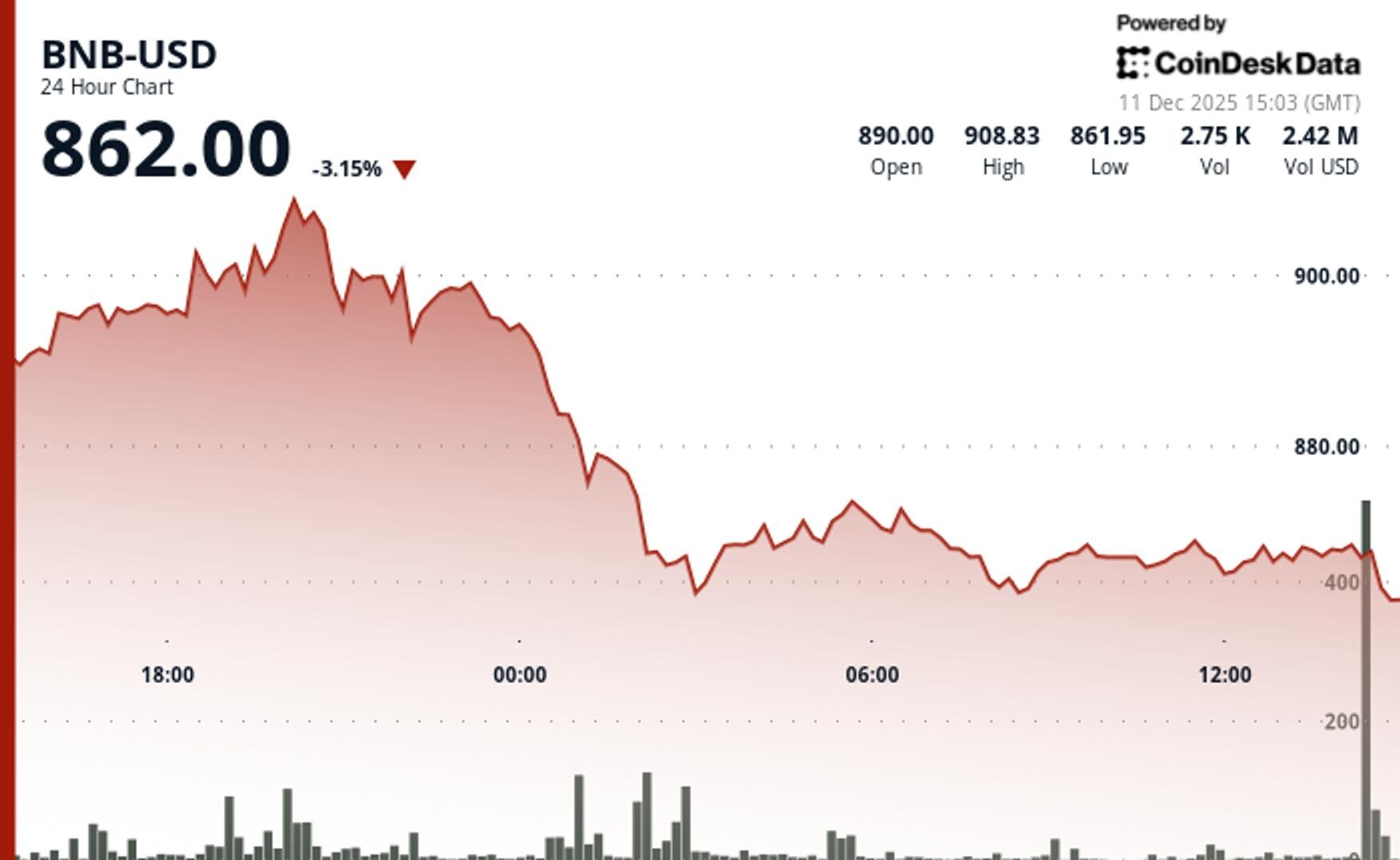

BNB Drops Below $865 as Crypto Market Moves Lower

The token is now trading in a tight range, with buyers defending the $864-$867 zone and sellers capping gains near $868.50.

By CD Analytics, Francisco Rodrigues|Edited by Stephen Alpher

Updated Dec 11, 2025, 4:57 p.m. Published Dec 11, 2025, 4:24 p.m.

- BNB dropped 3% to $865, breaking through a key support zone of $870 and falling below its 30-day moving average.

- The token is now trading in a tight range, with buyers defending the $864-$867 zone and sellers capping gains near $868.50.

- A recovery above $874 could shift momentum, but a deeper slide could push BNB toward $839, the next technical support level.

The price of BNB, the native token of the BNB Chain, dropped 3% in the last 24-hour period to $865 as traders digested the Federal Reserve’s Wednesday rate cut.

BNB moved down with the broader CoinDesk 20 (CD20) index, which is lower by 3.4% over the same time frame.

STORY CONTINUES BELOW

The token rose as high of $908.83 Wednesday before reversing sharply. Selling pressure increased as BNB pierced through $870, a key support zone that had held in recent weeks, according to CoinDesk Research’s technical analysis data model. The breakdown was backed by volume, with trading activity surging.

BNB also fell below its 30-day moving average and the 23.6% Fibonacci retracement level at $874, adding to the bearish setup. These indicators often serve as signals to traders that a short-term uptrend may be ending.

While BNB found some footing near $861.95, multiple attempts to recover toward $870 met resistance. The token is now trading in a tight range, with buyers defending the $864–$867 zone and sellers capping gains near $868.50.

For now, traders appear cautious. A recovery above $874 could shift momentum, but with network activity set to pause, most are waiting for the upgrade to complete before taking new positions.

A deeper slide could push BNB toward $839, the next technical support based on Fibonacci levels.

Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By Will Canny, CD Analytics|Edited by Jamie Crawley

3 minutes ago

Trading volumes jumped 38% above monthly averages as institutional players repositioned ahead of a scheduled token unlock.

What to know:

- APT slipped 7% to $1.69.

- Trading volumes jumped 38% above monthly averages as institutional players repositioned ahead of a scheduled token unlock.

- The selling pressure intensified as market participants positioned for the scheduled unlock of 11.3 million APT tokens, representing 1.5% of total supply flowing to core contributors and early investors

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language