BTC

$108,324.58

–

0.36%

ETH

$2,537.10

–

0.44%

USDT

$1.0000

–

0.01%

XRP

$2.3445

+

3.02%

BNB

$658.79

–

0.64%

SOL

$151.28

–

1.11%

USDC

$0.9999

+

0.00%

TRX

$0.2869

+

0.81%

DOGE

$0.1687

–

1.20%

ADA

$0.5862

+

0.02%

HYPE

$39.55

+

0.22%

SUI

$2.8898

–

1.09%

BCH

$493.08

–

0.58%

WBT

$44.91

–

0.05%

LINK

$13.54

+

0.58%

LEO

$8.9690

–

0.46%

XLM

$0.2544

+

3.67%

AVAX

$18.04

–

1.25%

TON

$2.7805

–

4.26%

SHIB

$0.0₄1160

–

1.83%

By CD Analytics, Francisco Rodrigues|Edited by Sheldon Reback

Jul 7, 2025, 3:57 p.m.

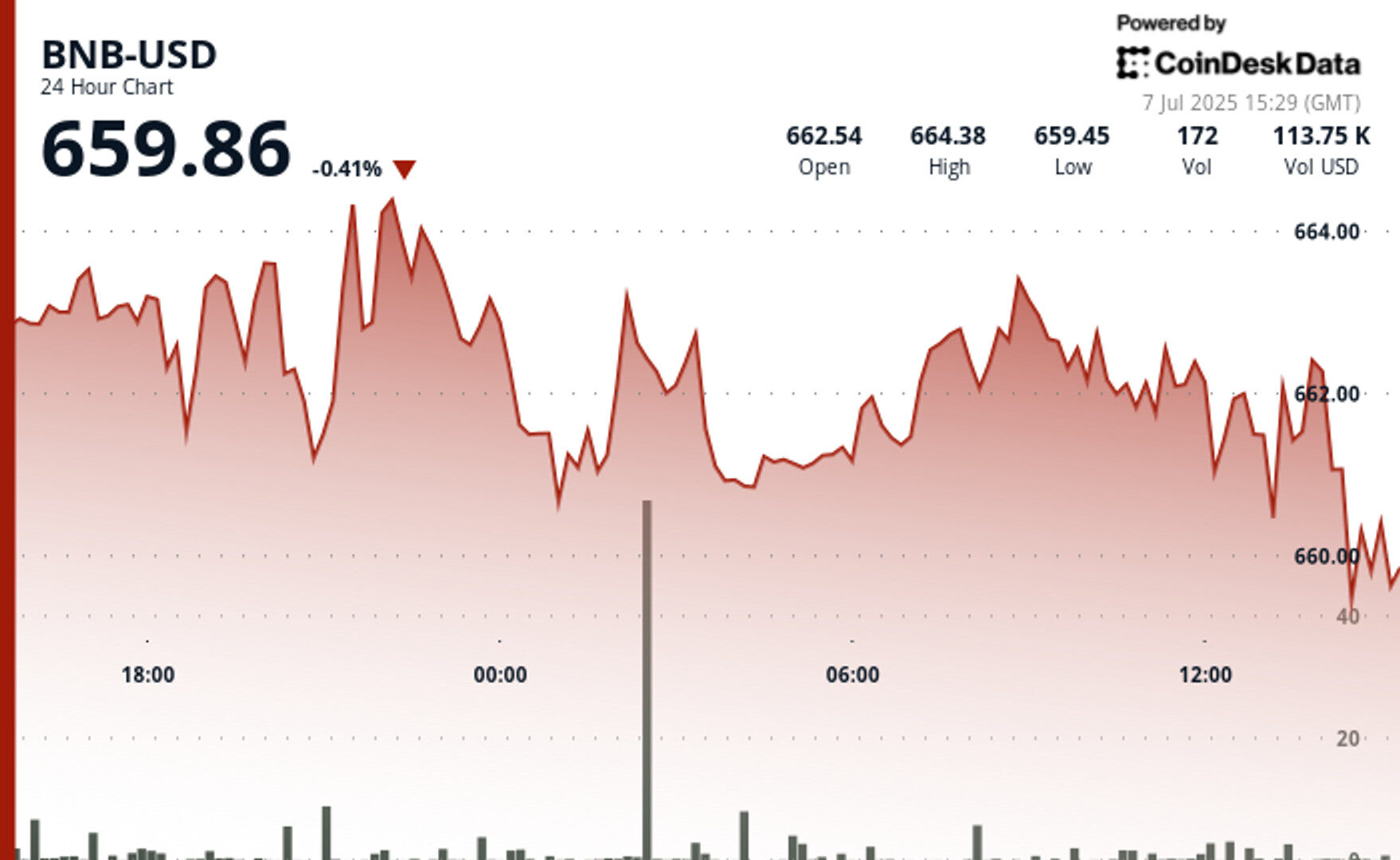

- BNB has remained stable near $660 with technical analysis suggesting the token is consolidating.

- Buyers are supporting the price around $659.45 and sellers capping gains at $664.38.

- On-chain data shows mixed sentiment among traders, with funding rates declining and corporate adoption growing.

BNB Chain’s native token

held steady near $660, shifting in a narrow band of less than 1% over the past 24 hours. The lack of volatility underscores a pattern of consolidation.

BNB is trading at $659.61, down just 0.5% for the day, with buyers stepping in repeatedly around $659.45. Sellers, meanwhile, blocked advances beyond $664.38, a price ceiling that traders are eyeing as a potential launchpad for a breakout if macroeconomic pressures ease, according to according to CoinDesk Research’s technical analysis model.

STORY CONTINUES BELOW

On-chain data points to mixed sentiment among traders. Funding rates, the fees paid between traders in perpetual futures markets, have slipped lower, a signal that traders are hedging rather than chasing after bitcoin’s recent rally above $109,000.

Corporate adoption is nevertheless growing, with Nasdaq-listed chip market Nano Labs recently acquiring about $50 million worth of BNB as part of its plan to own as much as 10% of the cryptocurrency’s global supply.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

Francisco is a reporter for CoinDesk with a passion for cryptocurrencies and personal finance. Before joining CoinDesk he worked at major financial and crypto publications. He owns bitcoin, ether, solana, and PAXG above CoinDesk’s $1,000 disclosure threshold.