-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

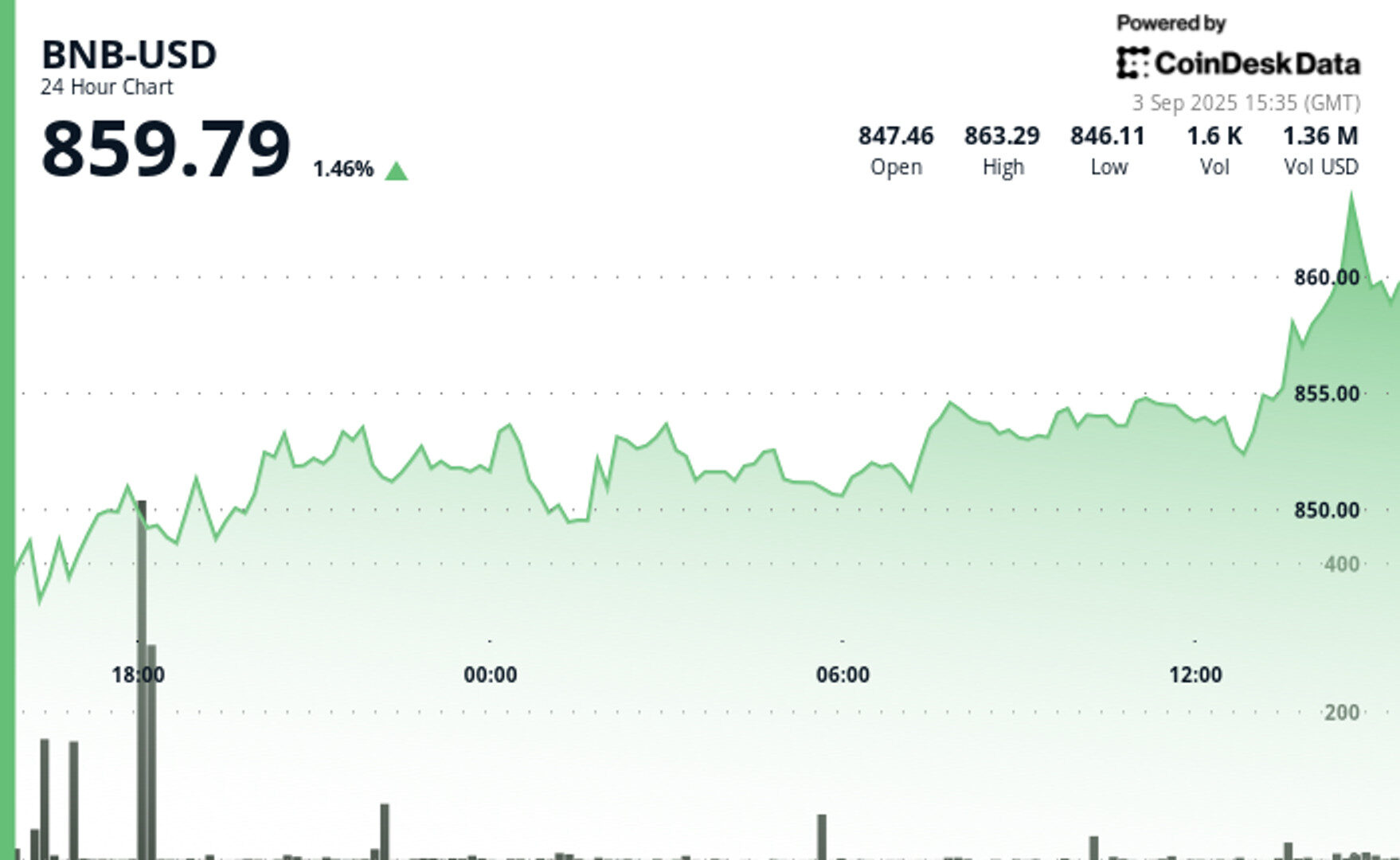

The advance came as broader crypto markets rose and after CEA Industries announced it expanded its BNB stash to 388,888 tokens worth $330 million.

By CD Analytics, Francisco Rodrigues|Edited by Sheldon Reback

Sep 3, 2025, 4:02 p.m.

- BNB rose 1.5% to near multisession highs, testing the $860 mark, on unusually strong buying pressure.

- The gains came as broader crypto markets rose, with the CoinDesk 20 index up 2.7%, and after CEA Industries announced it expanded its BNB stash to 388,888 tokens worth $330 million.

- The rally in BNB comes as traditional markets deal with concerns over swelling government debt.

BNB rose nearly 1.5% in the last 24-hour period to test the $860 mark and is at near multisession highs after breaking key resistance zones in the upward move.

The move came on unusually strong buying pressure in the most recent hour of trading, according to CoinDesk Research’s technical analysis model. Volume surged to 49,560 tokens, about 70% above the 24-hour average of 27,459.

STORY CONTINUES BELOW

The price broke through layered resistance at $851–$853 before a push above $854 kicked off the final leg to current levels. In a shorter 60-minute window, BNB added 0.5% as it rose from $854.75 to $859.

The gains in BNB came as broader crypto markets flashed green and after CEA Industries announced it expanded its total BNB stash to 388,888 tokens worth $330 million while targeting 1% of the supply by the end of the year. The broader crypto market, as measured by the CoinDesk 20 (CD20) index, rose 2.7% in the last 24 hours.

The rally comes as traditional markets saw a long-bond sell-off over rising concerns of swelling government debt. Safe havens including gold have benefited from the trend, bringing the tokenized gold market past $2.5 billion.

More For You

By CD Analytics, Oliver Knight

6 minutes ago

South Korea’s largest exchange pauses operations as Stellar prepares for a major network overhaul, with XLM price action showing resistance at $0.37.

What to know:

- Upbit suspended XLM trading as Stellar’s Protocol 23 upgrade began on Sept. 3, aiming to safeguard stability during the network overhaul.

- XLM price consolidated between $0.36 and $0.37, with repeated but unsuccessful attempts to sustain gains above resistance.

- Traders eye $0.45 resistance and $0.30–$0.32 support as key levels to watch following the upgrade’s rollout.